Good morning. Here’s what’s happening:

Prices: Bitcoin dipped below $23K earlier in the weekend and flattened on Sunday as investors await the next utterances from Federal Reserve Chair Jerome Powell.

Insights: If crypto continues to rebound, venture capital in blockchain projects is likely to rise. Will venture capitalists avoid their past investment mistakes in the blockchain space?

Prices

Crypto Trades Flat as Investors Await Powell Speech, More Earnings

By Sam Reynolds

Major digital asset prices traded flat over the weekend, with bitcoin and ether down 1.7% and ether 2.3%, respectively over the weekend.

After a mediocre start to earnings season, investors are thought to be looking ahead to Federal Reserve Chairman Jerome Powell’s speech, scheduled for Tuesday afternoon, before making any big moves.

FactSet data shows that less than 1% of the companies in the S&P 500 reported earnings that were above estimates. This is below the 5-year average of 8.6%, and the 10-year average of 6.4%.

"As a result, the earnings decline for the fourth quarter is larger today compared to the end of last week and compared to the end of the quarter," FactSet's senior earnings analyst John Butters wrote in a Friday market update. "If the index reports an actual decline in earnings for Q4 2022, it will mark the first year-over-year decline in earnings reported by the index since Q3 2020.”

Speaking late last week on CoinDesk TV, David Siemer, the CEO of accounting software provider Wave Financial, said that the market is giving mixed signals – strong job numbers, but mediocre earnings results – and he still expects a recession this year, albeit a weak one.

“I am a little more optimistic that it won't be quite as severe recession as in a great recession or major, major recession,” he said, pointing to the resilience of consumers. “The fact that the Fed's actions are having such a slow effect doesn't mean cumulatively they won't eventually have a major effect. We're probably still a quarter or two away from seeing what the Fed's actions have really actually done to the economy.”

And what does this mean to crypto prices, looking forward? BitBull Capital’s Joe DiPasquale wrote in a note to CoinDesk that crypto markets are “optimistic” after a modest rate increase and bitcoin will “oscillate around the $20K support level for the next few months, barring other unforeseen events and market action.”

Meanwhile, the U.S. Dollar Index (DXY) is opening the Asia trading week at 103.12, staying in what many analysts call a “defensive” position. The measure of the world’s largest fiat asset spent most of last year surging, hitting stock and crypto prices hard. Year-to-date it’s down 1.4%.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Cardano | ADA | +1.4% | Smart Contract Platform |

| Cosmos | ATOM | +1.1% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Loopring | LRC | −5.0% | Smart Contract Platform |

| Terra | LUNA | −4.5% | Smart Contract Platform |

| Decentraland | MANA | −4.2% | Entertainment |

Insights

Can Crypto VCs Avoid the Mistakes of Last Year?

By Sam Reynolds

The last quarter of 2021 was the end of an unprecedented bull market that began the year before with Covid-included macroeconomic policy and finished with the Fed raising rates in 2022, and with a trio of collapses, most notably crypto exchange FTX and its trading arm Alameda Research. Venture capitalists enjoyed the ride on the way up, but certainly felt the pain on the way down in 2022 as cascading failures knocked the wind out of their portfolios.

For the industry, the trillion-dollar question will be: Did VCs learn anything, and can they avoid repeating the mistakes of last year that severely dented their profits. VCs invested furiously as crypto prices rose but their methods often seemed slapdash.

An upbeat January

Bitcoin and many altcoin categories had a fantastic January, with the world’s largest digital asset rising 40% on-month, some metaverse tokens making triple-digit gains, and Layer-1s like Aptos’ APT rising by over 300%. Some of the more bullish takes even predict bitcoin hitting $45,000 by Christmas.

But despite these data points indicating that crypto winter is thawing, VCs investment in digital asset and blockchain projects fell 90% in January, according to a recent CoinDesk report.

"Over the past 18 months, VC investments into crypto reached a peak, with investments spread across the entire ecosystem. Diligence cycles were compressed to weeks and sometimes days during this time, with many investors shunned out of the round if they asked crypto startups follow-up diligence questions (this is partly why FTX was not properly diligenced),” Robert Le, a senior emerging technology analyst at Pitchbook, told CoinDesk in an email.

