Retail investors are currently displaying notable caution toward the crypto market. This behavior contrasts with past cycles when their involvement significantly influenced market trends.

Understanding the reasons behind this hesitance is crucial for predicting future market movements.

Retail Investors Are Not Here Yet

Retail investors are showing reluctance to engage with the crypto market, a trend that experts say may impact the market’s trajectory. Gustavo Faria, co-founder of Nosy, highlights key metrics indicating that retail participation remains low.

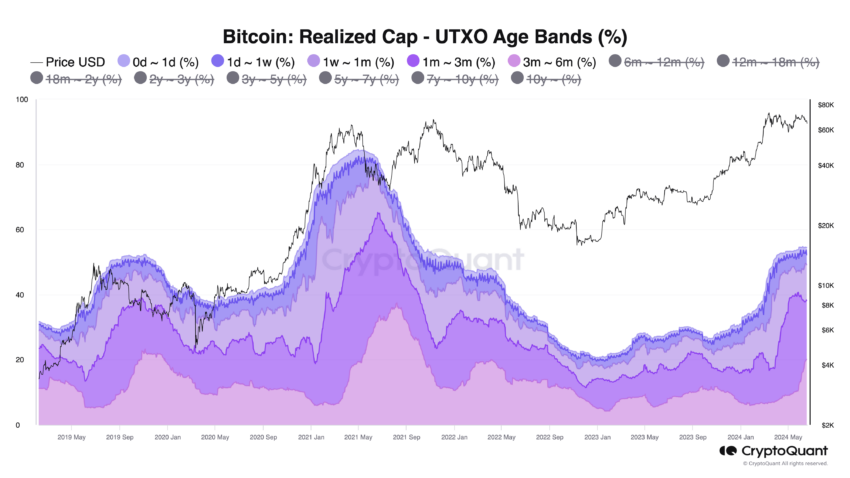

“A central characteristic of Bitcoin cycle tops is the dominance of coins with a holding period of less than 3 months,” says Faria.

Currently, short-term holders account for about 35% of the realized cap, compared to over 70% during previous market peaks. This suggests that long-term Bitcoin holders, often termed “smart money,” are maintaining their positions, providing a more stable market foundation.

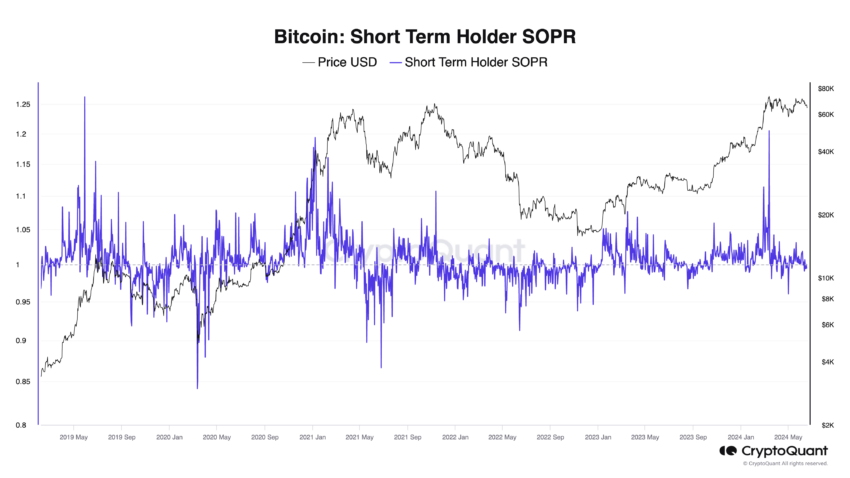

Historically, the Spent Output Profit Ratio (SOPR) of short-term holders has surpassed 1.10 during market peaks. In this cycle, the highest SOPR recorded was 1.05, indicating a more neutral market stance.

“This structure suggests that we have not yet reached the peak euphoria of this cycle,” Faria adds.

He believes the current market is strong, reducing the likelihood of an immediate transition to a bear market and signaling potential for further growth.

Read more: Bitcoin (BTC) Price Prediction 2024 / 2025 / 2030

Moreover, Anthony Sassano, an independent Ethereum educator, notes the peculiar nature of the current bull market, calling it the “weirdest ever.” He points out that the expected four-year cycle appears disrupted, with market behavior driven by crypto natives rather than retail investors.

Sassano highlights the absence of broad market growth, typically fueled by retail participation.

“Retail and new money were and are still not here – it’s all just crypto natives doing max PvP,” he observes.

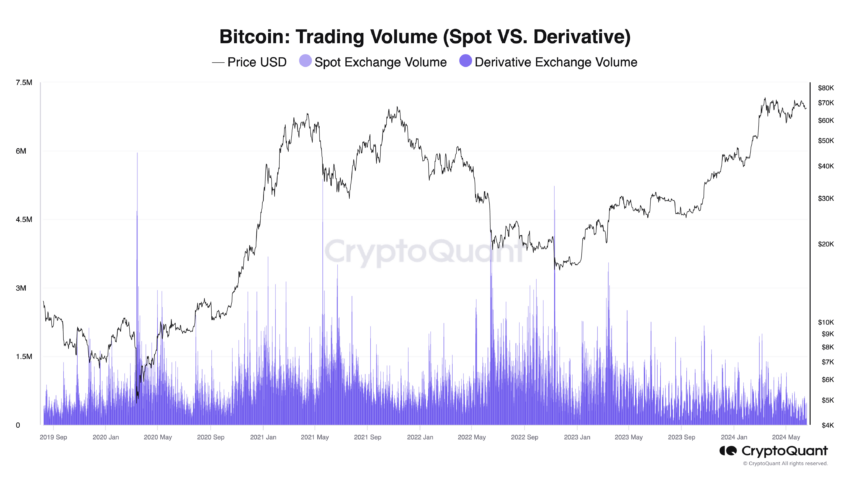

Adding to this perspective, crypto analyst Cyclop emphasizes the absence of retail enthusiasm. He points out that current trading volumes are significantly lower than those in 2021, despite Bitcoin’s higher price.

Cyclop suggests that this lack of retail involvement means the market has not yet reached the speculative frenzy seen in previous cycles.

“Normies are still not in crypto. My friends aren’t messaging me on WhatsApp. My mom doesn’t know that Bitcoin is at all-time highs,” he comments.

These insights suggest that retail investors are cautious, possibly due to the crypto market’s volatility. This hesitance, combined with the current market dynamics dominated by seasoned crypto participants, could limit the market’s growth potential.

beincrypto.com

beincrypto.com