The hype is mounting over a long-awaited Ethereum upgrade that alters the transaction fee mechanism. However, will it actually result in any gas savings?

The EIP-1559 modification will ship with the Ethereum London hard fork. Notably, this fork is scheduled for July sometime after being launched on testnet this month.

Many have assumed that it will reduce gas fees for the network, relieving the pain for most of its users. In recent weeks, average transaction fees have skyrocketed to record highs of around $70 – even higher for complex smart contract interactions.

However, this may not be the case as Ethereum software solutions firm ConsenSys explained in a recent blog post.

🤔What is EIP-1559?

🤔Will it make gas cheaper?

🤔How will it affect dapps on Ethereum?Learn how EIP-1559 will impact users, #dapp devs, and #ETH holders. The #Ropsten testnet fork is on June 24 – upgrade your #HyperledgerBesu client now! 👇https://t.co/Ii5IDE3xe7

— ConsenSys (@Consensys) June 22, 2021

Will EIP-1559 Reduce Gas Fees?

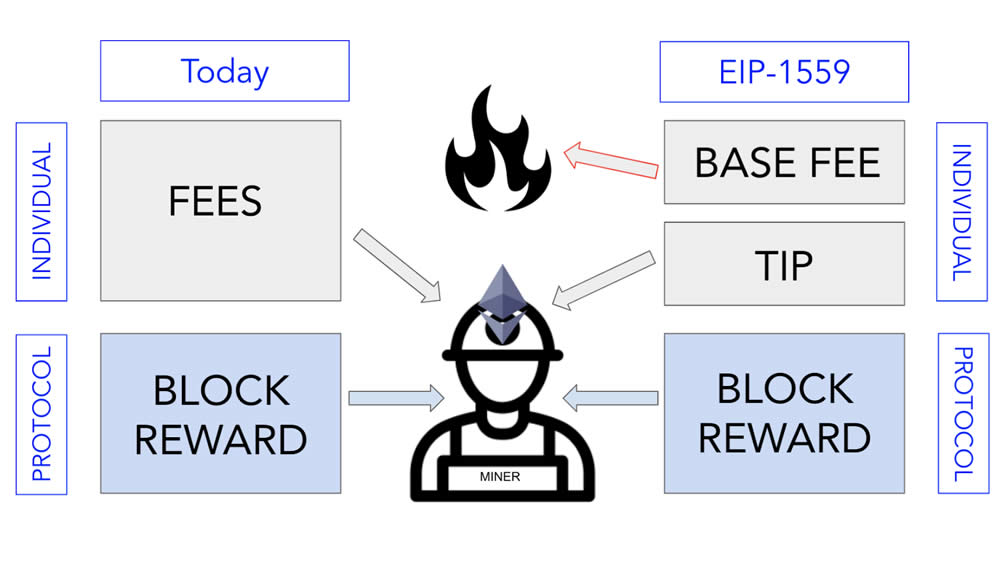

Ethereum network fees are currently calculated in an auction-type mechanism. This works by having users submit bids for how much they’re willing to pay to have their transaction processed. Naturally, the miners will prioritize the highest bid, which leads to network congestion and very long waits for everyone else paying a lower gas fee.

EIP-1559 will change this fee market mechanism by eliminating the first-price auction as the main gas fee calculation. Under the new mechanism, there will be a discrete “base fee” for transactions to be included in the next block. Users or applications that want to prioritize their transactions can add a “tip” to speed things up a little.

ConsenSys put together this rudimentary graphic to illustrate the differences.

However, it will not directly lead to a reduction in gas fees when the network is under heavy load. ConsenSys confirmed this in response to the question: will this make gas cheaper?

“No, this is not the intent of the EIP. As a side effect of a more predictable base fee, EIP-1559 may lead to some reduction in gas prices if we assume that fee predictability means users will overpay for gas less frequently.”

The base fee will dynamically change depending on how full the block is at the time of the transaction. However, this will allow dApps, wallets, and protocols to automatically set potentially lower and more accurate gas fees.

The only way to drastically reduce gas fees at the moment is to use a Layer 2 solution such as Polygon or Loopring. They are currently around $10 on average, according to Bitinfocharts.

Ethereum Becomes Deflationary

The major upshot of EIP-1559 is that the gas, or base fee, will be burnt, resulting in a reduction in the supply of ETH.

ConsenSys estimates that the annual supply change will be negative 1.6 million ETH. This will reduce the annual supply rate by 1.4%. This will be further compounded when proof-of-stake hits mainnet on ETH 2.0 in 2022 sometime.

ETH Price

At the time of publication, ETH was trading at $1,915.50, dropping 4.1% over the last 24 hours. Moreover, ETH has a market cap of $222,844,676,264 and a 24-hour trading volume of $25,169,428,567.

altcoinbuzz.io

altcoinbuzz.io