Dogwifhat price dipped below $2.8 on Thursday, May 9, down 24% from its monthly peak of $3.7 recorded on Monday: resilient speculative traders continue to place bullish bets on WIF.

Dogwifhat Extends its lead ahead of BONK.

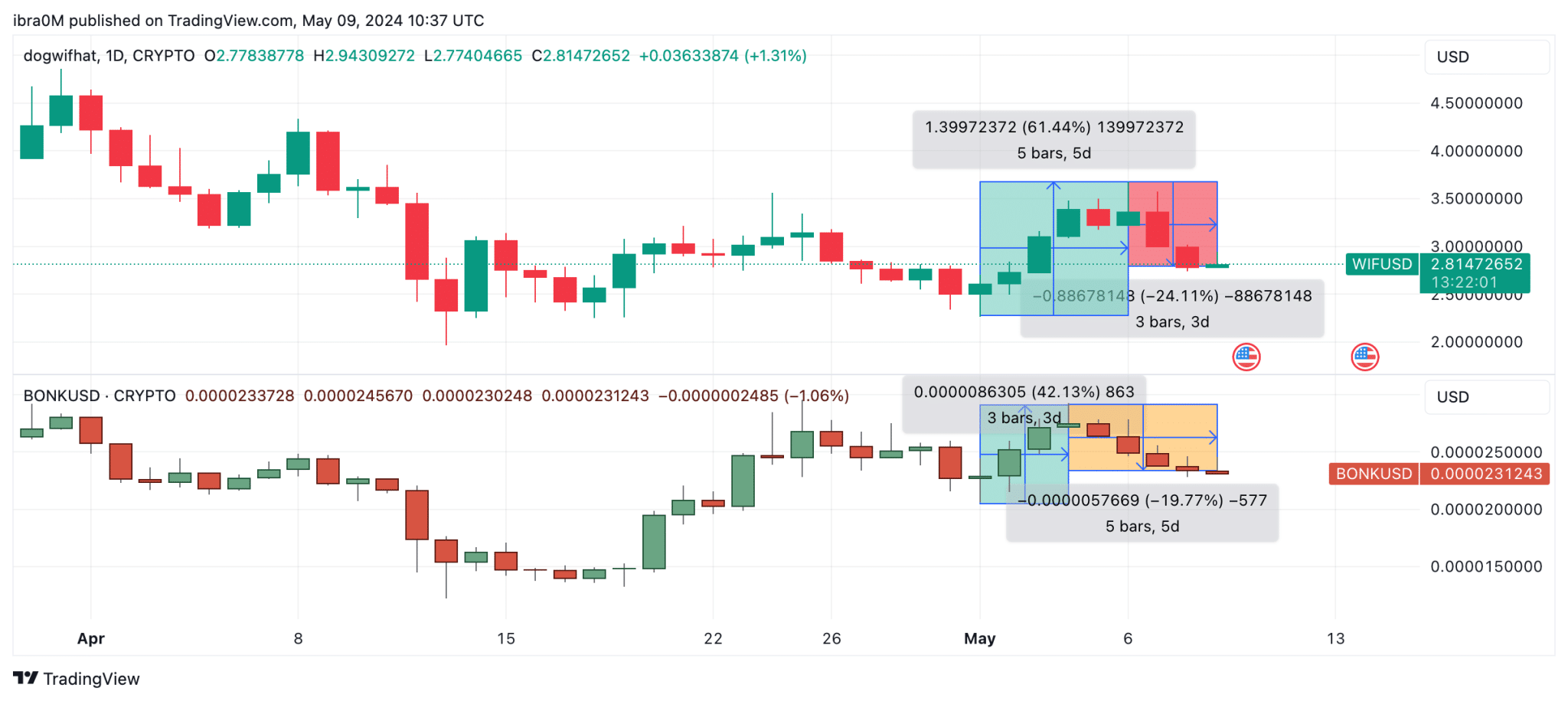

Dogwifhat price action in May 2024 began on a positive note as the WIF further stretched its ahead on BONK as Solana‘s largest memecoin project by market capitalization. The daily price chart below shows how WIF price had surged 61.4%, as prices grew from $2.6 to $3.7 between May 1 and May 6.

BONK’s price also grew significantly within the same timeframe. However, its 42.13% gain is a far cry from WIF’s 61.44% bounce in the first 5 days of May 2024.

Notably, WIF price has now retraced 24% in the last 48-hours to find support at the $2.81 territory at the time of writing on May 9. But despite this double-digit pullback, speculative WIF traders continue to maintain a largely bullish stance.

WIF Speculative Traders Invest Another $5M Amid Price Dip

Amid the 24% price dip, Dogwifhat investors in the derivatives markets continue to pile on more capital inflows into WIF futures contracts in high hopes that Solana’s most sought-after memecoin will regain its upward momentum in the near term.

Indicatively, the Coinglass open interest chart below presents the total value of capital currently invested in WIF perpetual futures contracts. It helps to track the level of investor participation and real-time swings in overall market sentiment.

