Dogecoin (DOGE) opened trading at $0.15 on April 26 after a third consecutive day in decline, while rival memes BONK and PEPE registered double-digit gains for the week.

DOGE Price Underperforming Compared to Rival Memes

Bitcoin Halving dominated headlines at the start of the week with fanfare surrounding the landmark event cutting across crypto-native and tradfi media like.

But curiously, prominent Proof-of-Work coins including have struggled for momentum since the April 20 event, as crypto investors grow skittish and wary of a potential post-halving crash.

Dogecoin, the largest memecoin project and one of the few that deploy the PoW consensus mechanism, has been caught in the crosshairs.

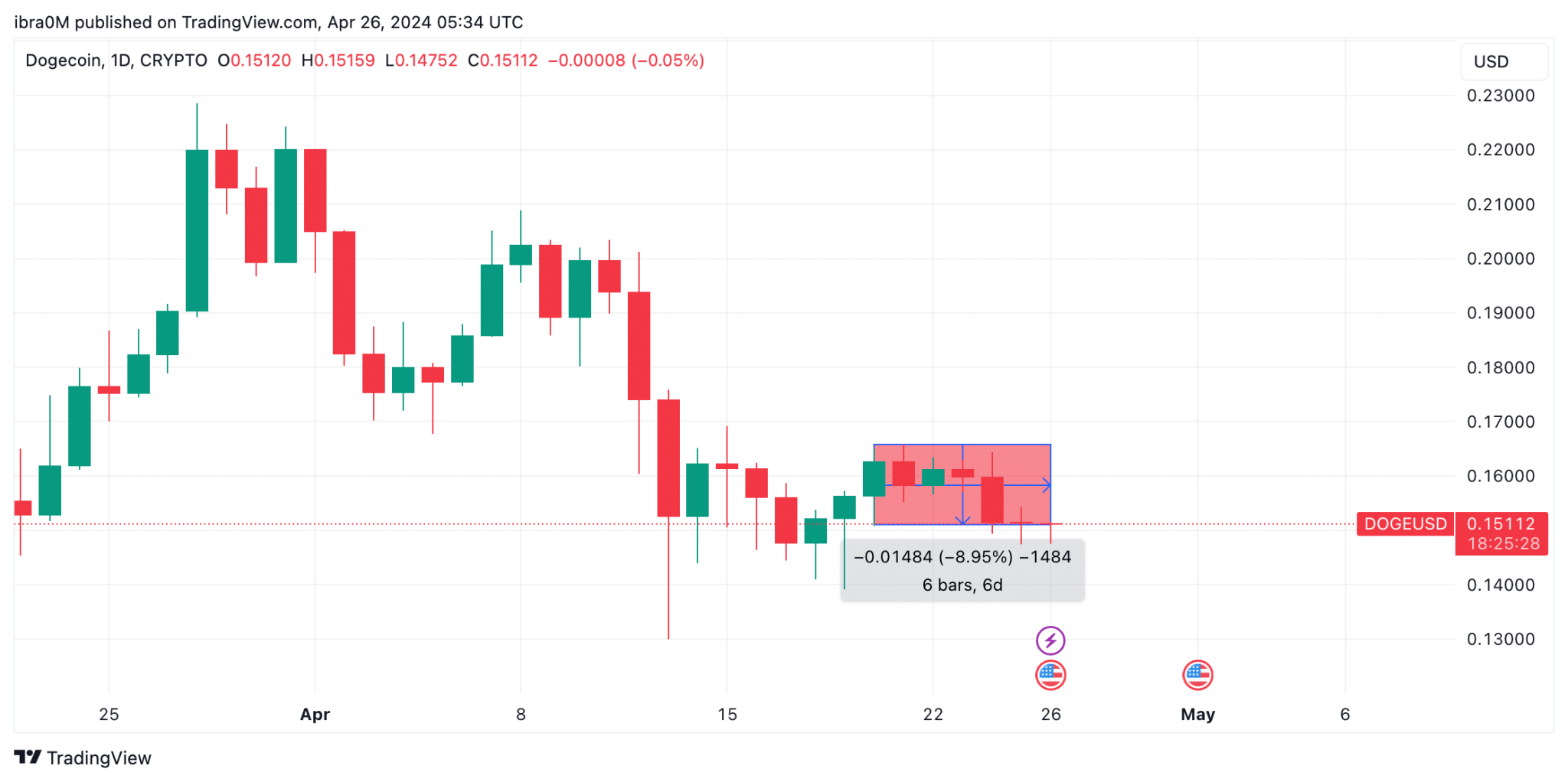

The Dogecoin price chart above shows DOGE is down 8.3% since the Bitcoin halving date. Looking at the broader memecoin market trends for the week, DOGE’s negative price performance appears to be an isolated pattern.

