Despite the initial recovery attempt engineered yesterday, Shiba Inu still trades below the pivotal 50-day EMA amid the Israel-Iran situation and market crash.

Shiba Inu has been on a downward slope like the rest of the crypto market since April 9. Down 24% from its opening price on April 9, SHIB has breached multiple crucial support thresholds amid the price collapse, currently changing hands below the $0.000022 psychological support.

The market saw a glimmer of hope yesterday after Bitcoin (BTC) retested the $59,700 support and Ethereum (ETH) touched the $2,960 level. Both assets recovered significantly, leading to a bullish response from the rest of the market, with Shiba Inu recording a 3.31% close to the day.

However, the bearish pressure has returned this morning, resulting in a 3.82% drop in SHIB’s price today. This resurgence of selloffs was triggered by multiple factors surrounding the crypto market, unfavorable macroeconomic conditions, and geopolitical tensions.

Macro Conditions and GBTC Outflows

First, Federal Reserve officials have indicated a potential delay in rate cuts due to high inflation, now suggesting that any reductions could be postponed until 2025. This shift marks a reversal from previous statements that proposed up to three rate cuts in 2024.

In addition, ongoing large-scale asset sales have intensified the downturn. Grayscale Bitcoin Trust (GBTC) reported saw outflows worth $90 million in Bitcoin yesterday. This activity contributed to a continued outflow from spot Bitcoin ETFs, exacerbating the downward pressure on the market.

Bitcoin ETF Flow – 18 April 2024

GBTC Outflow $90m

— BitMEX Research (@BitMEXResearch) April 18, 2024

Iran-Israel Situation

Notably, Reuters recently reported that Israel had responded to the April 13 attack from Iran. Recall that Iran launched over 300 drones and missiles targeted at Israel for a bombing that affected its consulate building in Syria. Though most of the drones were intercepted, Israel vowed to respond.

This response came today, with Israel reportedly launching an attack on Iran, Reuters and Aljazeera revealed. The reports noted that Iran activated its air defense system following explosions in the city of Isfahan. According to Aljazeera, Iran vows to send a second response if Israel launches another attack.

The tension from these events has triggered a second round of market declines as more investors pull out their funds to hedge against any economic response to the geopolitical issue. Blockchain reporter Colin Wu reported today that Bitcoin dropped below $60,000 and ETH collapsed underneath the $2,900 support.

Affected by the news of Israel's attack on Iran, Bitcoin fell below US$60,000 and Ethereum fell below US$2,900. Since leverage has been liquidated sometimes recently, the liquidation amount in one hour was only US$70 million.https://t.co/YQ6p9AZeYG https://t.co/iiszESKVdl

— Wu Blockchain (@WuBlockchain) April 19, 2024

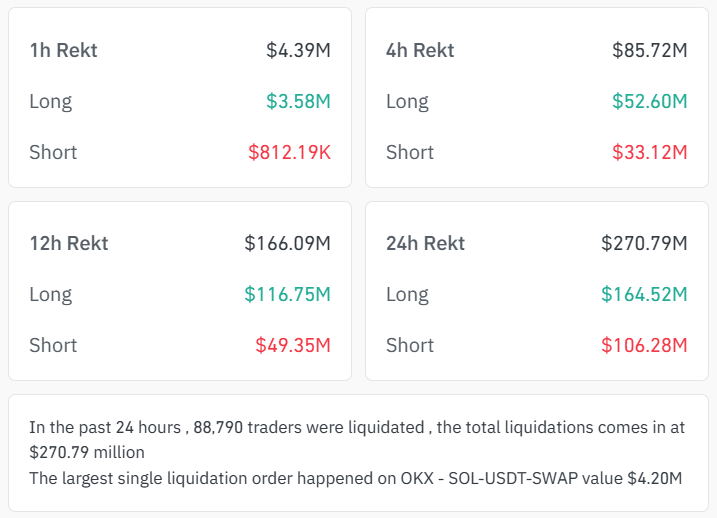

Wu confirmed that the crypto market recorded $70 million in liquidations in the hour leading to 2:36 AM (UTC). Coinglass data indicates that liquidated positions had increased to $166 million over the last 12 hours, with nearly 70% attributable to long liquidations. In addition, in the past 24 hours, 88,792 traders have faced liquidations.

Shiba Inu Sees Downward Pressure

While SHIB has witnessed a 6.33% rise in derivatives volume in the past 24 hours to $168 million, most of this volume comes from traders betting on further declines as the long/short ratio drops to 0.9623. In addition, SHIB has recorded $742,450 in liquidations within this timeframe.

Shiba Inu did not escape this sudden price drop. After soaring to $0.00002296 last night, SHIB began this morning with a sharp decline, dropping 8.5% from midnight to 3 AM (UTC) as it collapsed to a low of $0.00002088. Despite a recovery from this crash, Shiba Inu is not yet out of the woods.

Notably, SHIB continues to trade underneath the pivotal 50-day EMA at $0.00002327, indicating prevalent short-term bearishness. Shiba Inu breached this EMA on April 13 and has remained below it since then.

Currently changing hands at $0.00002185, data suggests that Shiba Inu is also trading within a symmetrical triangle. Notably, SHIB is looking to break above the upper trendline of this symmetrical triangle with a push above $0.00003. Reclaiming the 50-day EMA ($0.00002327) could grant the bulls enough strength for this campaign.

thecryptobasic.com

thecryptobasic.com