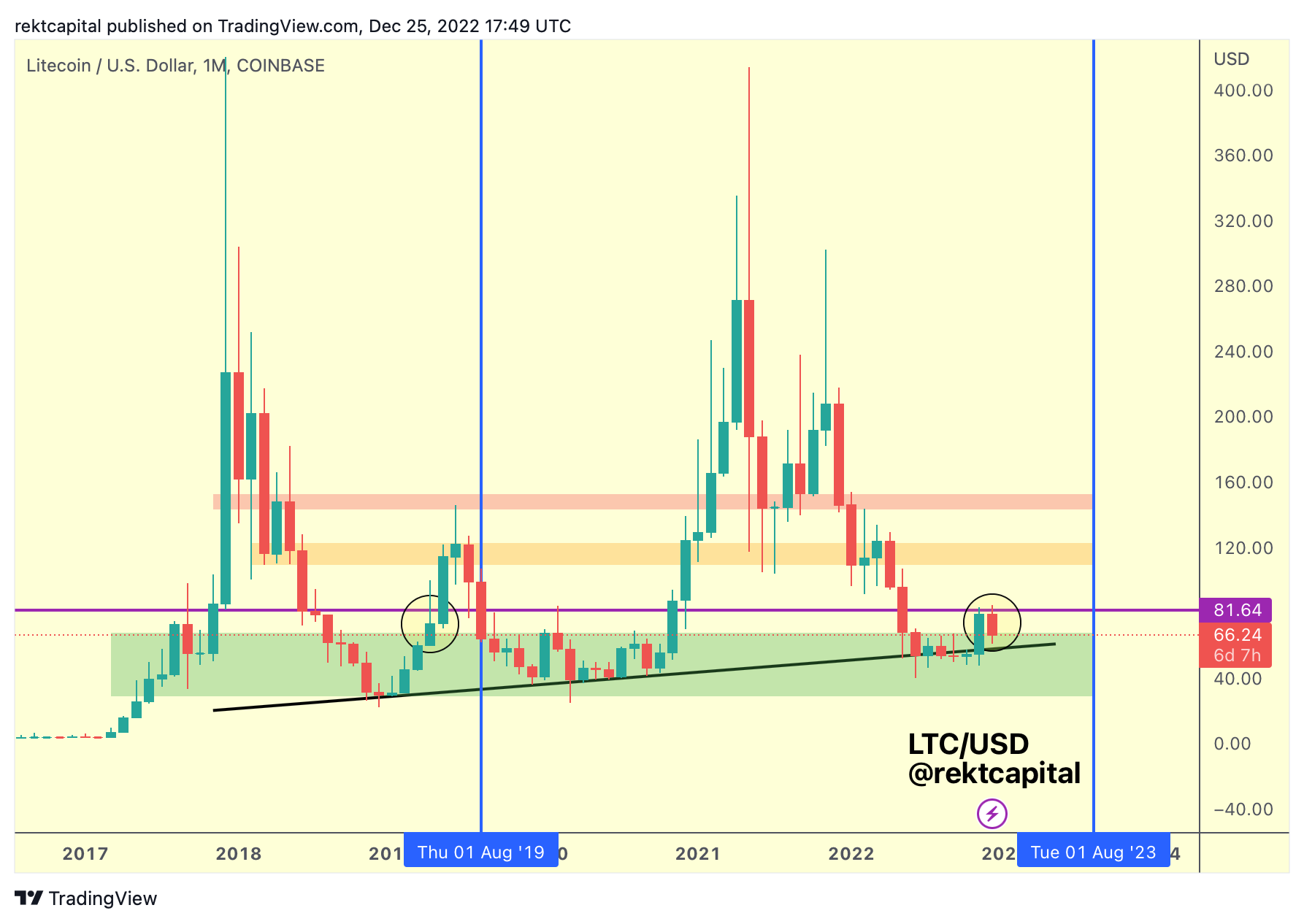

A popular crypto strategist says that Litecoin (LTC) could go on an epic surge before the peer-to-peer payments network’s halving event next year.

Pseudonymous analyst Rekt tells his 329,900 Twitter followers that Litecoin is showing signs of strength on the higher timeframe after rallying above its long-term accumulation level.

According to the crypto strategist, LTC could be mirroring its 2019 price action when it rallied from around $70 to $146 in just a few months.

“[The] last time LTC performed a monthly close above the green historical accumulation area prior to its Litecoin Halving in August 2019 (blue)…

LTC rallied towards the orange resistance to top out just before the Litecoin halving event.”

Based on the analyst’s chart, he appears to be predicting a rally toward $120, suggesting an over 70% upside potential for Litecoin.

At time of writing, LTC is changing hands for $70.31. Litecoin is scheduled to undergo its next halving in July 2023.

