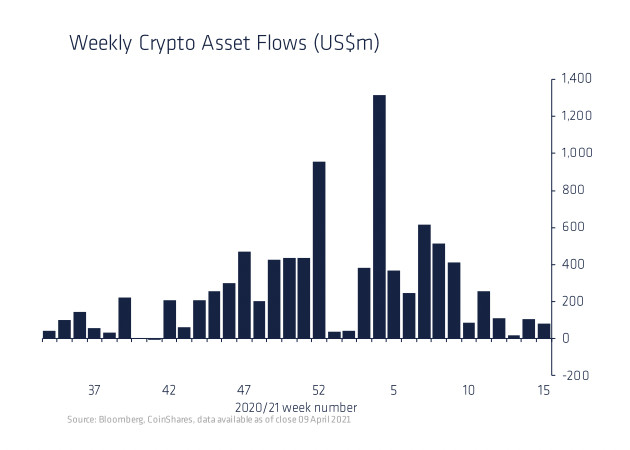

Net inflows to digital asset investment products declined by about $23 million last week to $83 million, though a recent bout of profit-taking appears to have subsided, according to a new report by CoinShares, a digital asset investment firm.

- “As is often the case when bitcoin prices make new highs, prices typically range trade in conjunction with a round of profit taking. Recently we have witnessed a similar profit taking round (minor outflows) following all-time highs in mid-March 2021,” wrote CoinShares.

- “This now looks to have run its course with the minor outflows over the last month gradually diminishing.”

- Last week was the first week of no outflows across funds since mid-February 2021.

- Bitcoin (BTC) prices were mostly stagnant last week, stuck in a range between roughly $55,000 and $60,000, unable to break through the all-time high around $61,700 reached in mid-March.

- Bitcoin-focused funds received most inflows in the seven days through April 9, totaling $55 million, while Ethereum (ETH) products attracted $22 million. Multi-asset digital investment products saw inflows of $8 million last week, the most since February.

- Rising inflows outside of bitcoin products coupled with Ethereum’s rise in popularity “indicate investors are beginning to turn their focus onto alternative digital assets,” according to CoinShares.

coindesk.com

coindesk.com