BITO sold $290M worth of shares in just the first 20 minutes of trading, but the outlook is different now, with Bitcoin in a slump as the rest of the crypto market.

It was one of the biggest first days of trading history, raking in more than half a billion from investors. Still, crypto investors are on the lookout for 2022 for the approval of the first spot bitcoin exchange-traded fund in the United States.

Although the Securities and Exchange Commission greenlighted the launch of ProShares’ Bitcoin Strategy ETF this year, the product tracks bitcoin futures contracts rather than giving investors direct exposure to the cryptocurrency itself.

Grayscale Investments has filed to convert its bitcoin trust, the world’s biggest bitcoin fund, into a spot ETF. And there are plenty of other bitcoin ETF applications waiting in the wings.

What that tells us is where money is today. And 75% is sitting in open-ended mutual funds, but that number has been steadily shrinking and because money has been flowing more rapidly into ETFs than it has in mutual funds,” Morningstar’s Johnson said.

Rosenbluth, the head of ETF and mutual fund research at CFRA said that thematic ETFs have seen a steady climb, with the focus having shifted to electric vehicles and infrastructure in 2021, compared with cloud computing and cybersecurity in the prior period.

Investors have over 200 thematic ETFs to consider for 2022 as they look to identify the next long-term trend.

Launching of BITO ETF – a looking back

Trading under the ticker BITO, the fund gained as much as 5.4% to $42.15 before paring gains and turning negative at one point. Still, more than 18 million shares worth roughly $740 million changed hands by around 1:24 p.m. in New York, according to data compiled by Bloomberg.

Bitcoin made a run at its record high, gaining as much as 3.4% to trade around $63,475 in November 2021, slightly below its April all-time high of just under $65,000. BITO was up about 1.56% after rising 3% to $41.22 in early action.

After the application was put forth to the SEC for approval of a Bitcoin ETF, it was revealed that a futures ETF has a higher chance of being approved.

This Bitcoin futures ETF is led forth by ProShares. Furthermore, it is legal for the ProShares Bitcoin strategy ETF to be listed on the New York Stock Exchange. Before you start trading Bitcoin futures ETF using BITO, it is essential to check out this BITO ETF price prediction.

Whereas the ProShares fund offers regulated exposure to Bitcoin, it will come at a price to investors. The BITO fund will charge an annual management fee (an expense ratio) of 0.95 percent.

ProShares Bitcoin linked ETF.

ProShares Fund will invest in Bitcoin while exposing the BTC futures trading on Chicago Mercantile Exchange or CME. The futures market is a volatile field in which investors can indirectly invest using the ProShares ETF, which provides exposure to Bitcoin.

After the approval of this ETF, Bitcoin soared to higher levels, and as a result, investors are bullish. ProShare celebrated this new development in the industry through a ceremony in a press conference wherein the prominent members rang their bell of success.

