The ETH/BTC ratio has rallied roughly 4.7% over the past five days as ETH outperforms BTC.

Ethereum based derivatives activity has resurged over the past week.

OpenSea opens 2022 with a bang, on pace for record monthly volume.

Latest in Macro:

- S&P 500: 4,793, -0.06%

- NASDAQ: 15,622, -1.33%

- Gold: $1,814, +0.60%

- WTI Crude Oil: $77.21, +1.49%

- 10-Year Treasury: 1.649%, +0.032%

Latest in Crypto:

- BTC: $46,155, -0.30%

- ETH: $3,813, +1.40%

- ETH/BTC: 0.0826, +1.98%

- BTC.D: 39.41%, -0.69%

ETH/BTC

ETH has outperformed BTC over the past five days with the ETH/BTC ratio up 4.72%, hovering near .0825, according to data from Trading View.

ETH derivatives picking up

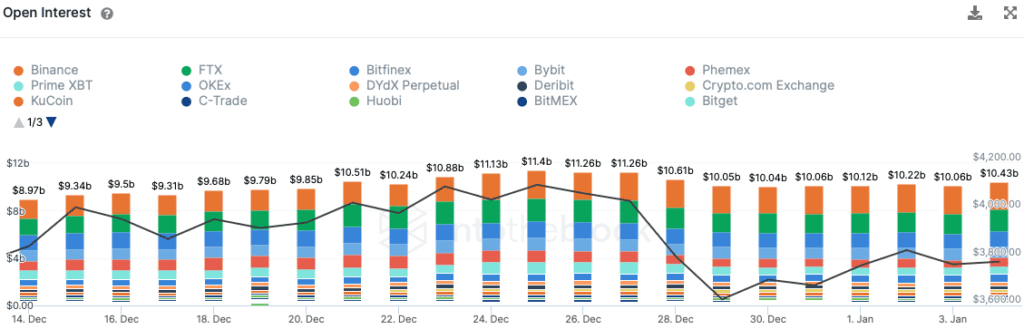

According to information from intotheblock:

- Perpetual funding rates on top exchanges are turning positive

- Swap volume of perpetuals futures contracts have topped $22 billion again

- Perps open interest is perking up

OpenSea volume explodes

OpenSea is eyeing a $13 billion valuation, according to Eric Newcomer.

Trading volume on OpenSea has exploded to start out 2022, with roughly $870 million of volume in the first four days of the new year, according to data from Dune Analytics. This puts OpenSea on pace for $6.74 billion in monthly trading volume. For comparison, that would be nearly double the current high of $3.42 billion seen in August 2021.

NFTs

Information from ARK Invest suggest a majority of NFT demand comes in the form of collectibles, as seen in the following chart:

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

blockworks.co

blockworks.co