The rapid growth of stablecoin issuance could have implications for the functioning of short-term credit markets, the bond-rating service Fitch said Thursday.

Stablecoins, typically digital tokens linked to government-issued currencies such as the U.S. dollar, could over time pose “contagion risks,” the ratings service said in a press release.

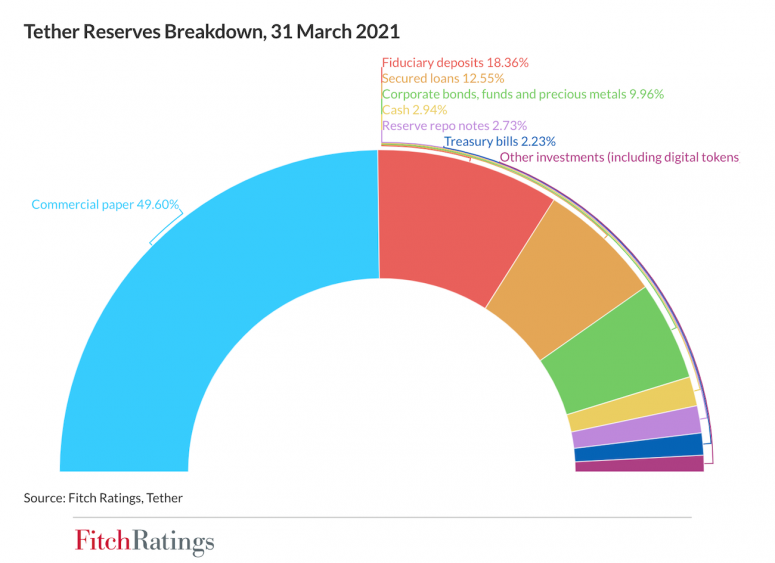

Fitch noted that Tether, the largest stablecoin issuer, had increased total assets of the dollar-linked stablecoin USDT to $62.8 billion on June 28. According to the release, Tether has announced that it held only 26.2% of its reserves in cash, fiduciary deposits, reverse repo notes and government securities, with a 49.6% in commercial paper (CP), a type of short-term corporate debt.

Tether’s CP holdings amounted to $20.3 billion on March 31, according to Fitch.

Some traders, analysts and economists have speculated that financial losses at Tether or even a crisis of confidence might trigger a sell-off that could put downward pressure on prices for other cryptocurrencies, including bitcoin.

The Fitch report suggests that the turmoil also could also have implications for traditional markets.

“A sudden mass redemption of USDT could affect the stability of short-term credit markets if it occurred during a period of wider selling pressure in the CP market,” said the report. “These figures suggest its CP holdings may be larger than those of most prime money market funds in the U.S.,” as well as in Europe, Middle East and Africa.

Potential asset contagion risks linked to the liquidation of stablecoin reserve holdings “could increase pressure for tighter regulation of the nascent sector,” according to Fitch.

The report defines contagion risks to be primarily associated with “collateralized stablecoins, varying based on the size, liquidity and riskiness of their asset holdings,” among other things.

There’s less risk associated with coins that are fully backed by “safe, highly liquid assets,” according to the rating service. Stablecoins that use fractional reserves may run a greater risk.

coindesk.com

coindesk.com