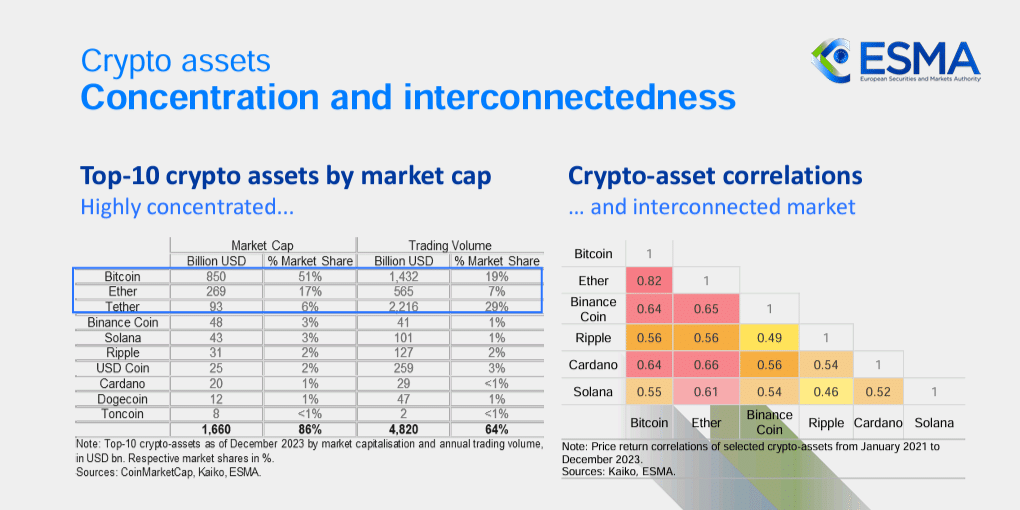

A report from the European Securities and Markets Authority (ESMA) confirms XRP surpassed Solana and BNB in volume last year despite dropping below them in market cap share.

The report, released by the Economic, Financial Stability and Risk Department of ESMA last month, was recently highlighted by prominent XRP community figure WrathofKahneman (WOK). He specifically spotlighted the interesting divergence in XRP’s market cap share and trade volume share among the largest crypto assets.

Interesting data from ESMA: The trading volume tells a slightly different story than the token market caps. #XRP, for instance traded $25b more than Solana & $80b more than BNB. Still only 2% of market share but interesting. #XRP also seems the least correlated of the major… pic.twitter.com/ZLAHwekBOZ

— WrathofKahneman (@WKahneman) May 20, 2024

ESMA published the report to demonstrate the impact of social media influence on cryptocurrency trading and the broader financial market. In a session dedicated to the correlation of cryptocurrencies, the government agency presented data on the market cap and volume shares of the top 10 crypto assets as of December 2023.

XRP Drops Below Solana in Market Cap Ranking

The data revealed that XRP’s trade volume remained fairly high in Q4 2023 despite relinquishing its position among the top 10 to Solana and USDC. For context, The Crypto Basic disclosed on Dec. 8, 2023 that Solana was on the verge of overtaking XRP in market cap amid a 13.88% price uptick.

At the time, SOL secured the sixth spot among the largest cryptocurrencies by market cap, boasting a valuation of $30.64 billion. Meanwhile, XRP held fifth with a market cap of $34.42 billion, only below Bitcoin (BTC), Ethereum (ETH), USDT and BNB.

Solana eventually surpassed XRP’s market cap as of Dec. 21, 2023, relegating XRP to sixth among the top 10. The ESMA report reveals that XRP has continued to secure more trade volume despite the recent events that saw it drop on the top 10 ranking.

XRP Surpassed SOL and BNB in Volume

Citing data from CoinMarketCap and Kaiko, ESMA disclosed that XRP had an annual trade volume of $127 billion as of Dec. 31, 2023. This volume represented 2% of the total annual trade volume in the crypto market last year. XRP was only below market leaders BTC and ETH, and stablecoins USDT and USDC in this metric.

XRP’s $127 billion volume was $26 billion more than Solana’s volume ($101 billion) and $86 billion above BNB’s volume ($41 billion) within the same timeframe. Despite garnering more interest, XRP ended Q4 2023 with a 19.56% gain. Meanwhile, BNB saw a 45.29% rise and SOL spiked 376%.

Correlation with Price

Some commentators argued that this divergence in volume and performance confirms the theory that XRP suffers from price suppression. However, WOK presented an alternative viewpoint. According to him, the data might be proof that XRP’s utility, which has caused its volume to surge, has not overshadowed speculative trading.

WOK emphasized that the XRP Ledger has continued to work as expected. The network has been delivering effectively, welcoming an AMM functionality and looking to include a native lending protocol, a native stablecoin and an EVM sidechain, as its DeFi functions expand. The Ledger has also been instrumental in moving funds.

Tranglo, a Ripple partner, has processed a total volume of $11.8 billion, with some of this volume carried out through XRP with ODL. However, WOK noted that despite the XRPL’s utility in moving money, the XRP market has not seen an influx of new capital.

I think it proves utility has not overcome the power of speculation. The XRPL is working, moving value, but there's no new money coming in. Either a greater amount of value needs to be moved the requires even more #XRP use or someone (retail/inst/enterprise) needs to buy more.

— WrathofKahneman (@WKahneman) May 20, 2024

According to the pundit, XRP could record a resurgence in price if it experiences more demand from retail or institutions or if it is used to move much greater value, a trend that would require its price to significantly surge.

thecryptobasic.com

thecryptobasic.com