The global cryptocurrency market capitalization has recorded an impressive momentum after the U.S. Consumer Price Index (CPI) report was released.

Notably, the US CPI for April increased by 3.4% over the past year, crypto.news reported. In March, the CPI reached 3.7%.

Following the CPI report, Bitcoin (BTC) and most of the leading altcoins recorded impressive gains. Data from CoinGecko shows that the global cryptocurrency market cap increased by 5.7% in the past 24 hours and is currently sitting at $2.51 trillion — a level last seen on April 23.

The global crypto daily trading volume witnessed a 40% rally, surpassing the $100 billion zone.

Moreover, the leading digital asset, Bitcoin, gained 6.7% in the past 24 hours and is trading at $65,980 at the time of writing — it briefly touched the $66,000 mark earlier today. The BTC market cap surpassed the $1.3 trillion mark for the first time in the past three weeks.

The BTC daily trading volume also increased by 72%, reaching $43.3 billion.

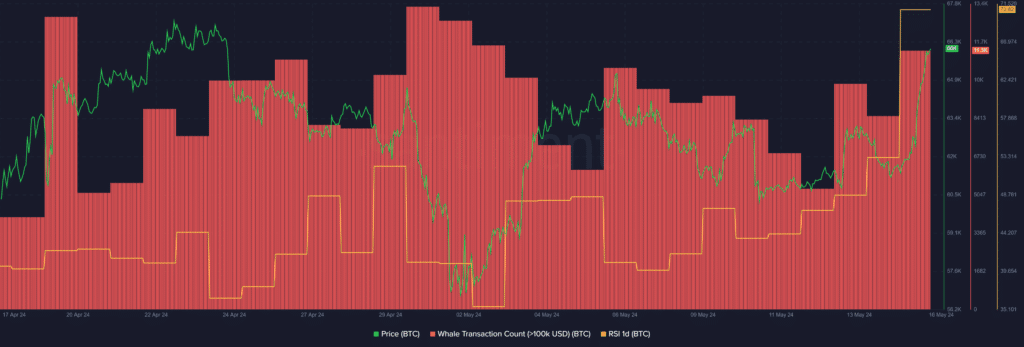

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of BTC surged by 33.8% over the past day — rising from 8,520 to 11,397 unique transactions.

The mix of heightened trading volume and increased whale activity shows potential high price volatility and sudden price movements would be expected.

In addition, the BTC Relative Strength Index (RSI) rose from 53 to 70 over the past 24 hours. The indicator shows that Bitcoin is currently overvalued.

An RSI of lower than 50 could potentially put Bitcoin for a gradual price hike.