The wider crypto market has been on a general uptrend since late 2024, with many cryptocurrencies hitting new all-time highs (ATH) or, at the very least, hitting prices not seen in years at one point or another.

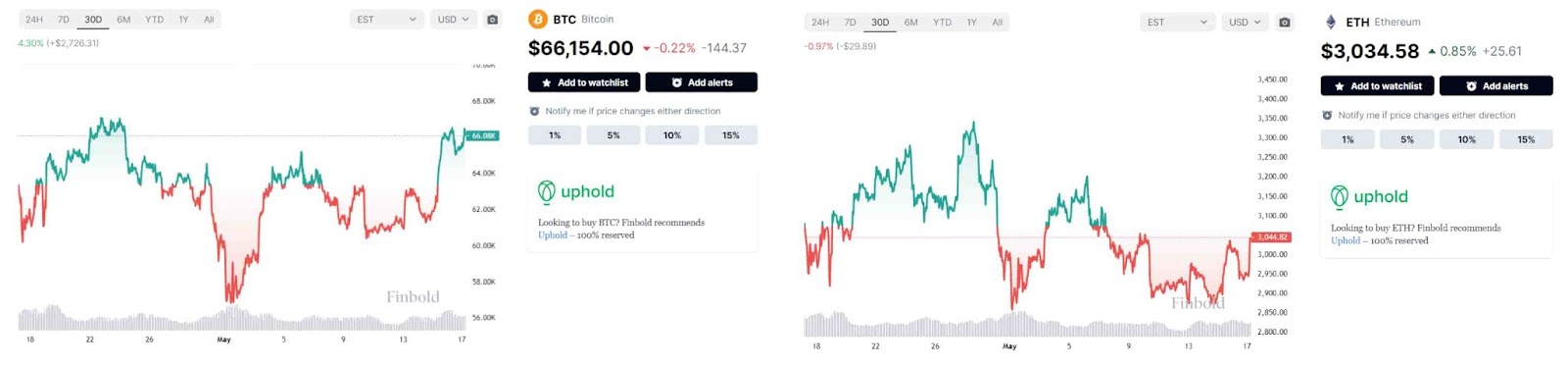

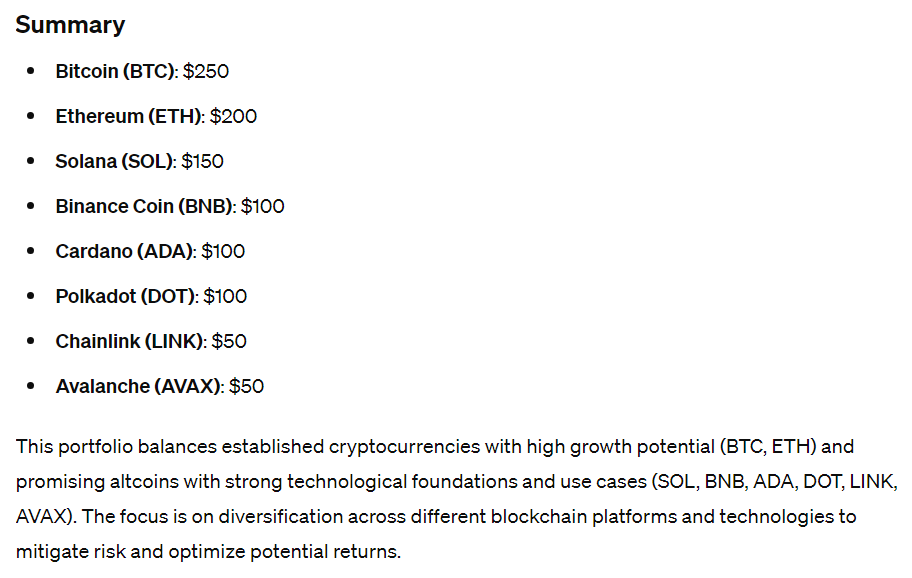

So far, March has proven to be the cycle’s most exciting month given it featured a major meme coin rally and Bitcoin (BTC) at a new record high, while April – offering the BTC halving on the one hand, but also a correction and stagnation on the other – has arguably taken the second spot for crypto traders.

Given that, by mid-May, it appears as though the correction phase is over – most evidently seen by both Bitcoin and Ethereum (ETH) making a significant breakout attempt – Finbold decided to consult the most advanced model of OpenAI’s flagship artificial intelligence (AI) platform – ChatGPT-4o – to help design a strong portfolio for the future.

