Will other countries follow or has China signed itself up for some hefty regret?

One of the contributing factors in Bitcoin’s decline over the past months was the growing effects of Chinese regulations on mining. Despite China’s 2017 ban on ICOs, it managed to become the top cryptocurrency miner in the world. However, this time, the scenario is a tad different, hinting towards a more drastic boycott of cryptocurrencies altogether. The prevailing adversity of the matter came into the picture as some of the largest crypto miners around the globe, including Houbi Mall and BTC.TOP, declared their exit from China shortly after the crackdowns were announced.

Nonetheless, the outrage wiped almost $70 billion from bitcoin’s market cap in less than a week, along with a substantial fall in Ethereum as its market value came down to $218 billion on June 22. While the market has relatively stabilized from the fear-struck fall, the question follows- Has China started a trend that could be adopted by other countries or made an excruciating mistake that the Asian dragon might regret later?

China Sliced the Crypto Mining Competition in Half

China is responsible for 65% of the global hashrate as some of the large-scale, industrial cryptocurrency mining farms are heavily concentrated in China. Proof of work networks like Bitcoin are designed to be powered and secured by hashpower, which is a miners’ contribution to the network in return for rewards in BTC. Since the announcement of the mining shutdowns in China flooded, bitcoin’s already falling value and hashrate plummeted further down, but to the gains of miners outside China. Attesting to this, Geoff Morphy, president of Bitfarms confirmed,

“We are now mining more bitcoin on a daily basis than we were before, without doing anything, without adding any machines,”

With the sudden halt in the computing power coming from miners in China, the competition for BTC rewards reduced and quickly polished the profitability outcomes for mining operations elsewhere. While a huge chunk of the decline in hashrate came in hand with the dropping value of BTC, making it difficult or rather unattractive for miners to indulge in mining, it is crystal clear that miners are exiting China in bulk and directly leaving their rewards for other miners’ gains.

But what about the Chinese miners though? Are their mining days behind them or is there hope for them?

Miners exiled from China have been trying to move their machines to countries that are nearby like Russia and Kazakhstan. Many are simply preserving their equipment and machinery in the hopes of a reversal in the Chinese policy. Others are contacting large-scale mining operators to share their facilities. However, most of these miners will face a great share of obstacles like the ones thinking of setting up new mining operations outside of China, according to Kevin Zhang, VP of business development at mining firm Foundry Digital. He added that with the manufacturing disruptions in lieu of the coronavirus pandemic, there’s a heavy shortage of electrical transformers.

However, even if entirely new setups of mining operations outside of China come into action, it would take at least a few months for them to completely build up and start full operations, explained Zhang. This would inevitably benefit miners around the globe with the competition drop in place.

Not a Trend, More Like a Collective Reaction to the Current Bear

The Crypto market is used to the term volatility and with the recent plunge in the market, investors have lost capital, selling largely in fear. However, just like a collective sum of reasons drove the market into a deep correction, China’s current stance is fueled by more than one cause. Along with the crypto market being prone to massive fluctuations, Chinese leaders have previously focused on investment scams and massive financial frauds like PlusToken that have evidently caused huge losses to the investors.

While the political agendas in China are definitely a contributing variable with the 100th anniversary of the Chinese Communist Party last week, the current bear market didn’t really help the cause. However, when it comes to trends and the question of other countries walking the same plank, educated variables have to be considered behind the bear run that slashed the price of bitcoin almost in half.

The market came tumbling down in May right after Tesla’s CEO, Elon Musk, put a halt to his decision to accept bitcoin as a mode of payment with concerns about Bitcoin mining taking up heavy energy consumption causing environmental harm. Which, in full disclosure, is a legitimate concern except it’s not entirely true, at least not according to recent estimations.

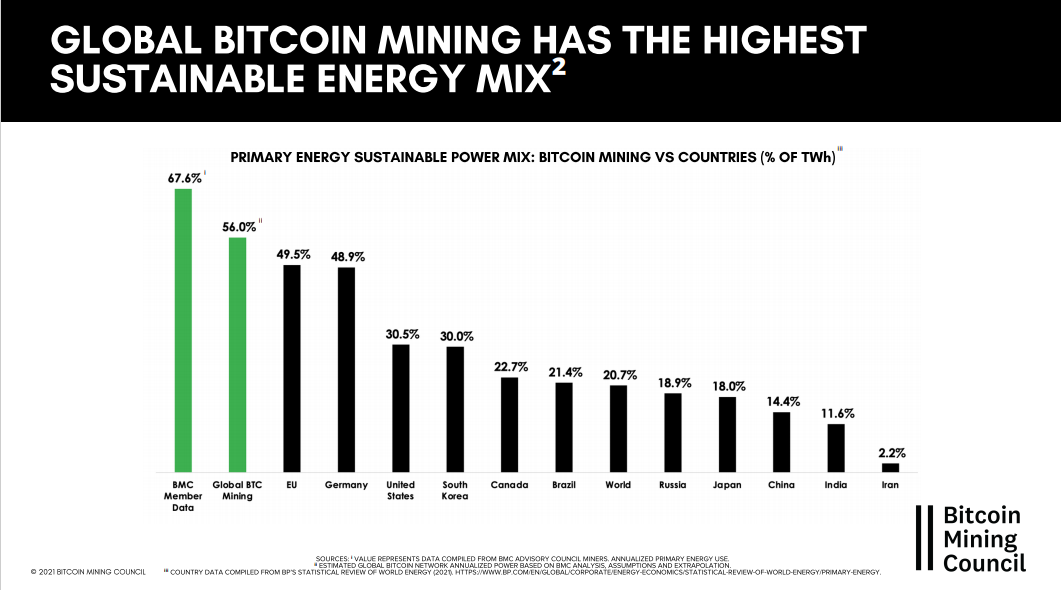

According to the estimations of the Bitcoin Mining Council (BMC) report, the global Bitcoin mining sector has achieved a 56% sustainable energy mix in Q2. In the press release, the Bitcoin Mining Council stated-

“Bitcoin mining uses a negligible amount of energy, is rapidly becoming more efficient, and is powered by a higher mix of sustainable energy than any major country or industry.”

Conclusion

In a short span of time, the crypto market has emerged above prominence, offering opportunities and advancements in the financial systems around the globe. Decentralization has emerged itself to be more than just an idea but a step towards a seamless digital evolution. And while the market is still finding its pace both on charts and among regulations in countries around the globe, China’s ban on cryptocurrency can be translated as one of the many phases in crypto history.

Will it harm China in the long term? Yes! While Chinese miners have already suffered loss as it is, this decision will set China back in terms of innovation and talent that lies in blockchain. As for other countries following suit, it depends on their willingness to advance with the rest of the world. There are countries like El Salvador that became the first in the world to legalize digital currency Bitcoin, and that seems to have more potential as a trend than China’s recent meltdown. Maybe the Asian leader will find sense as the hype settles down to bring at least a little area for experiments in cryptocurrency. Otherwise, it’s a huge loss for them and a great gain for the rest of the world.

cryptoknowmics.com

cryptoknowmics.com