Jonathan Carter, a self-acclaimed market technician, expects XRP to rally to $1.68 in the mid-term if it can secure a breakout from a multi-year symmetrical triangle.

XRP has been trading within a downtrend since it dropped from the last cycle’s peak of $1.96 in April 2021. This trend has resulted in sustained lower highs, essentially leading to the formation of a symmetrical triangle featuring robust resistance at the upper descending trendline.

XRP Caught in a Symmetrical Triangle

However, Carter expects this downward pull to elapse as the market progresses, predicting an imminent breakout. Calling attention to XRP’s price movements over a weekly timeframe, the analyst revealed that the massive drop recorded last month resulted in a retest of the lower trendline of the 3-year symmetrical triangle.

#XRP

Ripple is bouncing from the lower trendline of a symmetrical triangle on the weekly chart🧐

A successful breakout above this triangle would be a bullish signal with mid-term targets at $0.93 and $1.68🎯 pic.twitter.com/sbZXfEYMCM

— Jonathan Carter (@JohncyCrypto) May 6, 2024

For context, XRP collapsed with the broader crypto market from April 11 to 13, recording three consecutive days of decline, which culminated in a 24% drop. This bearish pressure pulled XRP toward $0.4188 on April 13, a low last seen in May 2023.

Nonetheless, this sharp slump in XRP’s price resulted in a retest of the support at the lower trendline of the triangle, essentially signaling an imminent price upswing. Carter believes this upcoming price upswing could help XRP breach the upper trendline of the symmetrical triangle, leading to more substantial gains.

A Modest $1.68 Mid-Term Target

Should this play out, the analyst first projects a price pump toward the $0.93 high, XRP’s highest value in two years. Recall that XRP spiked toward $0.93 last July when Judge Analisa Torres declared it a non-security in the Ripple vs. SEC lawsuit. However, it faced major resistance at the $0.93 peak, eventually retracing all its gains.

Carter expects XRP to eventually breach the major resistance at $0.93 this time around. Consequently, he projects a higher mid-term target of $1.68 following this breach. Currently changing hands at $0.5362, XRP would have to rally by 213% to reach the $1.68 target, a feat achievable within this market cycle.

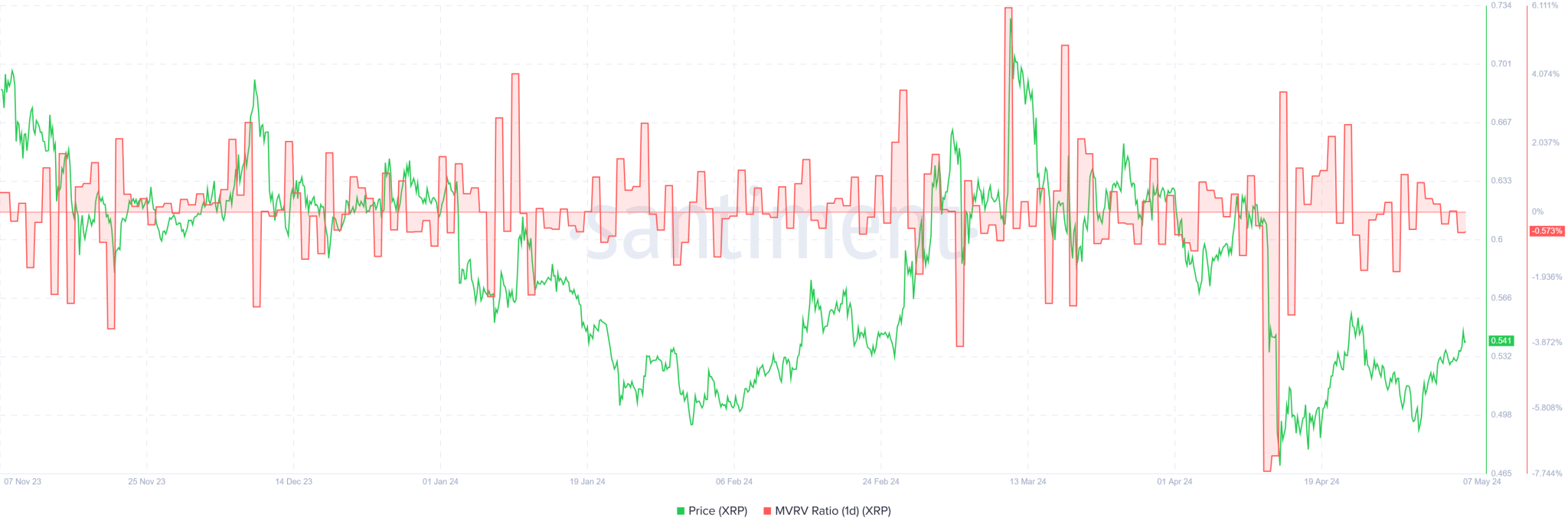

A metric that further bolsters optimism in XRP’s potential is its MVRV Ratio, which has recently collapsed to -0.5733%. This low MVRV ratio signifies that the current market price of XRP, at $0.5362, is relatively low compared to the average price at which coins were last moved. The metric suggests that XRP might be undervalued.

The XRP Commodity Channel Index (CCI) on the 1-hour chart adds credence to this signal. At the current value of -99.58, the CCI indicates that XRP is largely undervalued in terms of the hourly timeframe. This has led to price projections to audacious targets such as $20.

thecryptobasic.com

thecryptobasic.com