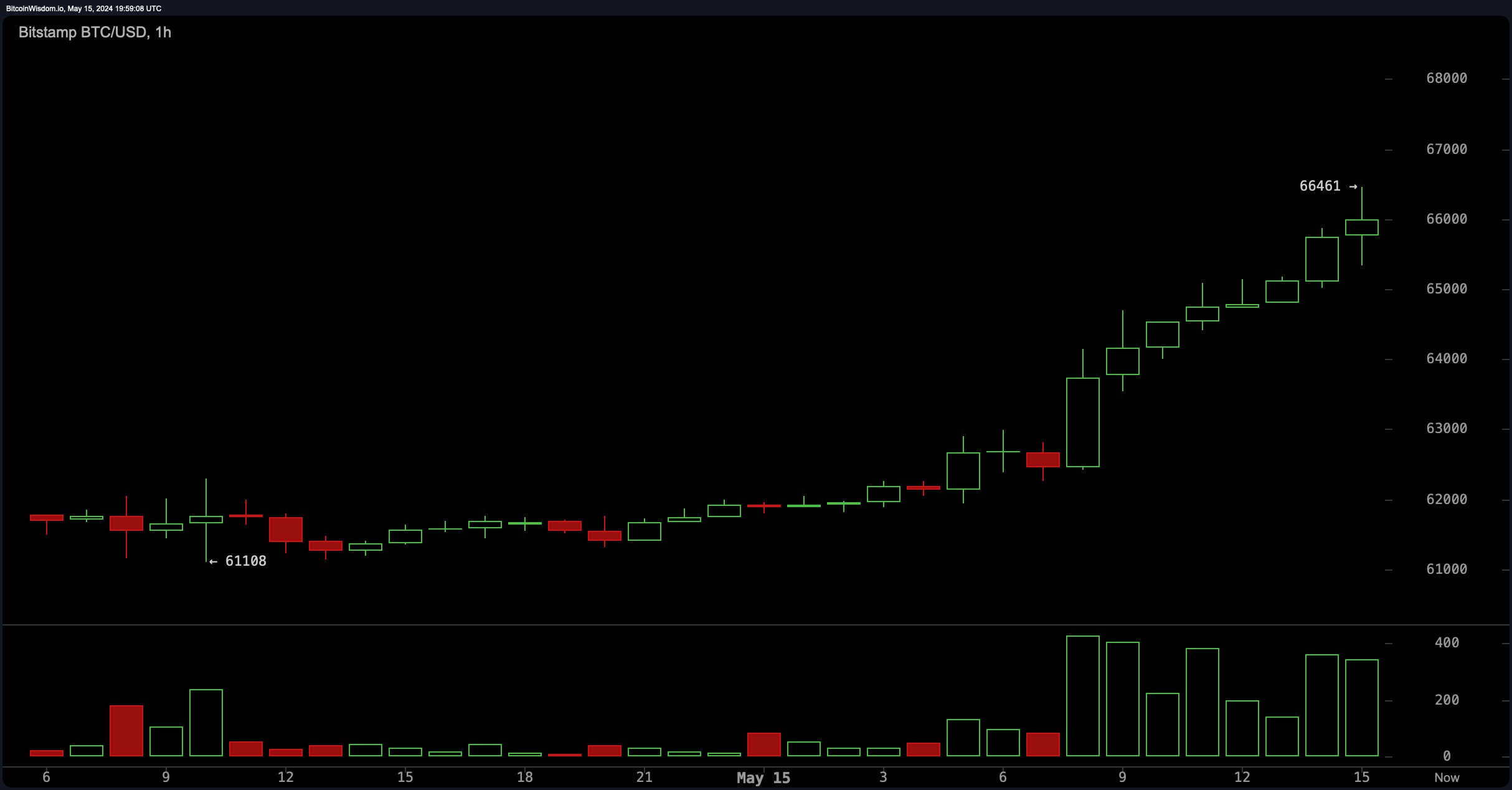

On Wednesday, the price of bitcoin demonstrated strong growth, escalating by more than $4,200 from its daily low. This 7.1% increase against the U.S. dollar propelled bitcoin past the $66,000 threshold, reaching a peak of $66,461 per coin on Bitstamp. Consequently, the entire cryptocurrency market rose by 6.2%, resulting in the liquidation of 51,567 traders on various crypto derivatives exchanges over the course of the day.

Bitcoin Climbs to $66,000, Crypto Derivatives Face $127M Liquidation Wave

Bitcoin has climbed 7.1% relative to the dollar, surpassing the $66,000 mark at 3:45 p.m. Eastern Time (ET) on Wednesday. At that current time, bitcoin’s price hovers at $66,300 per unit, with the past 24 hours seeing a global trading volume of $34 billion. From the day’s lowest price, bitcoin’s value has increased by more than $4,200 during the trading sessions. This recent upturn further marks a 5.2% rise over the past seven days against the greenback.

Bitcoin’s initial uptick on Wednesday followed the U.S. Labor Department’s Bureau of Labor Statistics’ release of the consumer price index (CPI) report. On May 15, bitcoin’s primary trading pairs included USDT, FDUSD, USD, USDC, and KRW, with the Korean won comprising 2.36% of bitcoin’s global trades. While the global weighted average price of bitcoin stands at $66,300 it traded at $67,632 on the South Korean exchange Upbit at 3:45 p.m. (ET) as well.

The day’s substantial price rise across the entire crypto economy led to significant trader liquidations, with 51,567 traders being wiped out today. Over the last 24 hours, derivatives positions amounting to $127.98 million were liquidated, including $83.39 million in crypto short positions. Specifically, $45.94 million of those positions were bitcoin shorts and $17.88 million of ethereum (ETH) shorts were also liquidated. Additionally, $6.27 million in PEPE shorts were liquidated throughout the day.

This latest bitcoin price uptick, driven by a favorable CPI report, catalyzed a wave of liquidations, predominantly affecting those on the wrong side of leveraged positions. As $127.98 million in derivatives were cleared off the table, the event underscores the high-stakes nature of leveraged crypto trading where significant price movements can either forge fortunes or obliterate investments in mere moments. The dynamics of leverage, while offering magnified gains, also pose massive risks, as seen in the swift liquidation of numerous traders’ positions on Wednesday.

What do you think about bitcoin’s price jump on Wednesday? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com