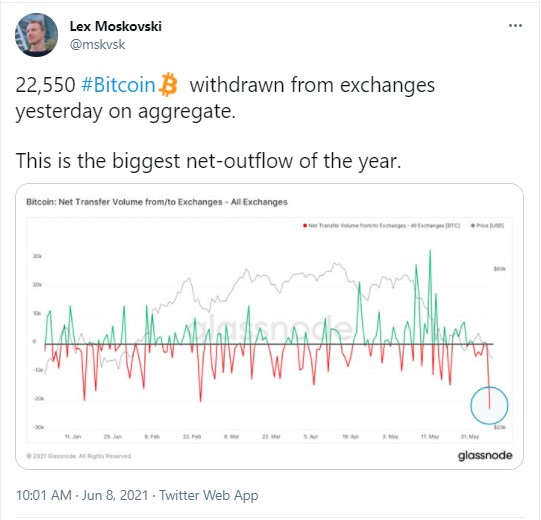

Data provided by the Glassnode analytics agency shows that a whopping 22,550 Bitcoins was moved from crypto exchanges on aggregate on Monday.

The tweet was shared by CIO of Moskovski Capital.

22,550 BTC in total bought on the dip

The aggregate amount of Bitcoin withdrawn from exchanges totals a massive $743,604,290 in fiat.

On the same day MicroStrategy announced raising $400 million to buy more BTC. The company offered senior notes to invest the debt in Bitcoin.

This has been the second fundraise of the company this year for purchasing the largest crypto by market cap. In February, it managed to attract $1.05 billion from shareholders for the same purpose.

Besides, later on the flagship cryptocurrency later on dropped to the $32,000 level on the news about FBI and US DoJ seizing $4.3 million in Bitcoin from the DarkSide hackers’ wallet.

This massive amount of BTC was likely bought on the dip and withdrawn to cold storage wallets. The chart shows that the amount of withdrawn Bitcoin has been the largest this year so far.

$457 million in stablecoins deposited after MicroStrategy’s announcement

The same source also shared that after the business software producing giant published the press-release about starting to raise the $400 million for purchasing Bitcoin, a sum in stablecoins, close to half a billion USD, was deposited to crypto exchanges.

The likely purpose of these deposits was Bitcoin purchases.

Peter Schiff runs a bearish poll on BTC and ETH

After Bitcoin declined to the $32,000 area, the vocal BTC hater and a gold bug Peter Schiff tweeted that he expects it to keep going down and hit $10,000 in the end.

He also published a poll, in which he offers his half a million followers to choose which bearish event will happen first – Bitcoin dropping below $30,000 or Ethereum plummeting under $2,000.

So far, 48 percent have voted for Bitcoin breaking below $30,000 first. However, 41 percent believes neither will happen.

21,664 respondents have taken part in the poll so far.

u.today

u.today