The cryptocurrency market has seen significant volatility over the past week, with total trading volumes reaching $64 billion. Bitcoin (BTC) remains the dominant force, holding a market share of 50.7%, followed by Ethereum (ETH) at 17%.

Amidst these fluctuations, several cryptocurrencies have entered oversold territories, presenting potential buying opportunities for investors and traders.

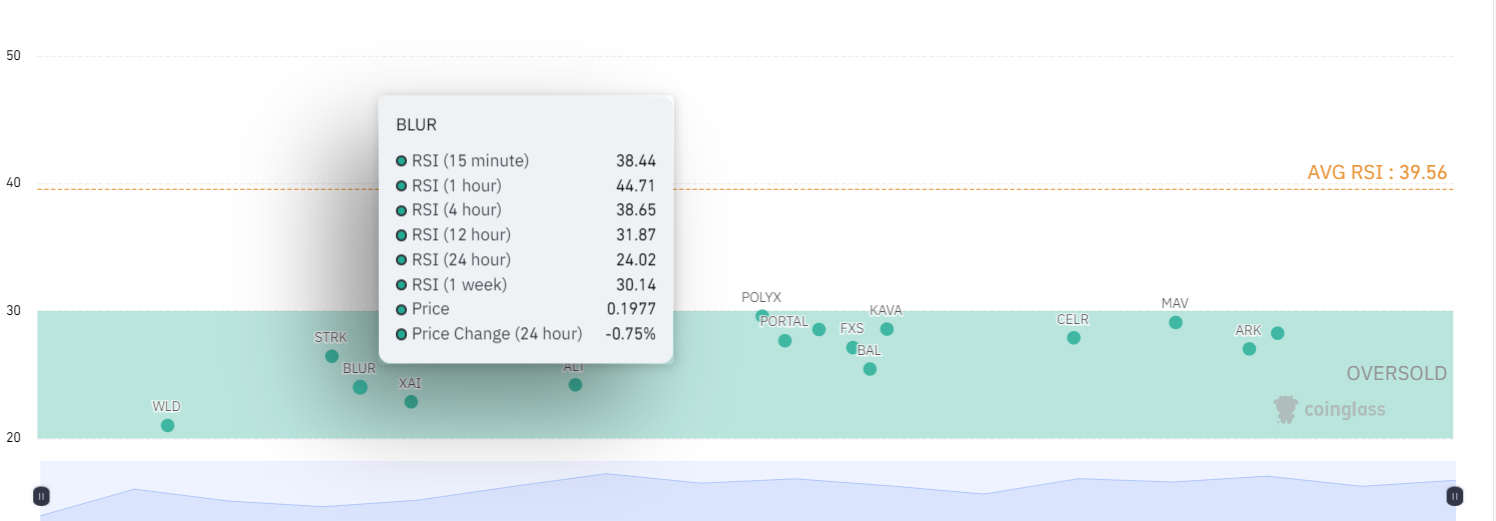

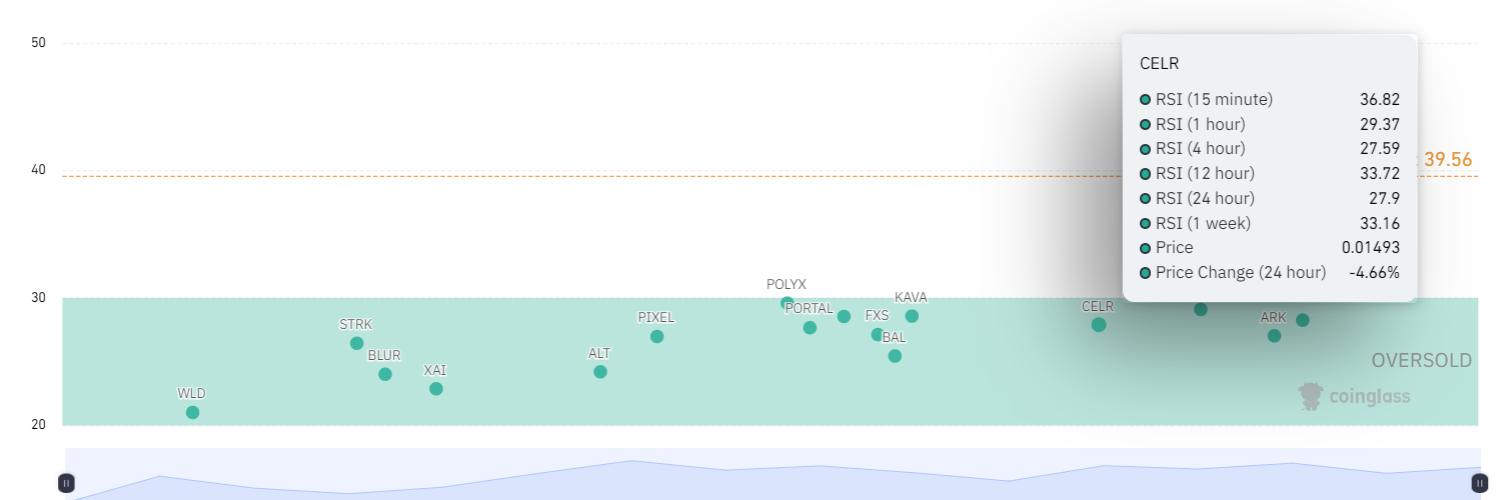

The overall Relative Strength Index (RSI) supports this transition, with an average 24-hour RSI of 39.56, according to CoinGlass.

An RSI below 30 generally indicates oversold conditions, suggesting that the asset has been subjected to heavy selling pressure and may be due for a rebound. This market scenario presents a strong opportunity for identifying undervalued assets poised for recovery.

In this context, Finbold has identified two cryptocurrencies as buy candidates for the week based on their RSI levels and other indicators.

Blur (BLUR)

Blur (BLUR) is currently trading at $0.1977, showing a slight increase of 0.05% in the last 24 hours. Despite this minor uptick, BLUR remains in the oversold territory, making it an attractive buy.

The 24-hour RSI for BLUR is 24.02, significantly below the market average of 39.56. This indicates that BLUR is considerably oversold and undervalued compared to the broader market.

Several technical indicators robustly support the buy signal for BLUR. The RSI at 23.4346 indicates that BLUR is oversold.

The Commodity Channel Index (CCI) also suggests oversold conditions. Additionally, the Momentum indicator, at -0.0478, points to potential upward price movement, while the Williams Percent Range (Williams %R) further corroborates the oversold status.

