A new DappRadar report finds that last month’s crypto market meltdown caused the total value locked (TVL) on smart contract platform Solana (SOL) to freefall.

The TVL of a blockchain represents the total capital held within its smart contracts and is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

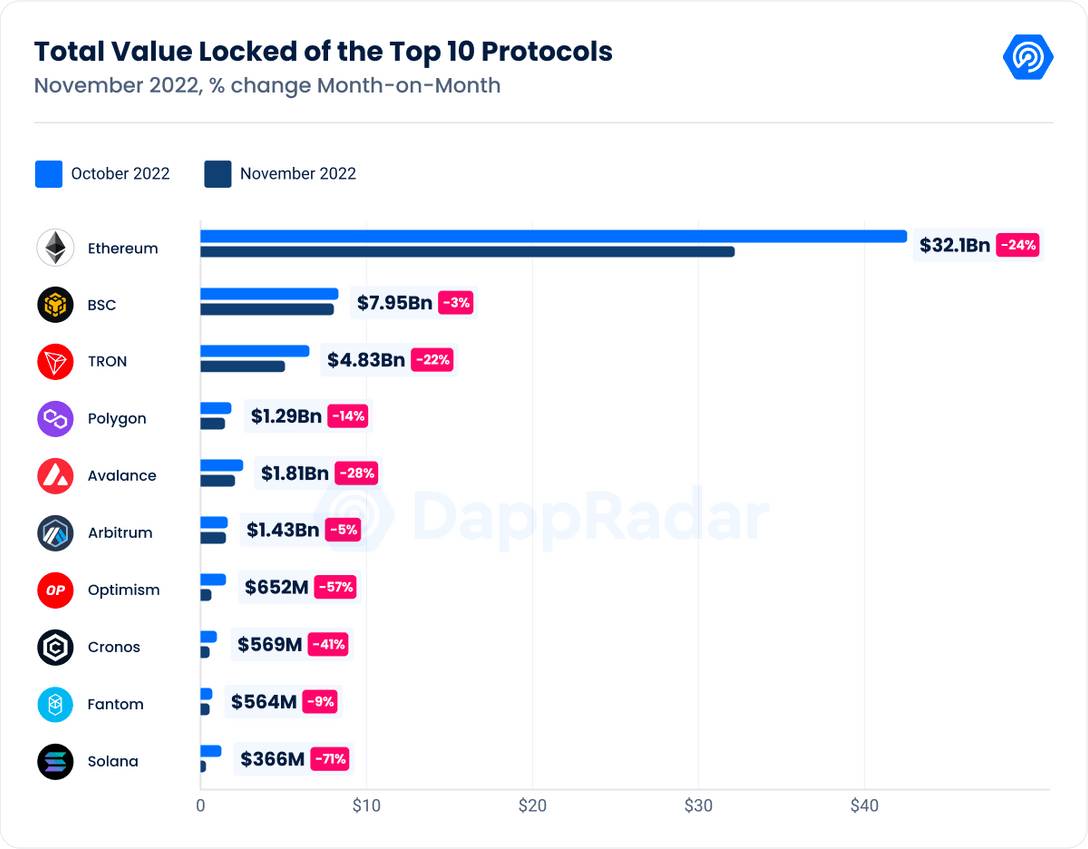

The data acquisition and analysis firm reports that Solana saw a 71% decrease in TVL month-on-month from October to November, crashing to $366 million.

SOL is trading for $13.70 at time of writing. The 18th-ranked crypto asset by market cap is down more than 57% since November 1st when it was trading at $32.24.

Conversely, Binance Coin (BNB) had the least impacted TVL percentage-wise, dropping only 3% month-on-month, according to the report. BNB registered $4.83 billion in TVL.

The native asset of the world’s largest crypto exchange platform by volume is changing hands at $289.96 at time of writing and is down more than 10.6% since November 1st when it was trading at $324.69.

The leading smart contract platform Ethereum (ETH) saw a 24% decrease in TVL but still remains the far-and-away leader of the decentralized finance (DeFi) space, with $32.1 billion in total value locked. Ethereum’s dominance over the sector did decrease from 61.97% in October to 49% in November.

The crypto sector’s overall TVL declined 22% to approximately $65.01 billion.

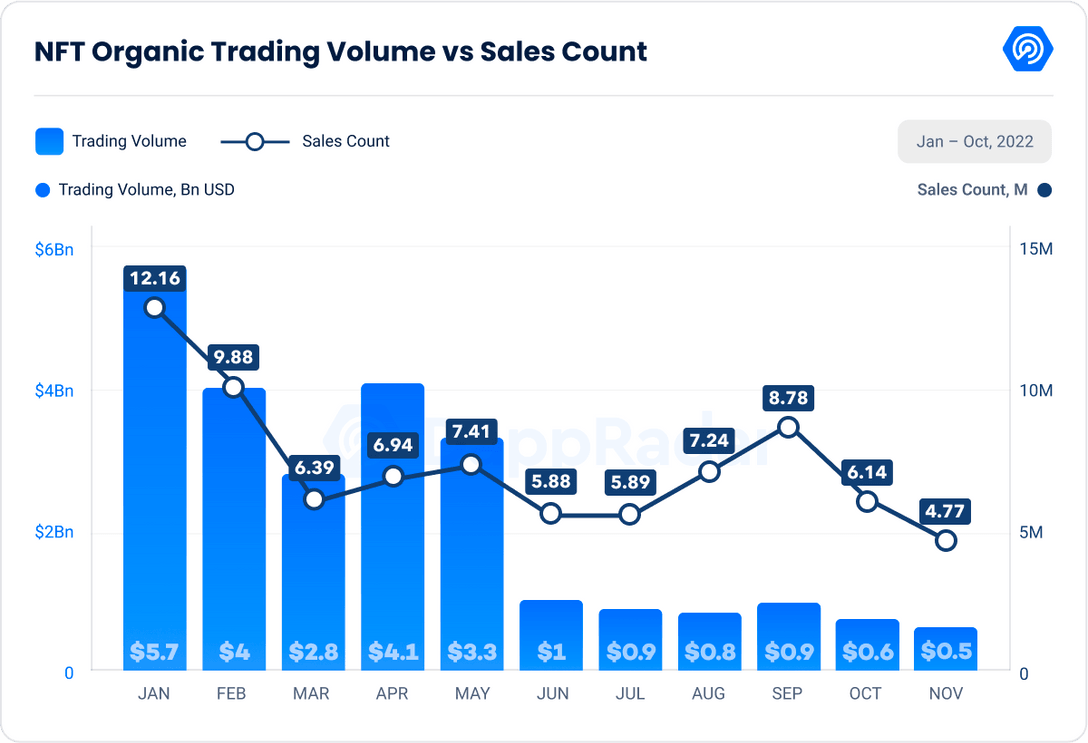

The nonfungible token (NFT) sector also declined, dropping 7.47% from October to $546 million, according to DappRadar. NFT sales count also decreased by 22.24% month-on-month.

dailyhodl.com

dailyhodl.com