ChatGPT’s selects the $1,000 portfolio’s biggest holdings

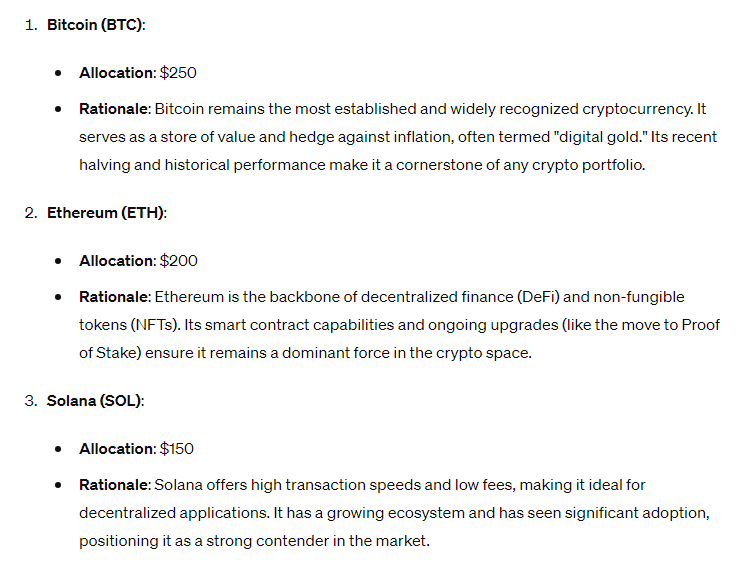

Upon analyzing the recent crypto market happenings and being informed of its task to help allocate $1,000, ChatGPT set about designing what turned out to be an 8-cryptocurrency portfolio,

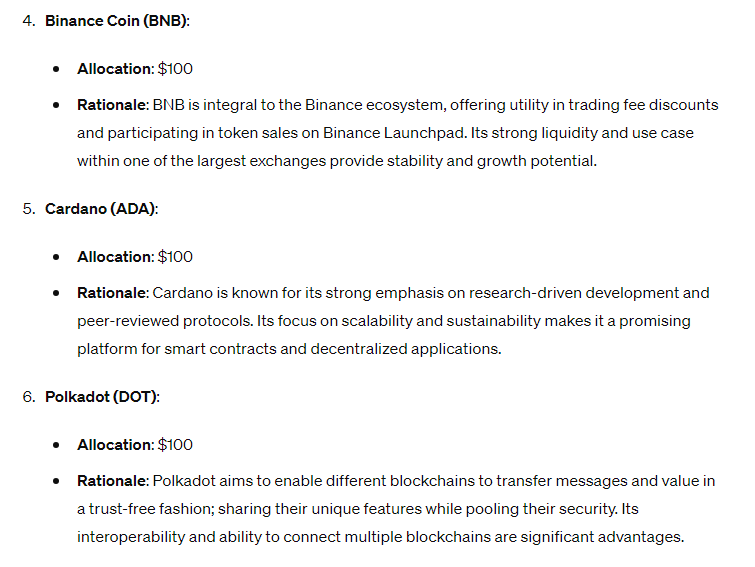

The biggest portion of the investment – $250 – went into Bitcoin, which the AI considers the ‘most established and widely recognized cryptocurrency’ and the ‘cornerstone of any crypto portfolio.’ ChatGPT particularly noted Bitcoin’s role as a store of value and a hedge against inflation.

It is noteworthy, however, that though the AI used common arguments, certain aspects of Bitcoin’s reputation have arguably come into question given its performance following adverse geopolitical and financial events, as well as given the fact that its most recent rally started after positive inflation data came out for the first time in months.

The AI portfolio’s second biggest holding – at $200 allocated – turned out to be Ethereum, which ChatGPT described as ‘the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs).’

The large language model (LLM) also explained that ETH’s smart contract capabilities and continuous upgrades are likely to only solidify its already dominant position.

ChatGPT’s third pick – at $150 – proved to be Solana (SOL) due to its ‘high transaction speeds and low fees’ and the fact that ‘it has a growing ecosystem and has seen significant adoption.’

ChatGPT designs the $100 club within the portfolio

The AI invested $100 into Binance Coin (BNB) given it is ‘integral to the Binance ecosystem’ and offers ‘utility in trading fee discounts and participating in token sales on Binance Launchpad.’ ChatGPT also explained that BNB’s strong liquidity in the world’s largest cryptocurrency exchange ensures strong growth potential.

Cardano (ADA) also received a $100 investment and the AI explains it favors it due to ‘its strong emphasis on research-driven development and peer-reviewed protocols,’ as well as the ‘focus on scalability and sustainability.’

Polkadot (DOT) was the last cryptocurrency to receive a $100 investment from ChatGPT, with the AI justifying its decision by highlighting DOT’s interoperability and efforts to ‘enable different blockchains to transfer messages and value in a trust-free fashion.’

ChatGPT finalizes the portfolio

Finally, ChatGPT split the final $100 of the investment between Chainlink (LINK) and Avalanche (AVAX).

According to the AI, Chainlink deserved its spot in the portfolio with ‘its critical role in the DeFi ecosystem and broad adoption’ given it functions as an oracle network.

Avalanche was described as highly competitive with a particular focus given to AVAX’s scalability and interoperability.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com