The $XRP/$USDT pair breaks a key trendline, indicating a possible 20-30% bullish wave, as it holds its prices above $0.50 and targets $0.55 resistance.

The $XRP/$USDT trading pair has exhibited alarming movement, breaking a crucial trendline in the 12-hour timeframe. ZAYK Charts confirms this breakout, indicating a potential bullish wave for $XRP.

According to a tweet from ZAYK, the $XRP market now anticipates a possible 20–30% bullish wave driven by this trendline breach. The chart further reveals that the $XRP/$USDT pair is anticipated to aim for the $0.68 zone should the bullish uptick occur.

$XRP Price Action

As of press time, the $XRP coin is experiencing a decrease of 0.39% within the past 24 hours, currently valued at $0.5369. This modest downturn contrasts with the 4.15% appreciation observed the preceding week, indicating a shift in market dynamics.

Amid the recent bearish trajectory, $XRP’s open interest experienced a drop of 0.73%, descending to $574.13 million. Moreover, $XRP, which occupies the seventh position by market capitalization, encountered a slight contraction of 0.52% in its intraday market cap, now evaluated at $28,289,580,993.

Contrastingly, $XRP’s trading volume paints a divergent narrative. It has soared by 63.52% from the prior day, escalating to $813,742,892. This alarming increase in trading volume suggests a robust investor interest and confidence in $XRP despite the prevailing weak bearish sentiment.

$XRP Token Eyes $0.55 Resistance

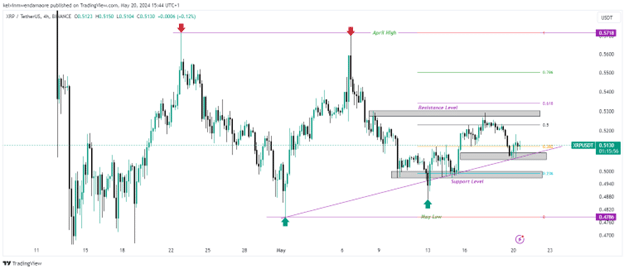

On the 4-hour chart, the $XRP token has held strong above the $0.50 key support level, last touched on May 15. Presently, $XRP is situated around the 38.2% Fibonacci retracement level, which provides low-level support. As a result, the coin intends to challenge the $0.55 mark, which serves as its primary resistance level.

If this resistance is broken, $XRP may target the 78.6% Fibonacci level, with the possibility of overcoming the critical resistance at $0.57, which was last tested in April. Conversely, if bearish sentiment prevails, $XRP’s price might fall, finding support again around the $0.50 region. A breach of this support could lead to further declines, potentially targeting the May low.

On the technical front, the MACD indicator is trending downward, positioned at -0.007, indicating weak bullish momentum for $XRP. The narrowing of the MACD histogram bars toward the zero line further supports the weakening of the bearish momentum.

Additionally, the RSI line is moving upward but remains below the neutral zone. Positioned at 49.62 and crossing over the signal line, this suggests that the bearish mood is decreasing, and a potential bullish shift may be imminent.

thecryptobasic.com

thecryptobasic.com