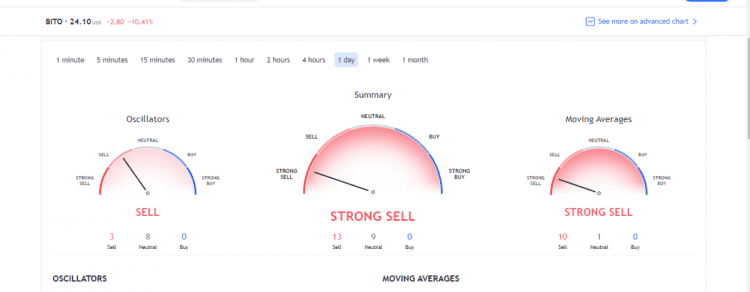

BITO Technical Analysis

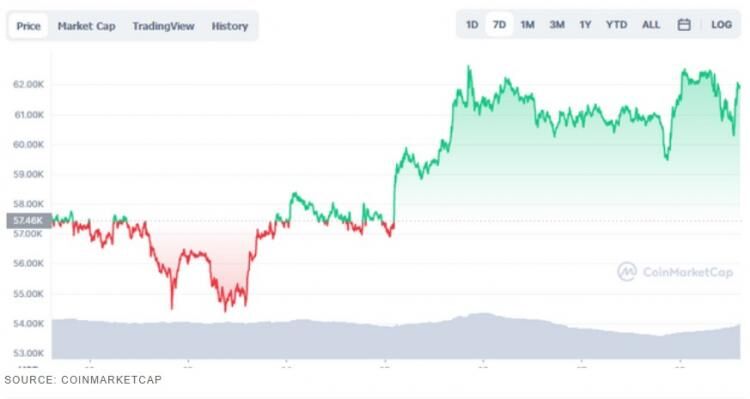

The price of BITO fell by 4.70% in the past seven days. However, the price declined by 0.01% in the last 24 hours. The current price is $0.06533 per BITO. BitoPro Exchange Token is 20% down from its all-time high of $0.0875. Also, the BITO price prediction sentiment is currently bearish, and its MA points towards the strong sell zone.

Where to buy BITO ETF?

After ProShares’s Bitcoin fund (BITO) made its debut on the NYSE on 19 October 2021, all interested investors can buy it, like they buy stocks, through brokers that support ETF trading, e.g., Etoro, Robinhood, SoFi, Webull, and other popular platforms accessible to retail investors for ETF trades.

BITO ETF price predictions 2022-2030

The ProShares BITO fund is based on Bitcoin futures on the Chicago Mercantile Exchange. Therefore, the fund will track Bitcoin’s price. Bitcoin soared and came close to its $65,000 all-time high in anticipation of the BITO ETF launch. Although the fund should track Bitcoin’s spot price, it could still trade at a premium or discount to the underlying asset.

Gov. capital

According to Gov. capital, BITO ETF can be a bad, high-risk investment option in the coming months. According to them, BITO may be completely devalued in the future, dipping by 100% before the start of 2023.

Wallet Investor

Wallet Investor is very bearish on BITO ETF. Their 1-year forecast puts BITO at 0.000000000001 USD.

Coinarbitrage

Coinarbitrage is bullish on BITO ETF. Based on their technical analysis prediction model that considers the moving average, they determine if a cryptocurrency is suitable for long-term investments.

The coin trading price is expected to increase, earning the BITO token an outstanding long-term investment tag. If you buy 100 dollars’ worth of this coin today, you should get up to 103% in profits by 2023.

Also, a long-term increase is expected; the price will climb up to $157 by 2025, the revenue is expected to be around 432%.

Cryptopolitan

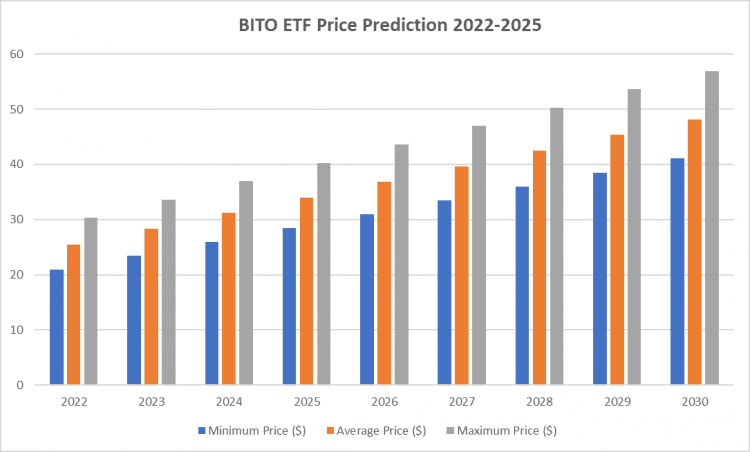

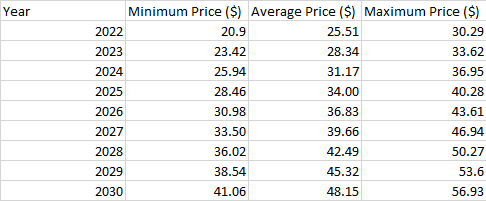

BITO ETF Price Predictions 2022

ProShares Bitcoin Strategy ETF (BITO) market price is expected to respond to Bitcoin’s growth pattern. Our deep technical analysis and price predictions expect a minimum market value of $20.9, an average value of $25.51, and a maximum value of $30.29.

