U.S. stocks exposed to blockchain and cryptocurrencies have outperformed the Standard & Poor’s 500 Index by about 34 percentage points year-to-date, according to Goldman Sachs, in a reminder of how the fast-growing technologies’ appeal extends to investors in traditional markets.

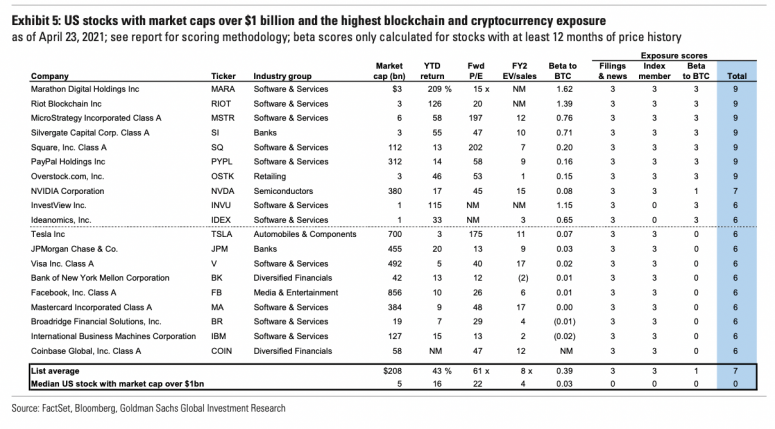

The Wall Street firm identified 19 stocks with a market capitalization of at least $1 billion and high exposure to blockchain technology or cryptocurrencies.

On average, the stocks have climbed 46% year-to-date, versus 12% for the S&P 500, according to the Goldman report dated April 26. Notably, the average lagged behind a direct bet on bitcoin (BTC), which gained 89% over the period.

Marathon Digital Holdings (NASDAQ: MARA), Riot Blockchain (NASDAQ: RIOT), and Microstrategy (NASDAQ: MSTR) were included in Goldman’s blockchain exposed stock list. Also included were traditional financial companies like JPMorgan Chase (NYSE: JPM) and Visa (NYSE: V).

- Goldman selected stocks included in blockchain indexes and ETFs, calculated the sensitivity of stock prices to bitcoin during the past 12 months and then scanned company filings to identify 19 stocks with blockchain exposure.

- “An equal-weighted portfolio of the stocks has demonstrated roughly 60% correlations with bitcoin and the Bloomberg Galaxy Crypto Index during the last several months, compared with 20% correlations for the S&P 500,” according to Goldman.

- 11 of the 19 blockchain stocks are in the software and services industry and trade at twice the price-to-earnings valuation as the median U.S. stock.

- The basket of blockchain stocks underperformed the S&P 500 by roughly 10% over the past two weeks as cryptocurrency prices dipped but outperformed by about 2% on Monday as bitcoin retraced nearly 30% of the prior sell-off.

coindesk.com

coindesk.com