Launched in 2017, TRON was originally positioned as an Ethereum killer. While all Ethereum killers failed to kill Buterin's brainchild, TRON managed to take the lead in the realm of stablecoin transfers. Let's see what happened on TRON over the last six months, and in which direction it is developing.

Stablecoins on TRON increased market cap in H1 2024

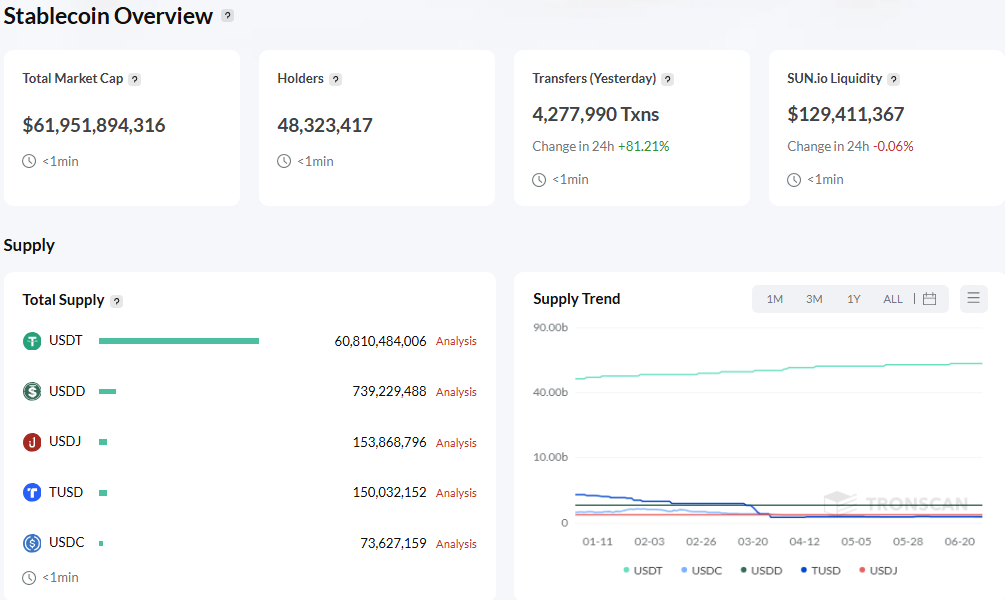

TRON's primary use case is to serve as a USDT stablecoin exchange network, surpassing Ethereum in this specific area. By focusing on stablecoin payments instead of DeFi or dApps, TRON delivers high speeds, operational continuity and reliability. Currently, about 53.7% of the entire USDT total supply is on TRON. That is about 2x the amount the USDT stablecoin settled on Ethereum.

At the time of writing, the total market cap of TRON stablecoins has almost reached $62 billion, with over 48 million holders. USDT is not the only stablecoin, although it accounts for approximately 98.2% of the total stablecoin supply on the TRON chain.

The most recent burning event took place on Aug. 22, 2023, during which 1.2 billion USDT were burned. A stablecoin burn is a mechanism to reduce liquidity on crypto markets, akin to how central banks decrease the money supply on traditional markets.

TRON ecosystem performance: Milestones and trends

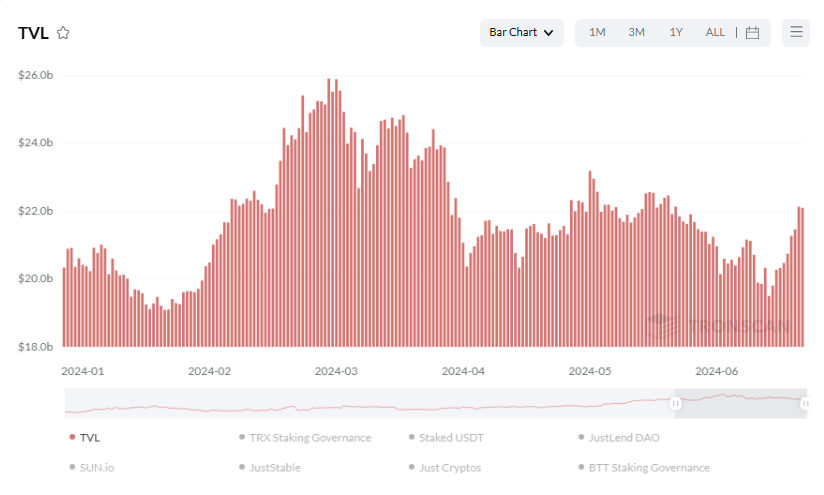

The current overall TVL on TRON recently surpassed $22 billion. The TVL chart below shows the total value of crypto assets locked in various protocols on TRON, including the TRON chain itself and DeFi protocols on TRON.

