A lackluster balance sheet, excessive debt load, and over-leveraged exposure to Bitcoin (BTC) have crashed MicroStrategy (MSTR) stock by more than 63% since February 2021 already. Nevertheless, the business intelligence company has ignored the risks of its frothy valuations; it now wants to raise more debts and buy Bitcoin with proceeds.

MicroStrategy announced Monday morning that it "intends to raise $400 million aggregate principal amount of senior secured notes in private offering [...] to acquire additional Bitcoins." The company already holds more than 92,000 BTC worth about $3.31 billion at current exchange rates, almost 1.5 times its principal investment.

MSTR plunged 2.17% after the New York opening bell Monday to $469.29 per share. At its year-to-date high, it was changing hands for $1,135.

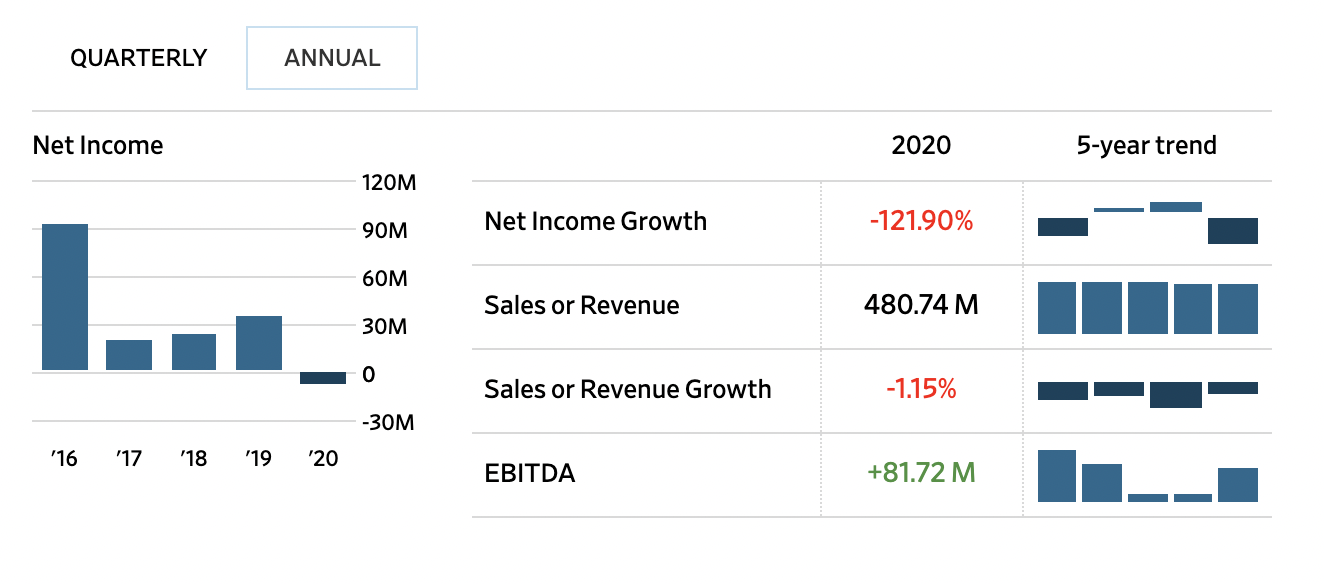

Not making money

In its previous statements, MicroStrategy has already clarified that it is building up a Bitcoin portfolio as an insurance policy against the continuing devaluation of the world's major currencies. But with its back-to-back Bitcoin purchases, the company has effectively protected itself from more than just the US dollar decline. Hint: unprofitable business lines.

A look into MicroStrategy's alternative asset holdings also shows the company overly skewed towards Bitcoin, with real estate accounting for less than 0.2% of the total investments.

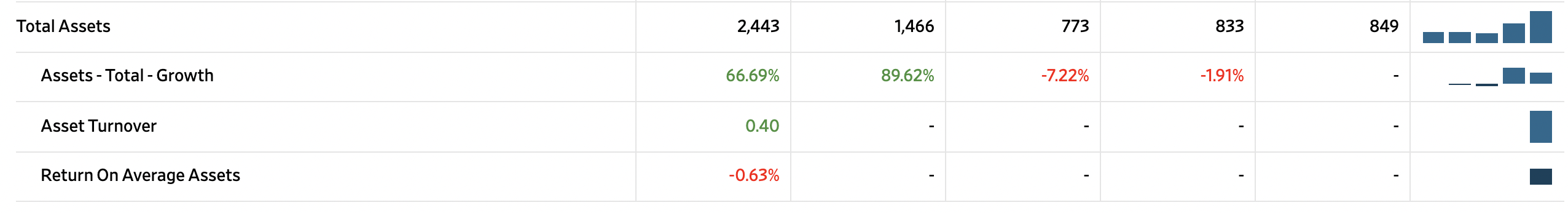

Its latest quarterly report also showed a weaker balance sheet, with a debt-to-equity ratio at 4.55 — a significant debt load of $1.66 billion against an equity valuation of $0.37 billion — as of March 31, 2020.

That is particularly risky when Bitcoin's price volatility is taken into account. MicroStrategy does not generate sufficient income to service its debt load and hugely relies on Bitcoin profits to do so. Atop that, it now wants to raise another $300 million, although its convertible notes are not due maturity until 2028.

Juan De La Hoz, a CETF/ETF fund strategist, feared that MicroStrategy risks becoming insolvent should Bitcoin fall by more than 50% in the future, reminding the flagship cryptocurrency's massive declines in the year 2014 and 2018. The analyst added MicroStrategy would most probably liquidate its Bitcoin holdings to avoid insolvency.

Hoz noted that he would not invest in cryptocurrencies through leverage nor he would invest in a company that did so, hinting his extremely bearish outlook for MicroStrategy and Bitcoin in one line.

It is simply too risky, you could lose it all, and I'd rather not take that chance.

Bitcoin prices sleepwalked through MicroStrategy's announcement early morning. The BTC/USD exchange rate continued trading sideways while maintaining support above $36,000.

cointelegraph.com

cointelegraph.com