What role does cryptocurrency supply play in shaping the value and scarcity of digital assets?

Table of Contents

A fundamental aspect of most crypto assets is their unique supply mechanism, which largely differs from fiat currencies.

Unlike fiat currencies issued by governments and central banks, which can be printed at will, many cryptocurrencies are often designed with a fixed token supply schedule. This means the total number of coins or tokens that will ever exist is predetermined and cannot be altered once the cryptocurrency is launched.

As a rule of thumb, crypto assets are decentralized and often have predetermined issuance rules.

These rules dictate the total amount of a cryptocurrency that will ever be created (maximum supply), the amount currently in circulation (crypto circulating supply), and the total amount in existence (total supply).

These metrics play a crucial role in determining a cryptocurrency’s scarcity, inflation rate, and, ultimately, its value.

Let’s delve deeper into these concepts and explore their significance, how they differ, and why they matter.

What is cryptocurrency supply?

Cryptocurrency supply refers to the total number of coins or tokens that will ever be created for a specific crypto.

What is max supply in cryptocurrency?

The maximum supply of a coin or token refers to the total number of coins that can ever be minted or mined, including the burned or unmined coins.

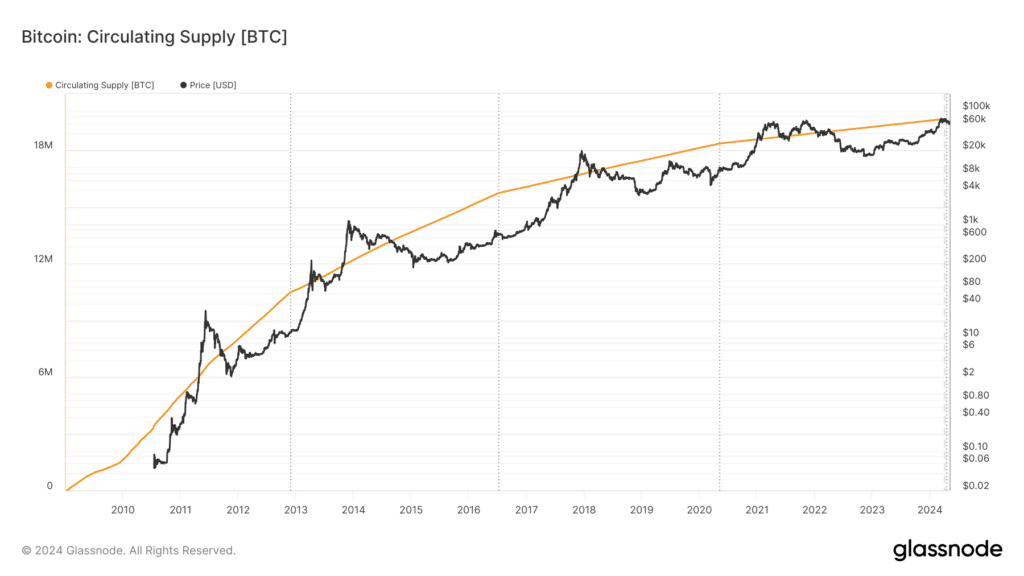

For example, Bitcoin (BTC), the first and most well-known cryptocurrency, has a max supply capped at 21 million coins. This scarcity is one of the key features that give Bitcoin its value, as it is designed to mimic the scarcity of precious metals like gold.

