Meme cryptocurrency Daddy Tate (DADDY), linked to former kickboxer and social media personality Andrew Tate, continues to reach new milestones despite ongoing controversies.

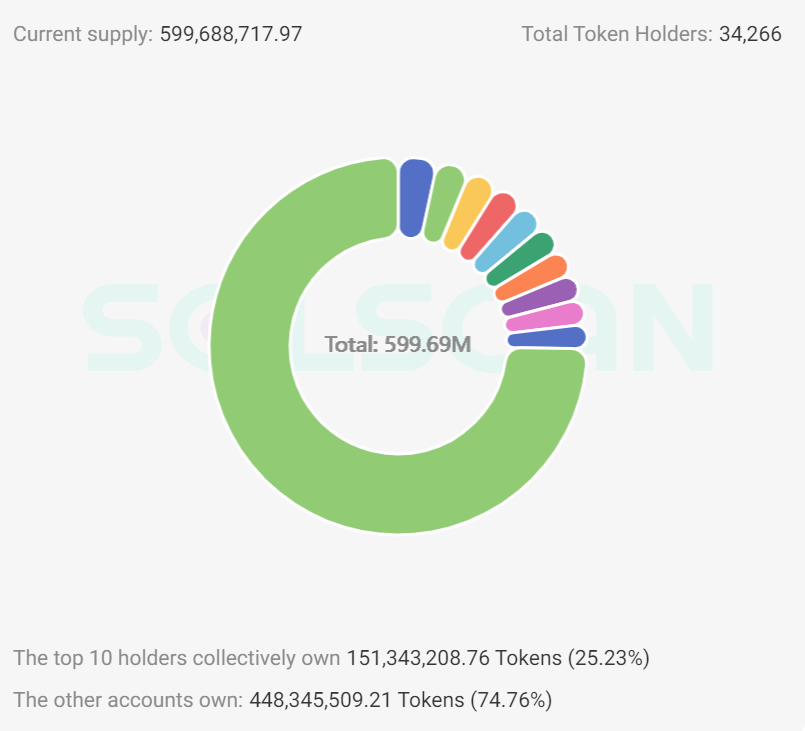

Notably, the number of holders of the meme coin has surged, reaching 34,266 as of June 17, according to the latest data retrieved from Solscan.

A breakdown of the holders shows the concentration of most tokens in a few addresses. Specifically, 25.23% of DADDY’s supply is held by 10 addresses, while the remaining 74.76% amounts to 448,045,509.21 tokens spread among other holders.

DADDY insider trading controversy

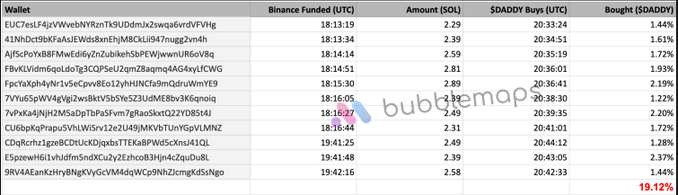

The milestones achieved by the Solana (SOL)-based token have sparked suspicion, particularly regarding insider trading claims.

Bubblemaps, an on-chain analytics firm, provided controversial data suggesting that insiders bought 30% of the supply at market launch, just hours before Tate began promoting the token on X. Additionally, Bubblemaps reported that Tate sent 40% of the total supply to a wallet but promised not to sell any of his tokens.

However, concerns persist about a potential crash if Tate decides to sell his holdings, valued at over $60 million. These concerns are heightened by the fact that similar incidents have occurred with other celebrity-related meme coins.

For instance, the MOTHER token, linked to rapper Iggy Azalea, crashed by over 50% from its all-time high. This crash allowed DADDY to surpass MOTHER in market capitalization.

Meanwhile, Tate has vowed to help push the token’s market capitalization to $1 billion. He has also alleged that once the market cap hits a point where the 40% he holds is worth $100 million, he will burn it.

DADDY price analysis

Meanwhile, the coin has experienced a significant price decline, marked by high volatility and substantial downward movement. Despite a slight recovery towards the end of the period, the overall trend remains negative.

As of press time, DADDY had corrected almost 22%, while over the past 24 hours, the token is down less than 1%, trading at $0.18.

A review of the weekly chart shows initial support around the $0.24 level, which eventually failed. The price found temporary support around $0.15 before recovering slightly and currently faces resistance at $0.20.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com