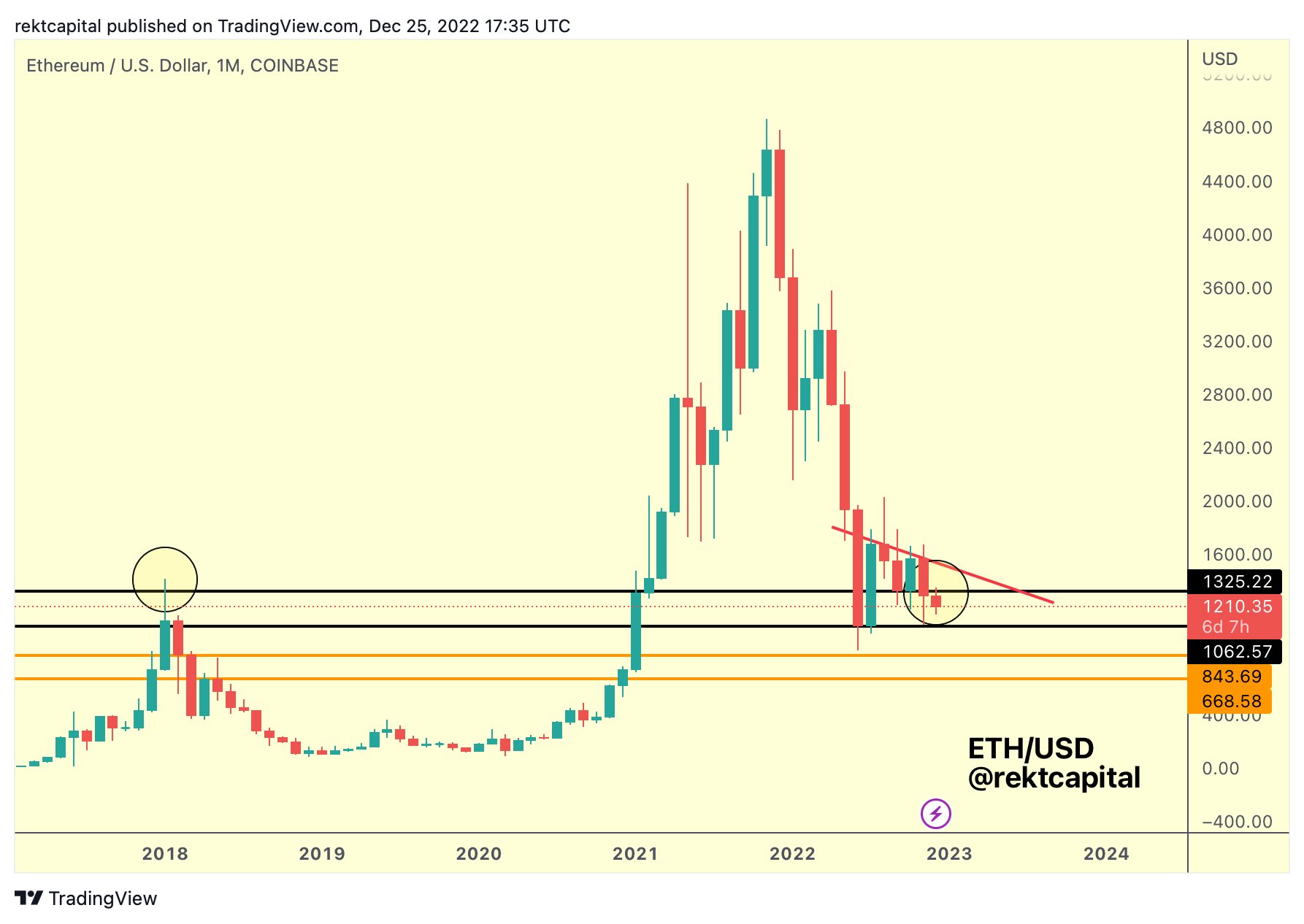

Looking at Ethereum (ETH), Rekt says the leading smart contract platform is trading within a wide range on the monthly chart and says that it must hold a key support level to avoid another sell-off event.

“Since the summer rally, ETH has been visibly downtrending (red).

In fact, red has forced ETH to drop below $1,325 support (black).

Looks like black is acting as resistance again, just like in 2017.

Lose $1,062 support as well -> drop to orange area below ($843).”

At time of writing, ETH is trading at $1,226, a fractional increase on the day.

Another altcoin on the trader’s radar is decentralized oracle network Chainlink (LINK). According to Rekt, the next few days are critical for Chainlink as it needs to reclaim a high timeframe support level to avoid witnessing a new corrective move.

“LINK is still consolidating inside this range, though threatening to lose the range low as support.

A monthly close below black range low ($6.27) could set LINK up for a drop into the sub-$5 area (green box).”

At time of writing, LINK is valued at $6.01, well below Rekt’s monthly support.

Next is decentralized lending and borrowing protocol Aave (AAVE), which Rekt says looks poised for a deep pullback.

“Macro downtrend still strong (red diagonal). Also, a multi-month downtrend is weighing on AAVE (blue), which is acting as confluent resistance with the red box (an old support). Reject here -> retrace to listing price (black).”

At time of writing, Aave is switching hands for $55.68.

The last coin on the trader’s list is Ethereum hard fork Ethereum Classic (ETC). Rekt says ETC is likely headed toward its historical support level around $13.

“ETC has dropped -58% since rejecting from the macro downtrend. In fact, ETC may soon reach green box. Green is where ETC formed an accumulation range that enabled the 2021 bull market. Likely ETC will drop into green to find a bear market bottom.”

At time of writing, ETC is swapping hands for $16.20.

dailyhodl.com

dailyhodl.com