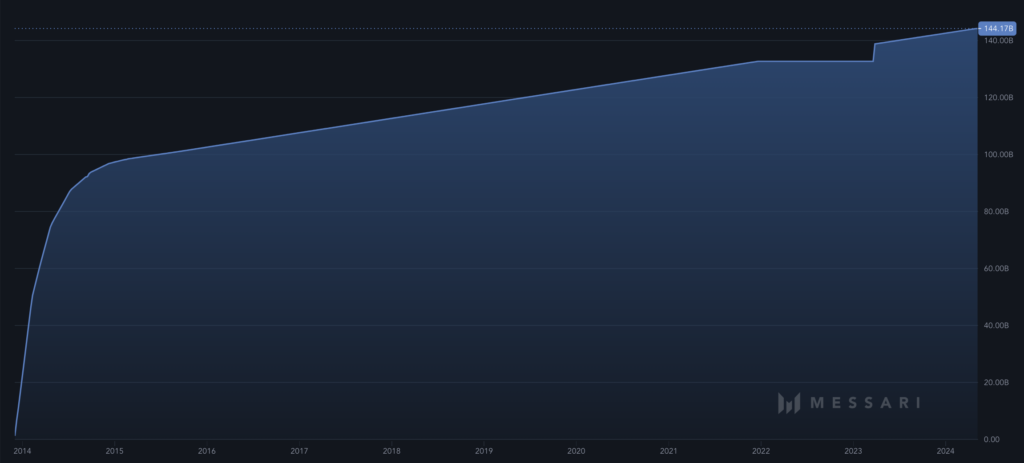

Dogecoin (DOGE), another well-known crypto that started as a joke based on the “Doge” meme, has an interesting approach to max token supply.

Unlike Bitcoin, Dogecoin does not have a maximum supply cap. Instead, it started with an initial supply limit of 100 billion coins, but this limit was removed in 2014, making Dogecoin an inflationary crypto with a continuously increasing crypto token supply. As of May 6, DOGE has a supply of over 144 billion tokens.

Another example is Ethereum (ETH), the second-largest crypto by market cap. Ethereum has a maximum supply that is not capped, meaning that new Ethereum tokens can be created indefinitely.

What is total supply in cryptocurrency?

Total supply encompasses all tokens or coins that have been created for a crypto. This includes coins that are actively circulating as well as those that are not.

Coins not in circulation could be reserved for specific purposes like staking rewards or held under lockup or vesting periods after a private sale or ICO. These tokens technically exist on the blockchain but are not actively traded or available in wallets.

For example, a project might initially create more tokens than are distributed to the public, reserving some for future use. These additional tokens could be used for various purposes, such as incentivizing network participants or funding ongoing development.

Total supply also includes coins that have been burned or destroyed. Burning coins involves sending them to an address for which no one has the private key, effectively removing them from circulation permanently.

This can be done as part of a coin burn event, where a portion of the total supply is intentionally destroyed to reduce the overall crypto token supply and potentially increase the value of the remaining coins.

What is circulating supply in crypto?

Circulating supply refers to the number of coins or tokens that are currently available and in circulation in the crypto market. This figure can differ from the total supply, as not all coins may be actively traded or accessible.

For example, if a crypto has a total supply of 100 million coins but only 50 million coins are in circulation, its crypto circulating supply would be 50 million.

Circulating supply plays a key role in determining the market cap of a crypto asset, which is calculated by multiplying the current price of the coin by its circulating supply.

A high circulating supply, coupled with low demand, can lead to price depreciation, while a low circulating supply can create scarcity and drive up prices.

Total supply vs. max supply

What is the difference between max supply and total supply? Max supply is the total number of tokens that will ever be created or minted for a specific crypto, encompassing all coins that have been, will be, or could be created, issued, burned, or lost.

Total supply excludes any burned tokens and represents the actual amount of the cryptocurrency that is available.

For mineable cryptocurrencies, once the max supply is achieved, no more coins or tokens will be generated. This feature contributes to the perceived scarcity and value of the cryptocurrency.

It’s important to note that while Bitcoin has a fixed max supply, most cryptocurrencies do not. Many cryptocurrencies have a max supply that can change over time, either increasing or decreasing, based on the protocol rules.

Circulating supply vs. token supply

Now, let’s explore the difference between circulating supply and total supply.Total supply represents the maximum number of coins or tokens that will ever exist for a cryptocurrency while circulating supply refers to the coins that are already circulating and available for trading.

Circulating supply excludes coins that are locked up or held in reserve, focusing only on the coins that are actively in the hands of the public.

The calculation of market capitalization, a key metric for investors, typically considers only the circulating supply. This is because the market prices of a cryptocurrency are primarily influenced by the coins that are actively being traded, rather than those that are locked or reserved.

As a result, the circulating supply provides a more accurate reflection of the current market conditions and the liquidity of a cryptocurrency.