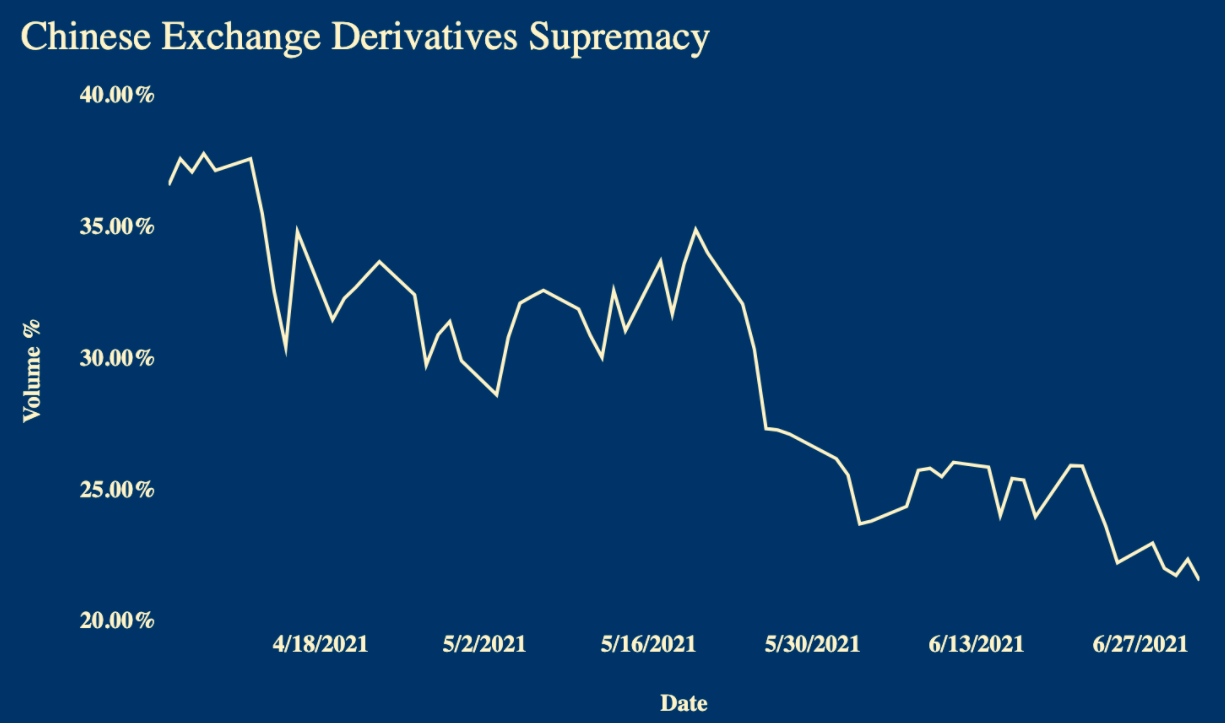

Up near $35,000, Bitcoin price is maintaining its $30k-$40k range while recovering from the deep sell-off that sent the leading cryptocurrency’s prices to about $28,800 on Coinbase late last month. Still nearly halved from its all-time high of nearly $65,000 in April, the bearish drivers are now taking a backseat. China’s clampdown seems to be over, with most of the miners shut down and moved overseas. Also, the 100th /anniversary of the ruling party is behind us, which reportedly was driving this clampdown. This crackdown has already affected the market structure, with OKEx and Huobi, the biggest cryptocurrency exchanges that cater to the region, starting to lose their relevance. Unlike Bybit and Binance, the market structure of these two exchanges was particularly affected after China’s strict regulatory measures. Over the last three months, the supremacy of these exchanges has taken a huge hit, as much as 15%, in the derivatives market, according to Split Capital. Bitcoin balance of these exchanges also declined while Bitfinex seems to have been benefiting from these outflows.  In response, Jay Hao, CEO of OKEx, clarified that the Seychelles-based exchange has seen “a deliberate and exponential growth in the past year.” Meanwhile, as OKEx and Huobi lose their market dominance, liquidity will get concentrated to Binance and FTX, noted trader CL of eGirl Capital. This will remove the number of popular trading venues that need to keep an eye on, bringing an “old bitmex-only style market.”

In response, Jay Hao, CEO of OKEx, clarified that the Seychelles-based exchange has seen “a deliberate and exponential growth in the past year.” Meanwhile, as OKEx and Huobi lose their market dominance, liquidity will get concentrated to Binance and FTX, noted trader CL of eGirl Capital. This will remove the number of popular trading venues that need to keep an eye on, bringing an “old bitmex-only style market.”

“Bitmex was kinda bearish for BTC tho, cus people just use BTC to long BTC and get rekt while Bitmex make tons of BTC in fees so they can sell the BTC. FTX and Binance have big stablecoin collateral products so it'd be much healthier.”

While FTX is gaining traction, accounting for 11.93% of Bitcoin futures open interest market and Binance at the top at 24.4%, institutional-focused CME has a 10.13% share, according to Bybt. On CME, institutions continue to close their shorts after their arbitrage opportunity has evaporated, with the basis going down now that the market is trading sideways. The price of Bitcoin futures expiring in September is actually lower on retail-focused exchanges than CME. https://twitter.com/skewdotcom/status/1411949996107313156 While the funding rates have calmed down, even still in negative on some platforms, the market is now worried about GBTC unlocking, which, as we reported, is rather bullish for Bitcoin price than bearish. However, as per JPMorgan,

“Selling of GBTC shares exiting the six-month lockup period during June and July has emerged as an additional headwind for bitcoin.”

While the impact can be both bullish and bearish, “it'll be immediately bullish,” notes on-chain analyst Willy Woo.

“Grayscale is a unique product. It's designed as a black hole that sucks in BTC. No BTC ever leaves the trust.”

He explained that GBTC increases its holdings by allowing accredited investors to add BTC into the trust's holdings in return for receiving shares in the trust, which has been a lucrative trade when there was a premium but required a six months holding period before being allowed to sell. This refers to the shares unlocking for cash. Those who hedged their risk by shorting BTC futures while being long spot BTC which they bought to put in GBTC — earning both the GBTC premium and yields from shorting on CME — now have to sell their shorts for USD and unhedge their shorts which is bullish. It can be bearish, too, as when GBTC shares unlock and get sold, the premium drops, and investors now have more incentive to buy GBTC shares rather than actual BTC, but it acts out very slowly and, as such overall bullish in the short term while neutral in the long term, said Woo.

bitcoinexchangeguide.com

bitcoinexchangeguide.com