Two years ago when the concept of staking was first announced it was a relatively niche vehicle limited to the Tezos and Cosmos, the first Proof of Stake crypto protocols. Fast-forward to today and the industry is an $18 billion behemoth, thanks to Eth 2.0’s Proof-of-Stake campaign and institutions’ quest for internet bonds, with over two dozen PoS protocols on the market.

A recent quarterly report from Staked about the state of the staking market quantifies this growth industry.

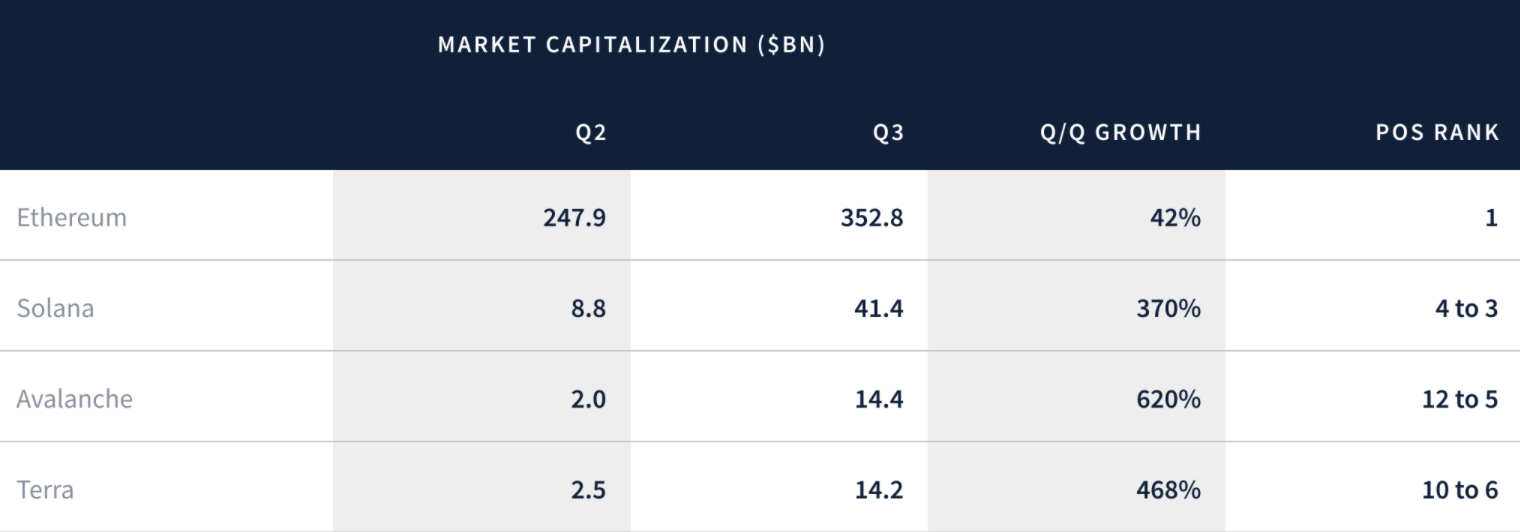

Staked reports that the overall market cap of PoS protocols now accounts for over 50% of crypto’s total market cap, or $594 billion as of September 30. While in some regards this is thanks to the general crypto bull market — which accelerated the growth of the top tokens like Ethereum, Cardano, Solana and Polkadot — there is also a lot to be said about the rise of smaller protocols which account for most of the 34 mainstream PoS protocols on the market.

The report highlights peer-to-peer connectivity and IoT protocol Helium, which has seen its token rise by nearly 1000% over the last year, moving to PoS as another success story for the mechanism.

And with all this growth comes the deployment of venture capital. During the past quarter Staked says there was $8 billion in venture capital injected into the sector such as Helium’s $111 million raise, Solana’s $314 million, and Avalanche’s $230 million.

The Great EIP-1559 Burn-off

Aside from staking, the other major value prop Ethereum has is its periodic burn-offs. Implemented with this summer’s London Hard Fork, EIP-1559 is something of a cross between a share buy-back and a deflationary measure.

Projections indicate more than 3 million ether, or roughly $12 billion, will be removed from circulation over the coming year, representing 2.5% of the current outstanding supply of 117 million ether.

Staked uses the metaphor of ‘price-to-generated fees’ as being similar to a listed company’s price-to-earnings ratio to point out that ether would trade at a 29x ratio similar to tech mega giants like Apple, Facebook, Alphabet and Amazon albeit with much better growth.

What will regulators do?

Regulators are bound to take notice of an $18 billion industry, and it’s only a question of when the SEC will take action.

While a legal briefing created by the Blockchain Association is steadfast in its thesis that staking service arrangements fail to meet the four criteria identified by the Howey Test, 1933 Supreme Court case for determining whether a transaction qualifies as an investment contract, some legal scholars see the SEC’s service of a Wells Notice to Coinbase as a prequel to the inevitable.

“This is part of a broader dichotomy happening where the innovators are innovating at a much faster clip than ever before, and the regulators, the legal system and lawmakers can’t keep pace,” Bloomberg quotes R.A. Farrokhnia, a Columbia business school professor, as saying.

While the SEC has yet to offer definite guidance on the matter, the New York State Attorney General has put serious effort into probing digital asset companies on their lending and deposit earnings products. Although these are currently directed nominally at crypto lending companies, many legal observers think staking is the next step.

But until then, Staked doesn’t see any sign that the industry is going to slow down. After all, of all the ether wallets out there, the Eth 2.0 staking contract wallet is the second-largest holding, with over 8,000 ether or $32 billion. That’s a significant part of the ecosystem to take on, which also means that regulators might feel the need to tread lightly to prevent a domino effect from occurring.

blockworks.co

blockworks.co