The broader cryptocurrency market has shed the short-term gains experienced leading up to the Bitcoin (BTC) halving event. Following the completion of the bullish event, the markets have failed to react positively, with analysts attributing it to the post-halving retracement.

Against this backdrop and prevailing market sentiment, Finbold has identified three cryptocurrencies worth watching in the coming week despite the predominantly red market.

Bitcoin (BTC)

One of the primary reasons for interest in Bitcoin is its recent halving event and how the price will evolve. Since the event, Bitcoin has experienced a correction, slipping below the $65,000 mark. Initial optimism revolved around Bitcoin’s potential to establish gains above $65,000. However, the post-halving correction has tempered these expectations and raised questions about the cryptocurrency’s short-term outlook.

It is worth noting that Bitcoin initially dropped below the $70,000 zone following heightened geopolitical tension. Indeed, in the coming week, investors will be interested in how Bitcoin’s price adapts to the evolving tensions in the Middle East.

Crucially, attention is on Bitcoin’s ability to sustain its gains above the $60,000 support zone. Analysts emphasize the significance of this price level, suggesting that a drop below $60,000 could spell trouble ahead for the cryptocurrency, pointing to possible further downside.

Whether Bitcoin can shake off the recent downturn, reclaim its momentum, navigate geopolitical headwinds, and hold above the crucial $60,000 mark remains to be seen in the coming week. Indeed, the trajectory of the crypto will likely influence general market sentiment.

By press time, Bitcoin was trading at $63,606 with daily losses of almost 2%.

Solana (SOL)

Solana (SOL), a decentralized finance (DeFi) project, remains a pivotal asset to watch, particularly regarding its blockchain activities likely to impact its price. Notably, Solana, which has experienced a significant rally in recent months, faced pressure amid the recent general market sell-off, with the asset hovering close to dropping below $130.

However, SOL managed to reclaim the $140 mark, showcasing resilience amidst market turbulence.

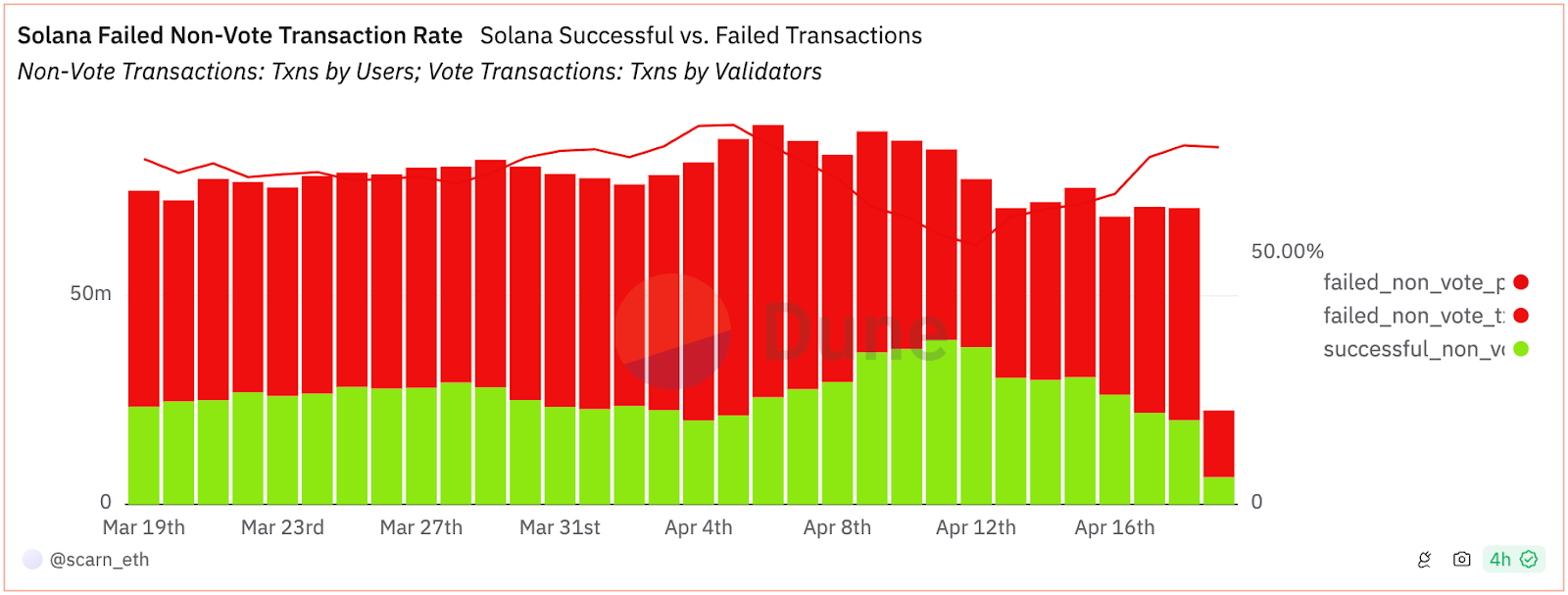

Despite this resilience, various network issues continue to persist around Solana. Despite the recent rollout of a major network fix, high transaction failure rates persist, with 71% of non-voting transactions still resulting in failures as of April 19.

The recent v1.18.11 update to the devnet by the Solana dev shop Anza initially failed but was successfully restarted in a second attempt. This effort aims to alleviate ongoing network congestion, signaling ongoing efforts to address technical challenges.

As of press time, SOL was trading at $141, having corrected by over 7% in the last seven days.

Celestia (TIA)

Celestia (TIA) cryptocurrency represents a modular network facilitating the straightforward deployment of individual blockchains with minimal overhead. The token has been a standout performer in the current market rally, notably maintaining a positive trajectory amid the overall prevailing bearish sentiments.

TIA’s upward momentum began in late 2023 following the launch of Celestia’s mainnet beta, signaling the onset of the modular blockchain era. Another contributing factor to its value surge could be its previous listing on Binance, underscoring promising scalability solutions.

As we move into the new week, attention is on whether TIA can sustain its resilience and trajectory in the green zone.

By press time, the token was trading at $11.29, reflecting daily gains of almost 3%. Over the last seven days, it has increased by over 15%.

It’s important to recognize that the cryptocurrencies discussed are still subject to external market forces that extend beyond their inherent fundamentals.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com