For context, rival mega-cap memecoins, BONK (+120%), PEPE (+70%), and Shiba Inu (+35%), have all registered considerable gains this week.

A closer look at the underlying on-chain data trends suggests that whale investors’ neutral position on DOGE and other PoW coins in the aftermath of the Halving played a critical role in the negative price action.

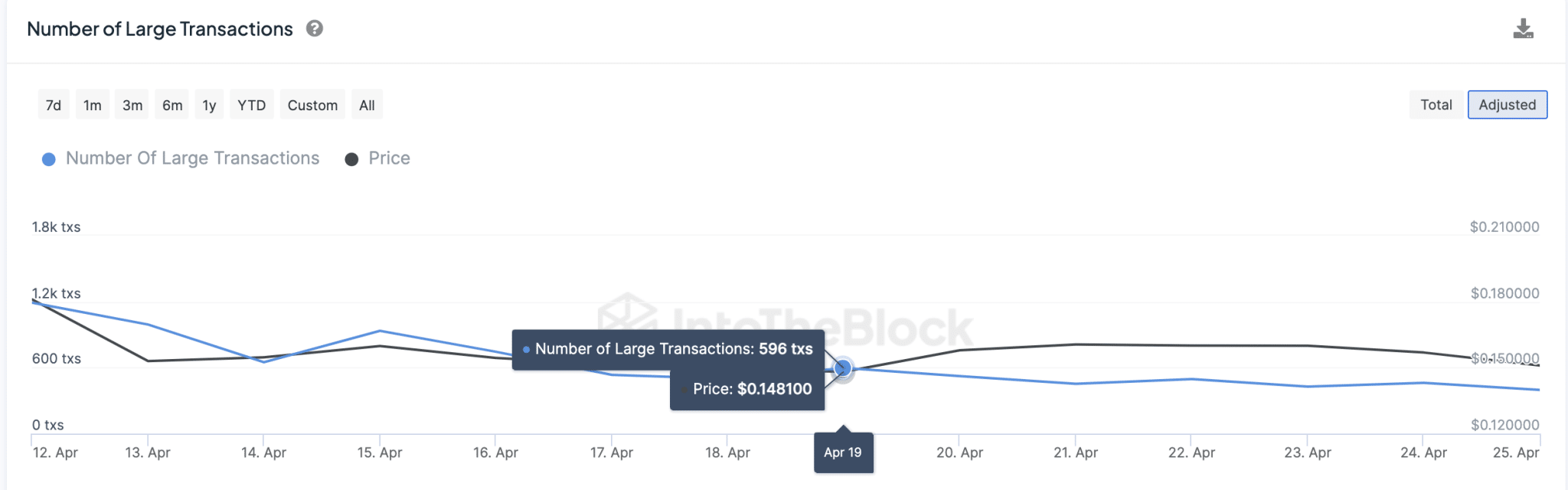

IntoTheBlock’s Large Transactions chart below tracks the daily number of unique confirmed transactions that exceed $100,000 in value. This serves as a proxy for monitoring real-time changes in whale investors’ trading activity.

On the Halving eve of April 19, Dogecoin whale investors executed 596 transactions, and it has been downhill since then. The latest Dogecoin network data shows that the figure has now dropped to 398 large transactions confirmed on April 25, representing a 34% decline in whales’ trading activity.

A prolonged drop-off in whale transactions, as observed on the Dogecoin network since the halving date, often negatively impacts price action for a number of reasons.

