Bitcoin Cash (BCH) price opened trading at the $480 territory on Saturday, April 27, closing the week 7% in the red. On-chain data showed that BCH long-term holders continue to accumulate more coins amid the price dip.

Bitcoin Cash Bulls Succumb to Post-Halving Pressure

The Bitcoin Cash network executed its second ever Halving event on April 3 2024, sparking speculations of the perennial post-halving crash that has often plagued major Proof-of-Work (PoW) coins over the years.

Bearish headwinds surrounding the halving saw BCH prices decline 37% in the first-half of April 2024. Over the last two weeks, efforts to reverse the post-halving losses have fallen flat.

The chart above shows how BCH price recovery phase at the start of the week rejected as the bulls failed to establish a steady support base above $500 level. Since rejecting at the $523 weekly top recorded on April 23, BCH price has now declined 7% to find support around the $475 territory.

But despite the negative sentiment triggered by Bitcoin Cash halving, a closer look at the underlying on-chain data suggests key stakeholders may be anticipating a price breakout in the days ahead.

BCH Long-term Holders Invest $76 million despite 7% Price Dip

BCH has tumbled 7% on the weekly timeframe. But, looking past the price action, Bitcoin Cash long-term investors have shown remarkable resilience that could be pivotal for an early rebound.

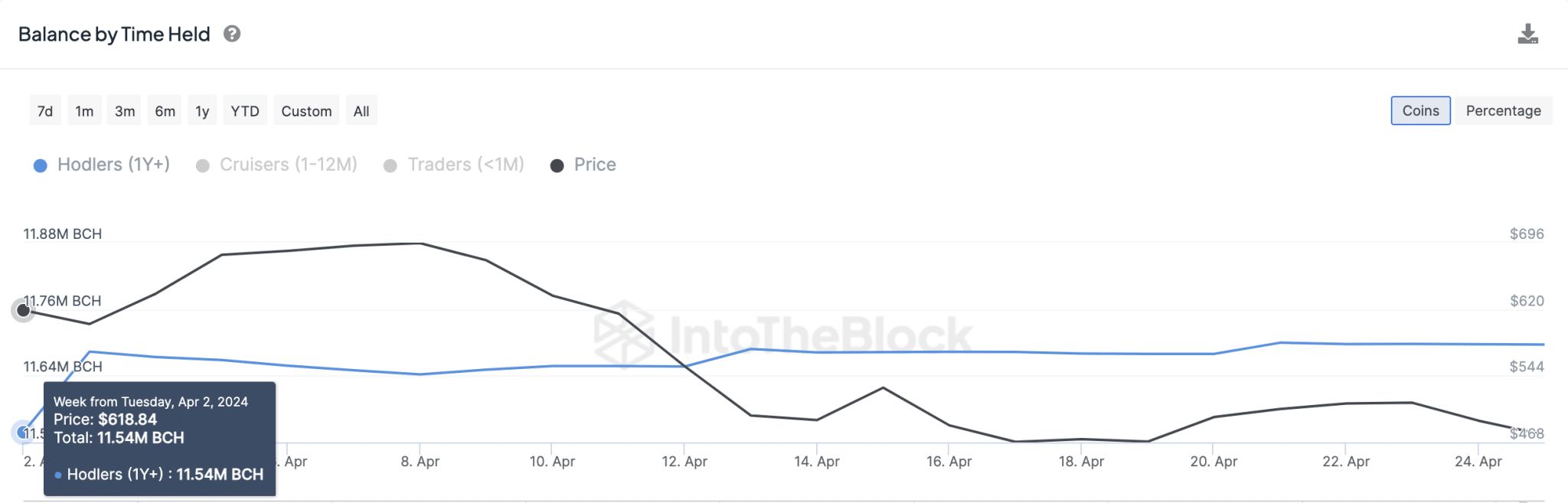

IntoTheBlock’s Coins by Time-Held chart below, tracks real-time time changes in the number of BCH coins that have remained unmoved for at least 1-year or more. This serves as a proxy for tracking the dominant sentiment among long-term investors.

At the eve of the Bitcoin Cash Halving event on April 2, BCH long-term holders held a total of 11.54 million BCH in their cumulative balances. But rather than sell amid the post-halving price dip, these long-term holders have remained in accumulation mode.

At the time of writing on April 27, BCH long-term holders balances now stands 11.7 million, marking an increase of 160,000 BCH since the halving.

Effectively, BCH long-term holders have shown remarkable resilience, ignoring the fears of the ongoing post-halving sell-off, and flaring geo-political tensions. Valued at the current prices of $478, the long-term holders’ newly acquired 160,000 BCH are worth approximately $76.4 million.

Typically, such a prolonged increase in long-held coins during periods of price decline could have a positive impact on the underlying assets’ price action.

First, it signals that despite the recent price struggles majority of Bitcoin Cash existing holders remain optimistic of the asset’s near-term price prospects, which could buoy the confidence of prospective new entrants.

But, more importantly, coins in custody of long-term holders are temporarily taken out of the short-term market supply.

As a result, the $76 million in drop-off in BCH spot market supply since the halving could slow down the selling pressure and help propel prices towards the $600 mark during the next recovery phase.

thecryptobasic.com

thecryptobasic.com