The massive growth of Ethereum’s futures and options arena is reportedly pointing towards significant institutional involvement in the second-largest cryptocurrency by market capitalization.

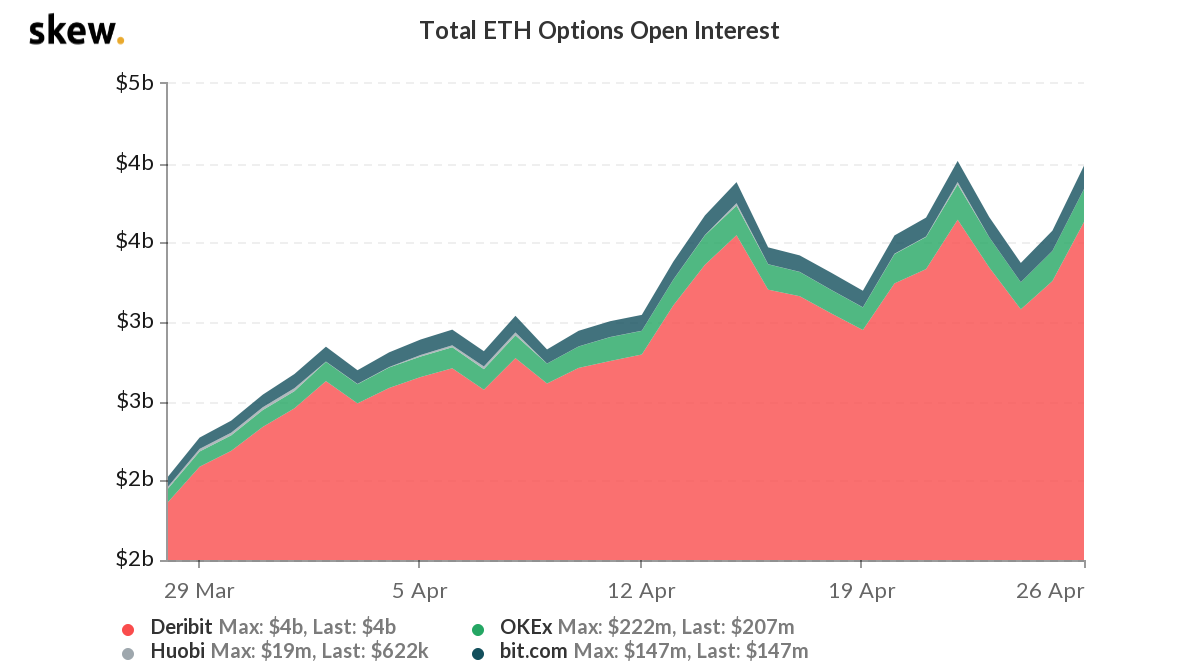

According to a recent report by crypto investment advisory firm Two Prime Digital Assets, the 80-fold growth in Ether (ETH) options open interest goes beyond mere retail speculation. As part of its report, the firm argued, “Institutional money managers have moved in to start hedging net long portfolios against outsized volatility events.”

The same exponential growth can also be seen in the ETH futures market. Indeed, data from crypto aggregator Bybt shows the open interest in ETH futures experiencing a 20-times increase within the same period and now sits at over $7.68 billion as of the time of writing.

Amid the growing institutional demand for ETH, Two Prime also predicted that Ether will decouple significantly from Bitcoin’s (BTC) price action. The Two Prime report also maintained that the involvement of big-money players will cause a steady decrease in realized volatility.

In another example of the apparent increase in institutional appetite for Ethereum, the Coinshares report on weekly digital asset fund flows saw ETH bucking the trend of investment product outflows for crypto-assets.

According to the crypto investment manager’s report on Monday, ETH saw $34 million in investment product inflows for the past week. This figure puts the total ETH inflow for crypto fund managers at $792 million — about 8% of the total asset under management for these funds, according to Coinshares.

The $34 million ETH investment inflow came amid Bitcoin’s lowest weekly inflow numbers since October 2020. Indeed, fund movements were primarily outflows for BTC, with $21 million (the largest weekly outflow recorded), moving the other way.

As previously reported by Cointelegraph in February, ETH represented about 80% of the institutional crypto inflows in the first week of the month.

cointelegraph.com

cointelegraph.com