Firstly, whale transactions provide much-needed market liquidity. Hence, a decline exposes the native coin to risks of downward volatility, especially when traders sell off large positions.

Additionally, the absence of whale transactions signals a loss of confidence among institutional holders, triggering a negative sentiment shift among small-hold retail investors and swing traders who may follow suit and sell their holdings.

This cascading effect can further exacerbate selling pressure and contribute to a negative feedback loop, driving Dogecoin prices lower in the days ahead.

DOGE Price Forecast: The $0.15 Support is at Risk

At press time on April 26, the DOGE price is hanging above $0.15 by a hair’s strength, down 8.4% within the weekly timeframe. Drawing inferences from whale investors’ skittish sentiment shift in the aftermath of the Bitcoin Halving, the Dogecoin (DOGE) price looks set for an imminent downswing below that critical $0.15 support level.

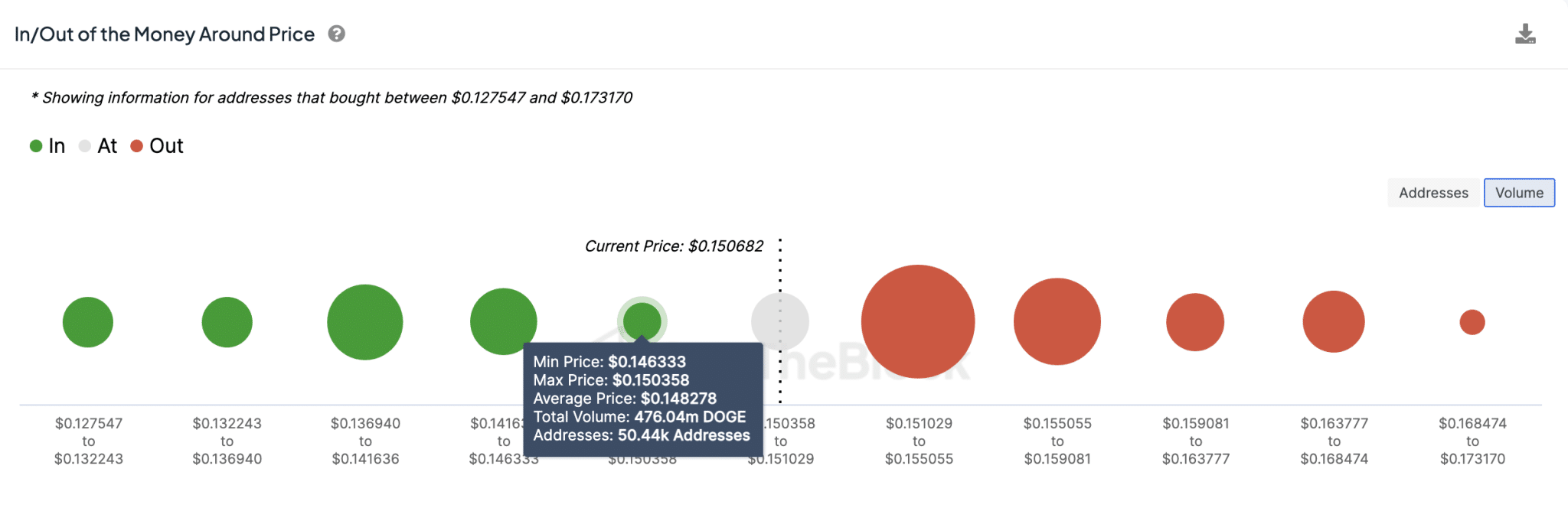

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) data, which groups existing DOGE holders according to their entry prices, also supports this pessimistic Dogecoin price outlook.

The IOMAP chart above shows that DOGE faces a resistance cluster at $0.16, currently much larger than the immediate support buy-wall. In essence, a reversal below $0.15 appears to be the more likely outcome in the near term.

However, the 50,440 address that acquired 476 million DOGE at the average price of $0.14 could swing into action to trigger an early rebound and avert major losses.

thecryptobasic.com

thecryptobasic.com