(Stablecoin) Binance-Peg BUSD is a Binance product but is not issued by Paxos nor regulated by the New York State Department of Financial Services. Only ERC20 BUSD is issued by Paxos and regulated in New York. Can this be a concern in the global scale of the stablecoin rise?

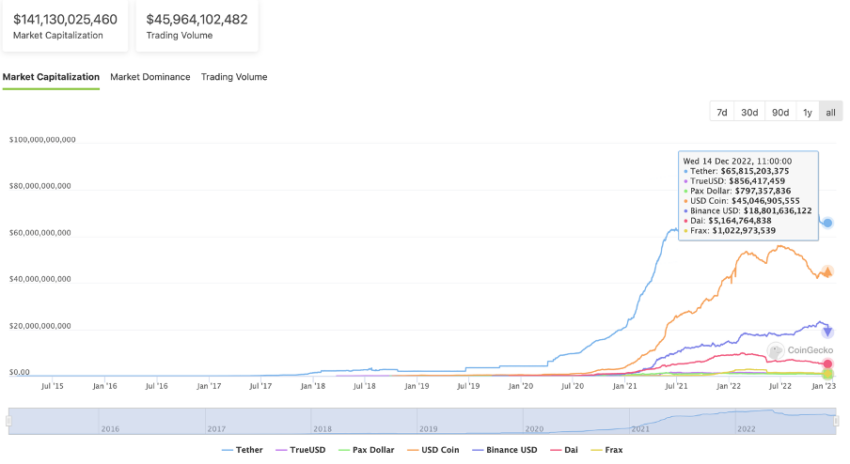

Stablecoins: There are over $100 billion outstanding; more crypto is traded against it than any fiat currency. Over the past year, it has grown by over five times in market capitalization, crossing $140 billion and representing 15% of the crypto market cap. It also plays a crucial role in global liquidity in the cryptocurrency markets.

While the growing operations, it has created a stir in the crypto-verse, there are potential risks beneath these cohorts. This article highlights such risks while highlighting a critical concern regarding the largest crypto exchange’s stablecoin and regulation.

Stablecoins: Types of variants

Stablecoins are cryptocurrencies pegged one for one to the cost of some other asset. In most cases, that is a fiat foreign money just like USD. While some are paired with different currencies, they’re enormously insignificant inside the overall scheme of the stablecoin marketplace. Stablecoins can hold their peg way to separate mechanisms.

Decentralized stablecoins depend on collateralized debt and smart contracts to preserve their peg. Another is centralized and fiat-backed stablecoins retaining a positive amount of money in a bank to make certain the foreign money is subsidized one-for-one.

The centralized fiat-backed editions are the maximum commonplace and famous, as they command the most market liquidity. No matter how modern decentralized stablecoins like DAI are, they have their troubles.

Nevertheless, human beings experience a lot greater security knowing that the stablecoin they maintain is bodily subsidized with the aid of some cash someplace in terms of those centralized stablecoins. Tether (USDT) and Circle’s USD Coin (USDC) take the first two spots for the stablecoins ranking. Coming in third is BUSD. A 1:1 USD-backed stablecoin issued by Binance (in partnership with Paxos), permitted and controlled via the New York State department of financial services (NYDFS).

Utilities

Increased liquidity is essential for the smooth operation of the crypto markets. Not only does it mean that it will be easier to execute larger block orders, but it also aids in the price discovery process vital for the efficient function of global markets.

Apart from this, there’s more adoption of stablecoins to be used as a method to pay for goods and services. Merchant adoption is on the rise, and by accepting payments in stablecoins, these merchants can reduce the risk of price volatility.

On top of all these, stablecoins have become incredibly popular in Defi protocols. They are borrowed or lent out to those users that would then use them to earn interest. The point of the matter is that stablecoins are incredibly valuable to the crypto ecosystem, which is why their restriction or limitations could pose such a risk to the market.

Risks around stablecoins

Several risks are posed with stablecoins. Perhaps the most important of these is what is more generally termed a ‘run on the bank.’ Quite simply, it’s a situation where all those with the stablecoin in question will rush to withdraw simultaneously. This could result from some lack of confidence aggravated by the unregulated nature of this cohort.

There are grey patches attached to stablecoins regarding regulations. Global regulators have raised concerns over the rise of stablecoins, including the US Federal Reserves. Meanwhile, the Reserve Bank of Australia, in a Dec. 22 bulletin too, highlighted the risks of unregulated stablecoins. In addition, Tether, the largest stablecoin, too, has faced severe scrutiny from regulators over not-so-transparent reserves disclosures.

Authorities believe stablecoins are prone to runs and that as the sector proliferates, it “remains exposed to liquidity risks.”

