Solana price wobbled below the $120 mark on May 1, SOL on-chain movements observed among node validators suggest further downside ahead after closing April with a 41% decline.

Solana Node Validators Withdrew SOL Worth $1.9B in 2-weeks

The crypto markets has continued on a downward trajectory this week, with Solana price reaching a 14-day bottom of $118.72 on May 1. Having posted a stellar performance in Q1 2024, lingering congestion woes and slowing market demand has seen SOL price plunge to 41% loss performance in April 2024.

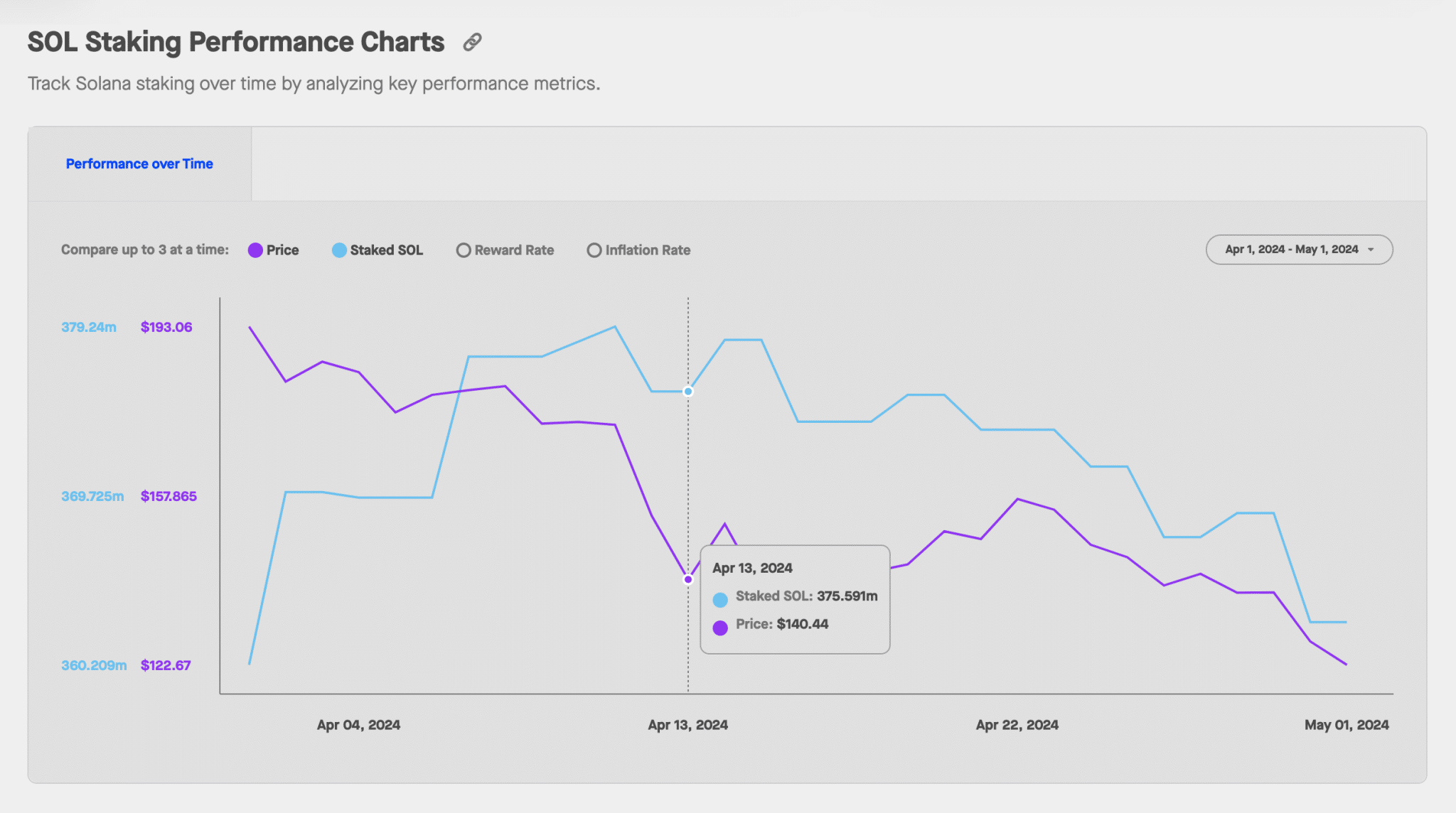

However, recent on-chain data trends suggest that more downside could follow in the days ahead. StakingRewards chart below presents historical data of real-time swing in Solana’s staking deposits.

As of April 15, investors held a total of 378.5 million SOL in staking contracts. But over the last two weeks, that figure has progressively dwindled, hitting 362.6 million SOL at the time of publication on May 1.

Essentially this implies that investors have withdrawn over 16 million SOL from staking contracts between April 15 and May 1. With SOL price currently trading at $119 per coin, the newly-unstaked coins are worth approximately $1.9 billion

While the market downturn has snowballed into double-digits, node validators reactions to the its network congestion woes appears to be a more pressing issue in the last few days.

Recent dev updates aimed at fixing bugs and have not delivered the promised decongestion on the Solana network.

