Tether’s USDT stablecoin has reached a significant milestone on the TON blockchain, with over one million addresses holding the asset in less than six months. This rapid growth reflects the increasing global adoption of USDT, pushing its market cap to new levels.

However, much of this growth is also due to the integration of the TON blockchain into the social messaging app Telegram, enabling about 950 million users to access the stablecoin for transactions.

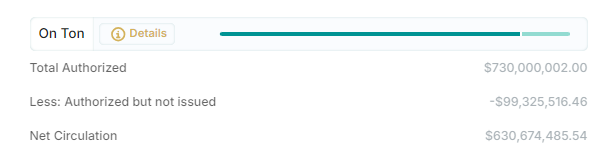

USDT supply on TON is now at $730 million

According to TON blockchain scanner Tonviewer, around 1.39 million addresses hold USDT on the network, with balances varying from millions to a few hundred. The biggest holder on the network is an unknown address, UQaj, with 99.35 million USDT.

Several exchange-controlled addresses are also among the top ten holders, with the Binance wallet holding 58.9 million USDT, the OKX wallet holding 32.23 million USDT, and the Gate.io wallet holding 20.03 million USDT.

Meanwhile, data shows that the growing presence of USDT on the TON blockchain has pushed its supply to $730 million, positioning it among the few networks nearing a $1 billion USDT supply. Transaction volumes have also surged, reaching nearly $2.4 billion in weekly activity by August.

Toncoin struggles as almost 90% of holders are in red

While USDT has been enjoying massive adoption and growth in volume on the TON blockchain, the network native token Toncoin has been struggling. It initially fell almost 20% after the arrest of the Telegram founder and has seen further declines since then despite Durov’s release on bail.

Toncoin trades at $4.68 on CoinMarketCap after seeing less than 1% gain in the last 24 hours. However, it has fallen 15% in the last seven days and 35% in the past three months.

Questions now surround TON’s stability, particularly after it experienced two outages last week. Many believe that the network might not have the technical resilience of other EVM networks, and its association with Telegram could affect it if the messaging app is banned in some countries.

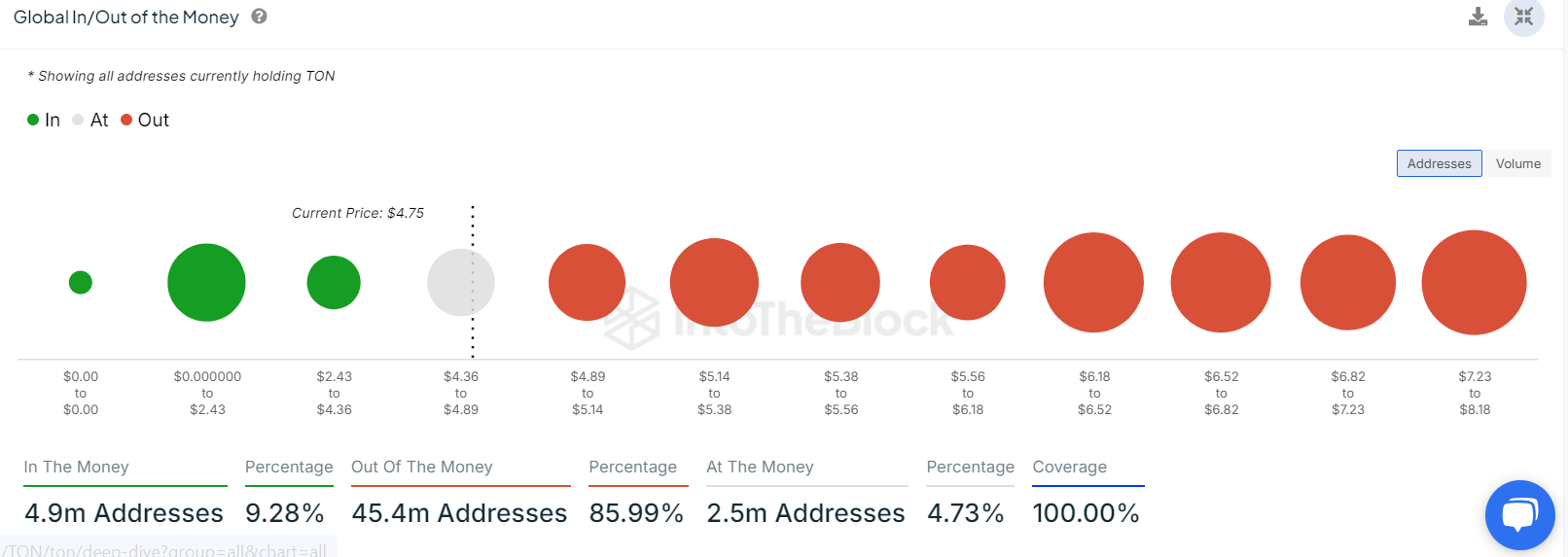

Meanwhile, Toncoin’s poor performance has left most of its holders with unrealized losses per IntoTheBlock data. Presently, 45.4 million addresses accounting for 85.99% of its holders are holding at a loss while 2.5 million addresses are at breakeven.

However, 4.9 million addresses (9.28% of holders) are still in the green. These are likely the early buyers since the token has not shed most of its gains in 2024. It is up 100% year-to-date according to CoinMarketCap.

cryptopolitan.com

cryptopolitan.com