Falling one by one

These criticisms have severely affected the overall confidence around stablecoins since several participants lost their peg to the USD. The leading name to fall is TerraUSD (UST). In May, once the third largest stablecoin, UST lost its peg to the dollar, causing developer Terraforms Labs Terra (LUNA) cryptocurrency to.

Once trading at the $1 mark, UST (now called TerraClassicUSD following the hard fork) remained below the $0.30 mark.

The fall here created a storm as the falling dominoes effect remained at large. With the de-pegging debacle overtaking TerraUSD, several other stablecoins appear to have lost their peg to the dollar.

Such as, Neutrino USD (USDN) fell past the $0.95 price point within the same period. At the time of press, it is currently struggling around the $0.66 mark. USDN, the stablecoin of WAVES ecology, has fallen sharply in the past 12 hours.

Given the risks around unregulated stablecoin, South Korea’s most significant domestic crypto exchange raised de-pegging concerns around USDN. Apart from this, the stablecoins USDX (Kava), Deus Finance’s stablecoin, DEI, too, lost more than 40% in May. More on the recent demise narrative, the price of the TRON USDD algorithmic stablecoin dropped to $0.97, losing even more of its dollar parity on Dec. 12.

Here’s an overview of leading stablecoins losing their $1-peg on CoinMarketCap.

Overall, the dark cloud over unregulated stablecoins, coupled with other factors, has led to the de-pegging event for stablecoins. This brings the article to another significant risk brewing in the crypto world.

Binance’s trending stablecoin

The sector’s largest crypto exchange Binance and its leader executive Changpeng Zhao (CZ), were trending. However here, the point of interest remains on the third largest stablecoin, BUSD. The marketplace cap of Binance USD (BUSD) has multiplied during the last few months. thanks to Binance’s steps to transform USDC, TUSD, and USDP deposits to BUSD on the alternate. BUSD’s supply passed $20 billion, capturing a 15.48% share of the stablecoin market. based on CoinMarketCap statistics – an all-time high.

BUSD, circulating in the crypto market, is issued by Paxos, based in the United States, specifically in New York. Paxos was founded in 2012 and has raised hundreds of millions of dollars. Now, most of this money came from lesser-known investors. But this list includes payment giants like PayPal.

Fun fact: Paxos custodies the cryptocurrencies being bought and sold on PayPal.

BUSD is technically a branded version of Paxos’s less popular PAX stablecoin, which went live in 2018. BUSD is the product of Paxos’s partnership with Binance in Q3 2019. The product is BUSD (ERC-20), where Paxos issues BUSD on the ETH blockchain. In terms of regulations, and notes from Binance’s academy, the offering remains fully backed by the NYDFS.

Regulation concerns

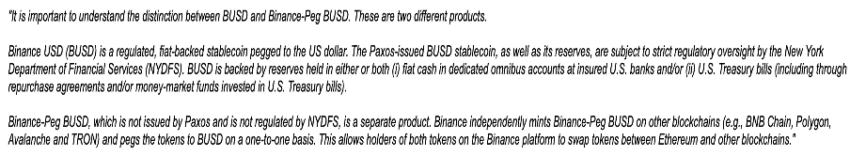

In addition, Binance also offers a Binance-Peg BUSD token on BNB Chain. But the main concern here is that it is not issued by Paxos nor regulated by the New York State Department of Financial Services. BeInCrypto reached out to two sources to confirm or support this narrative.

First, a Paxos spokesperson responded to BeIncrypto via mail that read:

However, the answer was quite different when BeInCrypto reached out to Binance’s official customer support on Twitter.

Binance Customer Team via Twitter stated:

“Binance pegged BUSD, or BEP20 BUSD is still BUSD and therefore is still issued by Paxos and regulated by New York State Department of Financial Services.”

Although it says that in the Binance academy document, the common misconception is that all BUSD is regulated, nonetheless, as mentioned above, unregulated stablecoins can have a series of rippling effects within the crypto ecosystem. So cautionary measures have to be taken to offset such an event.

Meanwhile, another question that comes to mind is about BUSD’s controlling entities. As BeInCrypto reported, almost 94% of the total supply of BUSD is held in just four wallets. This could raise further doubts over the stablecoin monopoly game.

Closing thoughts

Currently, stablecoins are not regulated in any meaningful way. A few publishers have US national licenses, however, those have minimal requirements. There aren’t any requirements that require issuers to protect reserves or preserve liquidity, nor can they simply depend upon scorned traders.

Critics argue that the shortage of financial law of stablecoins, as visible in UST and DEI, leaves investors at the mercy of exploitation and price erosion. Frightening stories of retail buyers dropping their financial savings highlight the disconnect between the infallibility of stablecoins as perceived by their owners and the fact of their vulnerability to excessive marketplace turmoil.

beincrypto.com

beincrypto.com