BITO ETF Price Predictions 2023

If BITO ETF gains 1% of BTC’s previous average yearly growth, it could reach $33.62 in 2023.

BITO ETF Price Predictions 2024

A maximum price of $36.95 is expected in 2024. BITO ETF’s average forecast price is $31.17, and its minimum price is 25.94 USD.

BITO ETF Price Predictions 2025

BITO ETF could approach the $40 mark for the first time since November 16, 2021. The expected maximum BITO ETF price for 2025 is $40.28. The asset will trade at $34, and its least possible price is $28.46.

BITO ETF Price Predictions 2026 and beyond

If BITO ETF gains about 5% of Bitcoin’s previous average growth yearly, it could potentially reach a maximum market price of $43.61.

By 2027, the prediction shows that BITO ETF will surpass its previous all-time high at $44.29 to reach about $47. Its minimum and average market valuation for 2027 are $33.50 and $39.66, respectively.

By 2030, Bitcoin strategy ETF price (BITO) could reach newer heights by closing the $60 mark.

BITO ETF outlook by market influencers

The majority of prominent individuals from the private sector commented on the same. Jack McDonald, Polysign CEO, mentioned at Forbes.

In general, I think a Bitcoin ETF will generate more demand for Bitcoin than not having one because it solves a lot of regulatory issues that many investors seek clarity on.

-Jack McDonald, Polysign CEO

For investors who are brand new to trading crypto and are not comfortable with the aforementioned ways to get direct access, futures-based ETFs are a good alternative.

-Silvia Jablonski, Defiance ETFs co-Founder

The majority of prominent individuals from the private sector commented on the same. Jack McDonald, Polysign CEO, mentioned at Forbes.

Final thoughts

According to our BITO ETF price prediction, investing in Bitcoin ETF depends upon your investment strategy. If you are new to crypto and want to get exposure first with less risk, the ProShares ETF should be the first preference. BITO ETF was one of the most-bought assets on Fidelity’s platform, with more than 7,500 buy orders coming from customers.

A futures-linked Bitcoin ETF has skeptics among registered investment advisors (RIAs). Investors are also apprehensive about the intricacy of a futures-oriented product versus spot crypto trading. While economic actors’ views on the nascent ETF’s prospects may differ, many concur that it represents a significant legislative victory for the cryptocurrency community. The exchange-traded fund is expected to open up new opportunities in this market.

This altcoin provides a low-cost avenue for investors who want to dabble in cryptocurrencies. The fund has grown at record speed, already amassing over $1 billion in total net assets, with an average daily trading volume of 10.4 million. BITO lets investors gain exposure to Bitcoin without needing to own it themselves.

If you are convinced that you can handle the volatility of BTC and have firm faith in blockchain-based projects, you can go ahead with direct investment in crypto. Although the BITO ETF sounds good, some crypto backers who want to trade bitcoin directly argue that this will create an extra cost for end-users. Something which you could avoid by using cash markets. Investors need to be particularly aware of what they’re buying and how it’s likely to perform.

Before you move on if you want to learn more about long-term cryptocurrency price predictions, visit here.

FAQs about BITO ETF

Is BITO a good investment?

The predictions provide different outlooks for BITO ETF. However, we believe that if the asset gains a reasonable percentage of Bitcoin’s previous yearly growth, its value will continue to surge and will be a good investment.

How much will BITO be worth in 5 years?

Our predictions put BITO at a 33 – 47 USD trading range in 2027. This price level is only achievable if investors turn to the asset. If otherwise, the bearish predictions could be right.

Before you move on if you want to learn more about long-term cryptocurrency price predictions, visit here.

cryptopolitan.com

cryptopolitan.com