Amid the minor uptick in trading activity in the general cryptocurrency market in the past 24 hours, the Layer 2 (L2) ecosystem has witnessed some growth. The market capitalization of all crypto assets in that category has risen by 1.42% during that period.

Starknet (STRK) and Manta Network (MANTA) are some of the L2 assets that have recorded the most gains in the past 24 hours.

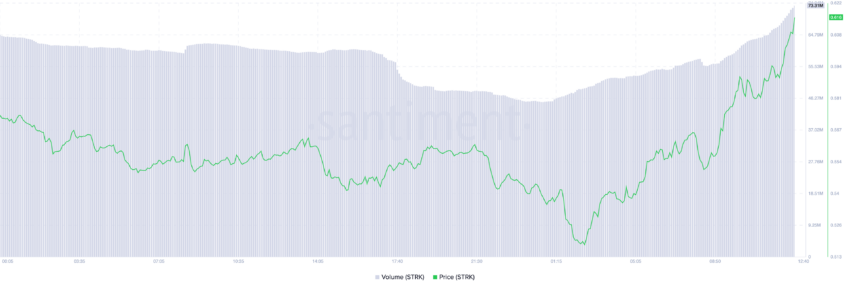

Starknet (STRK) Sees Resurgence in Trading Volume in the Past 24 Hours

Starknet (STRK) trades at $0.60 at press time. The altcoin’s price has risen by 9% in the past 24 hours.

The price hike is accompanied by a surge in daily trading volume. At $75 million as of this writing, the altcoin’s daily trading volume has risen by 30% during the period considered.

When an asset’s price rises alongside its trading volume, it strongly confirms the uptrend. This indicates that more buyers are entering the market, and the increased buying activity in the market is pushing the price up due to the higher demand for the asset.

STRK’s price movements, as assessed on a four-hour chart, reveal that the altcoin’s price has broken above the upper line of its descending channel, which has formed resistance since June 17.

A descending channel is a bearish signal. This pattern is formed when an asset’s price consistently moves lower, creating a series of lower highs and lower lows.

When an asset’s price crosses the upper line of a descending channel, it suggests that buying pressure is overcoming selling pressure. This marks the first time STRK’s price will rally above this upper line in over a month.

If it continues to trade above this level, it may rally to $0.61.

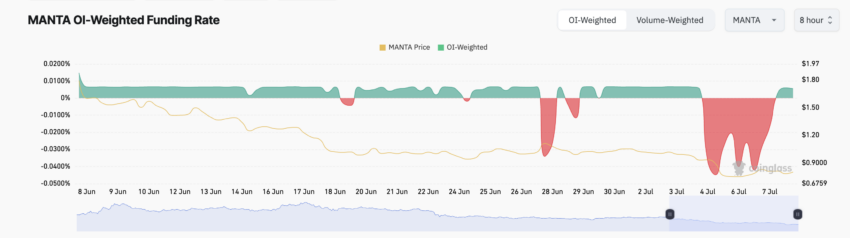

Manta Network (MANTA) Sees Uptick in Derivatives Market Trading Activity

The value of MANTA, the native token that powers Manta Network, has risen by almost 7% in the past 24 hours. It ranks as the third L2 token with the most gains during that period.

The uptick in the token’s price has led to a rally in activity in its derivatives market. During the period under review, trading volume across MANTA’s derivatives market has risen by over 30%. In the past 24 hours, this has totaled $87 million.

Further, for the first time since June 4, MANTA’s funding rate across cryptocurrency exchanges is positive. As of this writing, this is 0.56%.

Funding rates are a mechanism in perpetual futures contracts that ensures the contract price stays close to the spot price.

If an asset’s contract price is higher than its spot price, traders who hold long positions pay a fee to traders shorting the asset. Funding rates return positive values when this happens.

Conversely, if the contract price is lower than the spot price, short traders pay a fee to traders holding long positions, resulting in negative funding rates.

When an asset’s funding rate is positive like this, it means there is more demand for long positions. It signals that more traders are buying the asset in anticipation of a rally than traders are accumulating with the expectation of selling at a lower price.

If MANTA maintains its uptrend and the demand for long positions continues to surge, its value may rise to $0.89.

However, if a decline ensues due to a spike in profit-taking activity, the token’s price can drop to $0.86.

beincrypto.com

beincrypto.com