Prices for ether, the native cryptocurrency of the Ethereum blockchain, have already quadrupled this year. Now, some options traders are betting prices could double again – by the end of next month.

Market data reveals growing demand for ether’s deep out-of-the-money (OTM) call options – bullish bets with strike prices well above the spot market price of the underlying asset.

Ether has rallied from $2,000 to record highs over $3,500 in the past 10 days. On Tuesday, a single high-net-worth trader or a group of traders bought 9,000 contracts of the $8,000 call expiring June 25.

These block trades crossed the tape via the institution-focused, over-the-counter desk Paradigm and were booked on Deribit, the leading exchange for cryptocurrency options.

Theoretically, buyers of the calls are expecting the second-largest cryptocurrency by market cap to rise above $8,000 by the end of June.

However, if ether continues its steep bull run for few more weeks, the price of the $8,000 call would surge, simply because the trade would be more likely to pay off. At that point, traders could sell the options in the market for a quick profit.

Whatever transpires, according to analysts, the surge in demand now for the $8,000 call implies bullish price expectations potentially linked to the network upgrade known as EIP 1559 that would reduce the pace of the net issuance of ether.

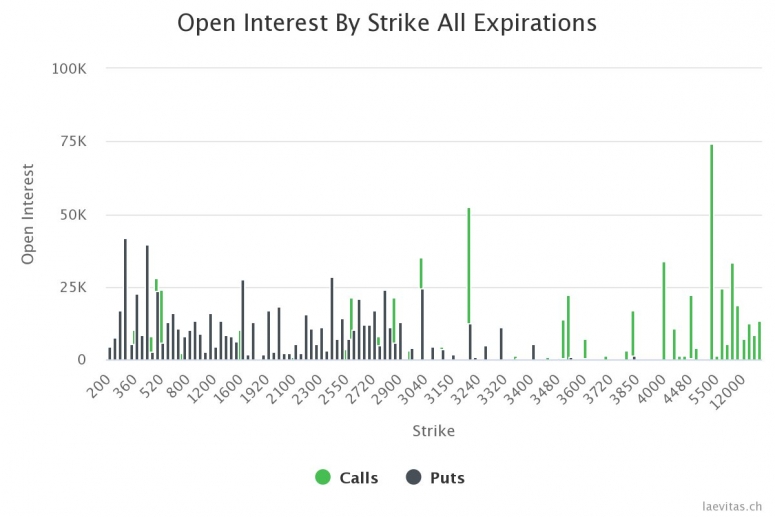

“Investors look to be betting on continued bullish momentum in anticipation of a big drop in ether’s issuance after the EIP 1559 upgrade,” according to Laevitas, a Swiss data analytics firm for cryptocurrency markets.

Call options, or bullish bets, with strikes ranging from $5,000 to $10,000 listed on Deribit have become popular in recent weeks.

Also read: Amid New Price Highs, Ether Flips Bitcoin on Options Volume

That said, the risks are steep. With the strike price so far away, the options could easily expire worthless, and the buyers would forfeit the premiums they paid for the contracts.

Hence, buying these deeply out-of-the-money call options is often considered analogous to buying lottery tickets.

coindesk.com

coindesk.com