When the Dogwifhat price pullback began on May 6, WIF’s open interest stood at $295 million. While prices have slid 24% since then, the latest data shows that WIF open interest has grown to $300.2 million.

This effectively means that rather than close out their positions amid the price dip, WIF derivatives traders have doubled-down on their positions with over $5 million capital inflows within the last 48-hours.

Typically, when open interest surges at the onset of a price dip, strategic investors may interpret it to be a positive signal. It essentially indicates that traders are mounting hedge positions, to consolidate on their holdings rather than exit.

WIF Price Forecast: Bulls Keeping $4 Rebound Hopes Alive

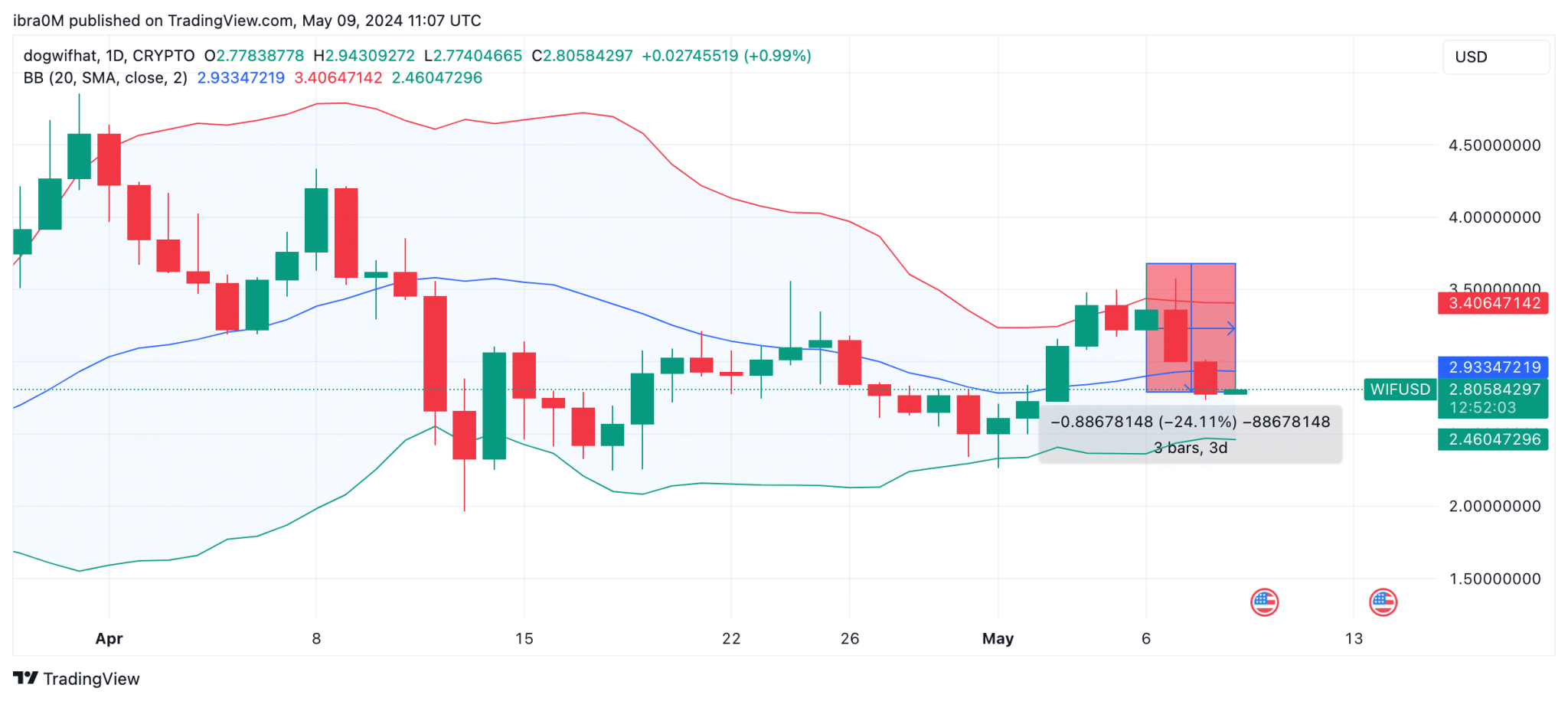

Dogwifhat price has succumbed to a 24% decline after failing to advance above $3.8 on May 6. But with Dogwifhat traders mounting $5 million in fresh capital inflows in the last 48 hours, WIF price is likely to snap out from the downtrend and make another attempt at reclaiming $4 in the days ahead.

Looking at potential resistance zones ahead, the upper band Bollinger indicator highlights the $3.40 territory as the next major roadblock. A decisive breakout from that resistance cluster could drive the WIF price above $4, as predicted.

But importantly, to validate this optimistic WIF price forecast, bulls must avoid a downsing below the $2.50 in the near-term.

As depicted by the lower-limit Bollinger band indicator, losing the $2.45 support could tilt the short-term market momentum in the bear’s direction.

thecryptobasic.com

thecryptobasic.com