As of April 30, Solana’s transaction failure rate remained worryingly high at over 60.5%. Congestion issues particularly have negative implications on projects like Solana, which are fundamentally geared toward Decentralized Finance (DeFi), Memes and Non-Fungible Tokens (NFTs), as they rely heavily on speed and reliable transactions.

The persistent network sluggishness observed in the recent weeks is a directly contradiction to Solana’s core value proposition of high transaction speed and efficiency.

Amid the market downtrends, node validators and Solana DeFi protocol investors could react by un-staking more SOL and possibly seek out alternatives in the week ahead.

Solana Price Forecast; Bears could target $100 Reverse in May 2024

Node validators flooding the markets with $1.9 billion in newly-unstaked coins has been a major catalyst behind the downward SOL price trend in the last weeks. However, with network congestion still driving up transaction failure rate, Solana appears poised for further price downswing towards $100 in May 2024.

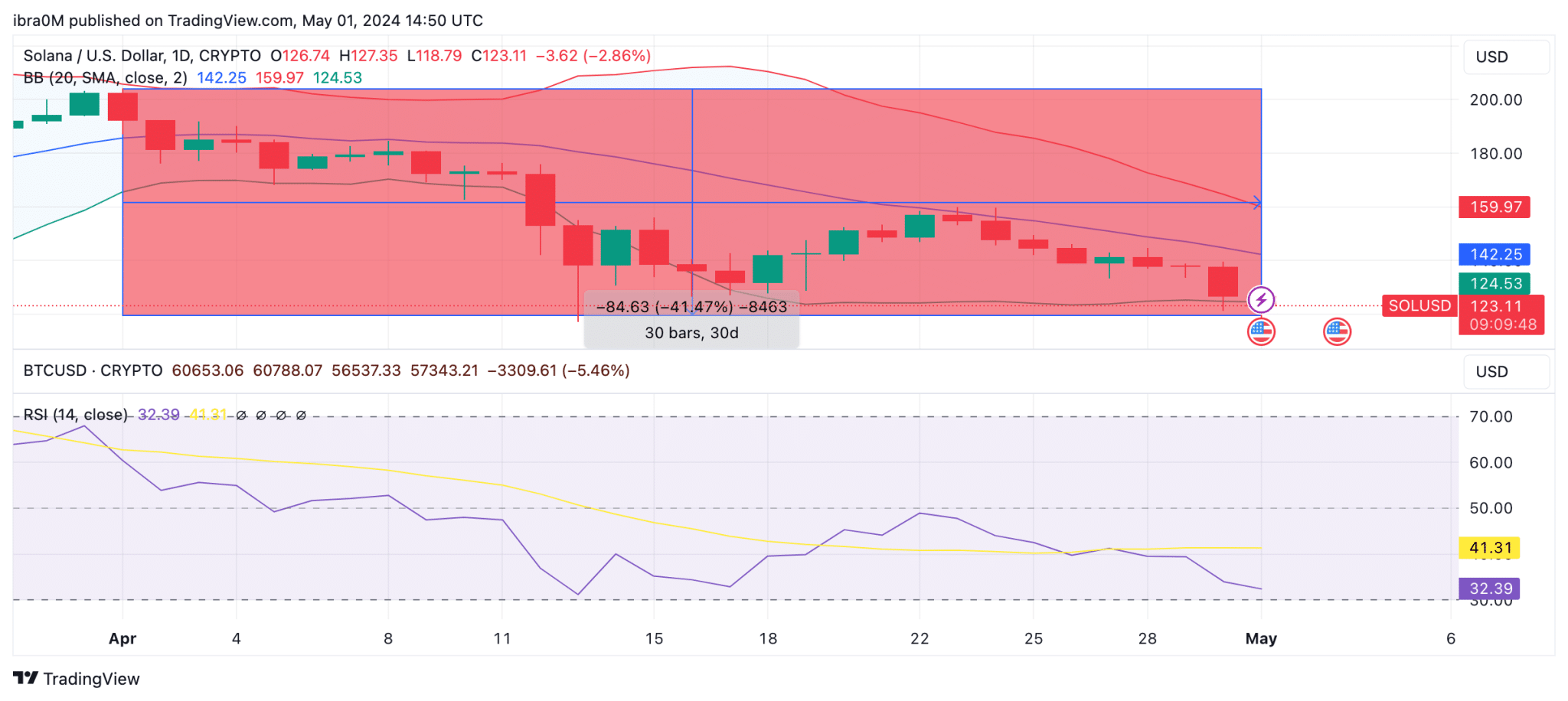

The Bollinger bands and Relative strength index technical indicators also affirm this pessimistic Solana price outlook for May 2024.

Firstly, SOL price is now trading below the lower-limit Bollinger band at $124, signaling an overwhelming bearish sentiment within the SOL markets. Without a significant support cluster around the current prices, SOL is now at risk of tumbling toward $100.

On the bright side, Solana RSI is currently trending at 32.6, just whiskers away from enter oversold territory below the 30.0 threshold. If bulls on the sidelines consider this a perfect entry point, SOL could begin to witness some demand surge if prices fall toward $110.

If this scenario plays out, an early price rebound toward $150 could be on the cards.

thecryptobasic.com

thecryptobasic.com