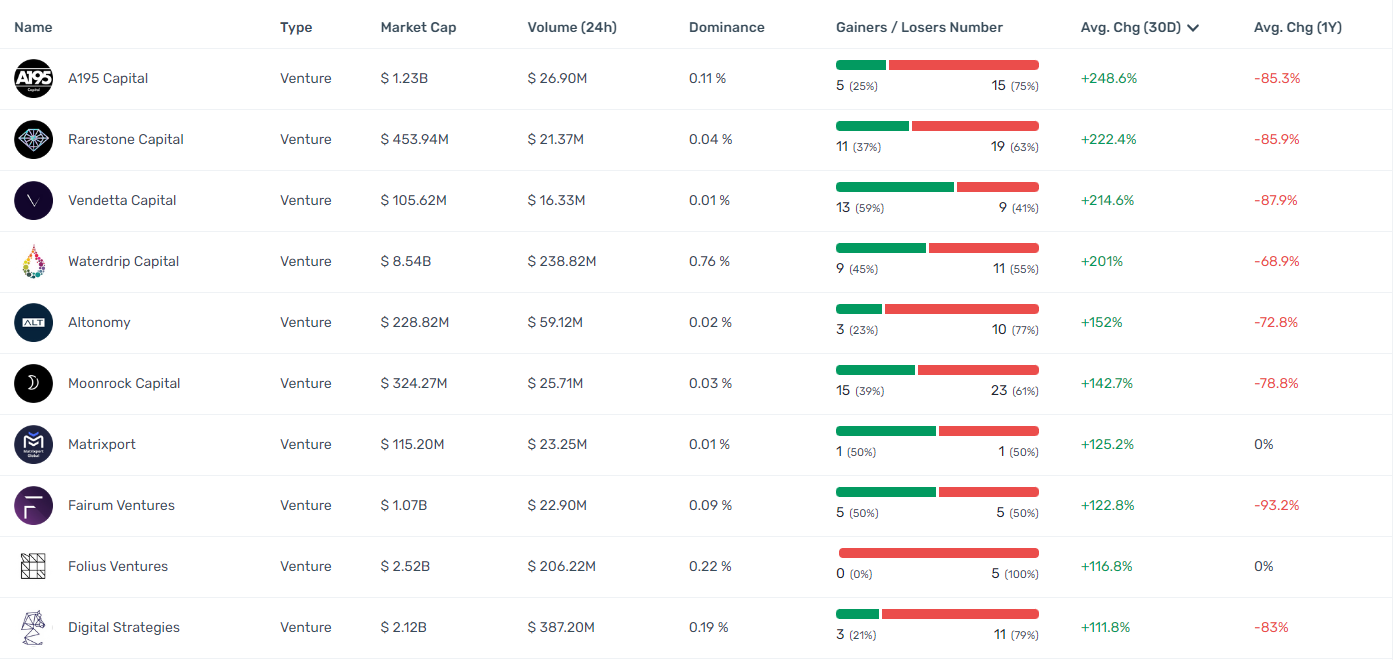

And what are they investing in? Lesser known protocols. The stuff that climbs fast and falls hard. Stuff that would be part of a “scattershot” portfolio.

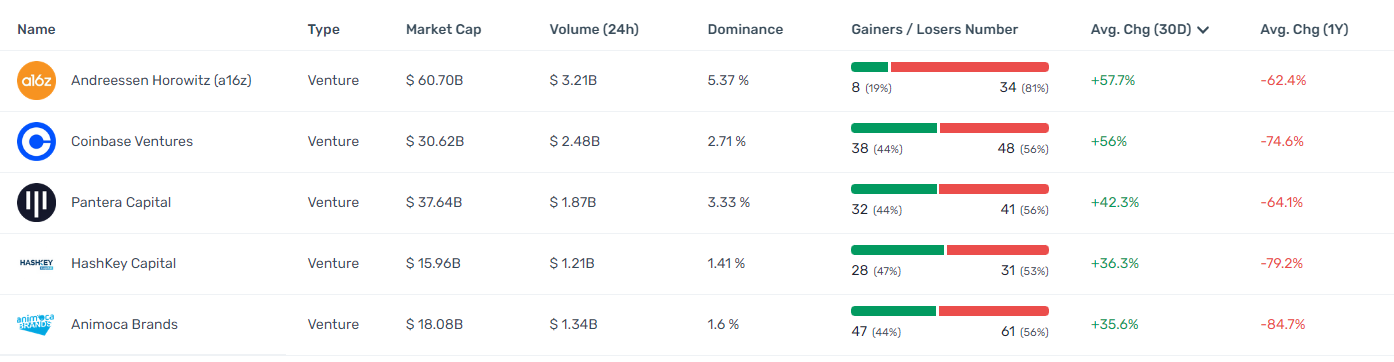

That’s not to say that the largest funds aren’t doing well in the last month.

(CryptoRank)

Coinbase Ventures, which was very busy throughout 2022 with 121 closed deals according to Pitchbook, has seen its token portfolio rise by 56% over the past month. A16Z is around the same. Animoca Brands, which was rumored to be suffering from serious financial strife at the end of last year, has had its fortunes turn around in a big way.

But which thesis will win?

Important events.

9:00 a.m. HKT/SGT(1:00 UTC) Eurozone Retail Sales (YoY/Jan)

10:30 p.m. HKT/SGT(14:30 UTC) Japan Overall Household Spending (YoY/Dec)

2:30 a.m. HKT/SGT(18:30 UTC) Reserve Bank of Australia Interest Rate Decision

coindesk.com

coindesk.com