Despite most of BLUR’s moving averages indicating a sell action, this often suggests the price might have been declining recently and is possibly bottoming out.

The combination of these buy signals and the potential for price recovery positions BLUR as a strong candidate for investment, as historical patterns demonstrate that oversold conditions frequently precede price rebounds.

Celer Network (CELR)

Celer Network (CELR) is another cryptocurrency presenting a compelling buy signal, currently trading at $0.01492 after experiencing a 2.93% decrease in the last 24 hours. The 24-hour RSI for CELR stands at 27.9, well below the market average of 39.56, clearly indicating an oversold condition.

Similar to BLUR, CELR’s technical indicators point to a potential rebound. The Momentum value of -0.00109 suggests potential upward price movement, while the MACD Level (12, 26) of -0.00179 indicates a bullish crossover or potential upward momentum.

CELR’s moving averages predominantly show a sell action, which often points to a potential bottoming out and suggests that the market has driven the price down excessively.

The low RSI combined with these bullish indicators indicates that CELR is significantly undervalued and poised for a potential rebound.

Both BLUR and CELR, with RSIs significantly below the average and supported by other technical indicators, present strong buy opportunities. Their low RSI values, combined with indicators pointing to potential price recoveries, make them attractive investments.

However, it is essential to also take into account other technical indicators, market conditions, and fundamental analysis when evaluating potential trades. Amid these positive outlooks, a cautious and well-rounded approach to investing is always recommended.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com