Data provided by cryptocurrency analytics platform Glassnode indicates that the seven-day moving average of unique daily exchange bitcoin deposits dropped to a monthly low of 2,845.357 on April 2, 2021. The previous monthly lowest deposit number was recorded on March 26, 2021, at 2,847.935.

The drop in exchange deposits indicates that investors are optimistic bitcoin will potentially surge further in value. Therefore, the market is likely experiencing HODL sentiments. If investors were not certain about bitcoin’s current rally sustainability, they would have moved the asset to exchanges to sell it in return, contributing to the rise in deposits.

In most cases, when there are price drops, investors transfer their digital assets to crypto exchanges to avoid further losses. Furthermore, the decline in exchange deposits signals that some bitcoin holders are not guided by the get-rich mentality when the asset experiences a minor price surge as they appear not swayed by factors that result in panic selling.

Additionally, there is growing optimism that more institutional investors will venture into bitcoin pushing it towards mainstream adoption. Furthermore, the debate on bitcoin price surge being a bubble is slowly diminishing since the asset has recovered from major price correction in 2021.

Bitcoin experiences fourth major price movement in 2021

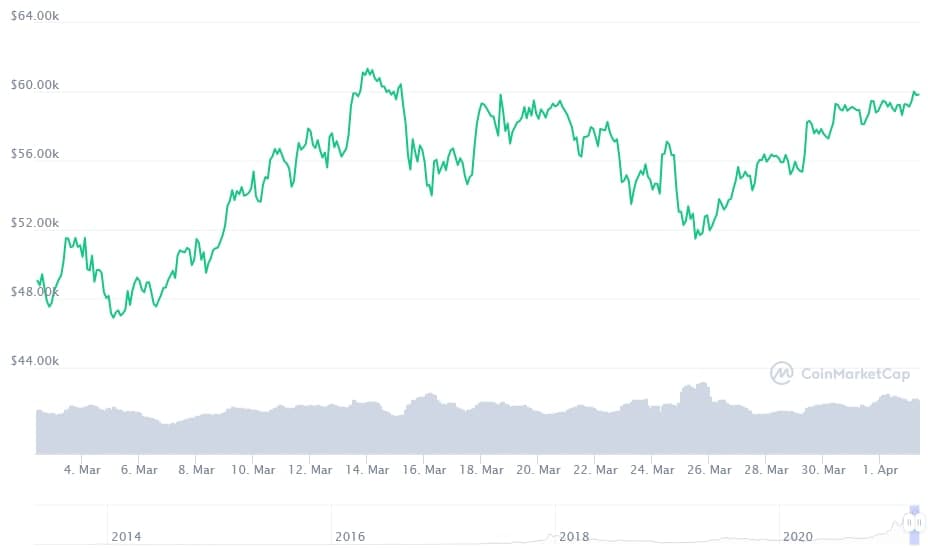

The current bitcoin price means that the asset is experiencing its fourth significant price rally in 2021 after hitting a new all-time high above $61,000 on March 14.

On March 2, 2021 bitcoin’s price was $49,056, surging by 21.97% to $59,83 on April 2, 2021.

The market movement is mainly due to the entry of institutional investors into the sector. For example, large corporations such as Tesla (NASDAQ: TSLA), Visa (NYSE: V), and PayPal (NASDAQ: PYPL) announced support for cryptocurrencies, a significant catalyst for the recent price surge.

finbold.com

finbold.com