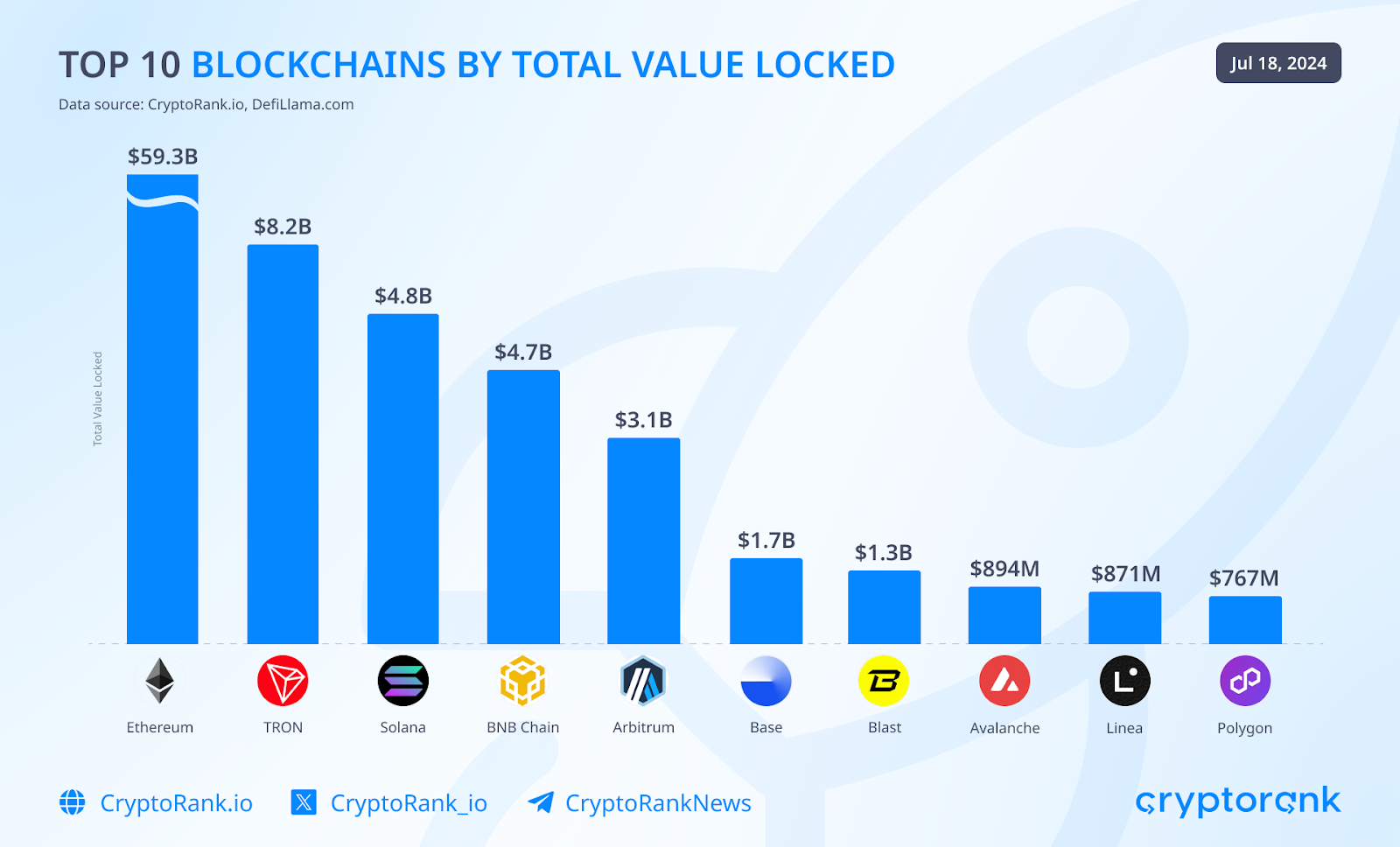

TRON now holds second place in dApp TVL among all blockchains. At the time of writing, the TVL of the TRON blockchain stands at over $8.2 billion.

The TVL volume held steady at around $8 billion throughout the first half of 2024. It is important to note that TRON's TVL, as well as most other indicators, barely correlates with marketwide fluctuations.

What’s next for TRON?

Stablecoin payments and adopting Bitcoin payments are in focus for TRON contributors and the community.

Bitcoin Layer 2

In February 2024, Justin Sun announced the development of Bitcoin Layer 2, based on the TRON blockchain. This initiative seeks to integrate various token types within the TRON network, including stablecoins, with the Bitcoin network and its layer-2 solutions, such as Bitcoin Ordinals. The goal is to provide a bridge that connects TRON directly with Bitcoin, enabling the movement and interaction of assets across both networks.

The roadmap includes several stages. In Stage α, with Bitcoin already accessible within the TRON network, TRON DAO plans to bridge more Bitcoin-based assets to TRON. Stage β will involve collaborations with multiple Bitcoin layer 2 protocols to support restaking initiatives and grow the Bitcoin layer-2 ecosystem. Stage γ will introduce a protocol integrating TRON, BitTorrent Chain (BTTC) and the Bitcoin chain, aiming to combine the benefits of PoS and PoW mechanisms.

Gasless stablecoin transfers

Justin Sun has recently announced a service that will allow for the transfer of stablecoins without paying a fee in TRX, but in stablecoins instead. The necessity of having a small TRX balance in your wallet just to pay fees has long been an obstacle to TRON’s real mass adoption among ordinary users.

In the first stage, the solution (similar to Ethereum’s Account Abstraction) will be integrated into the TRON blockchain and then extended to Ethereum-compatible networks, such as the BTTC Chain. The service is scheduled to launch in the fourth quarter of 2024.

Output

TRON has significantly evolved since its inception, shifting from its initial goal of directly rivaling Ethereum to focusing primarily on stablecoin transfers. Stablecoins, particularly USDT, have found a thriving ecosystem on TRON, driven by higher transaction speeds and reliability.

This has positioned TRON as a critical player in global stablecoin transfers, with over half of the total USDT supply circulating on its network.

u.today

u.today