Asset managers have increased long bets on bitcoin futures by 35% since last week to above 500 contracts for the first time since the fourth quarter of 2020.

The latest data by the Commodities Futures Trading Commission (CFTC) show asset managers have 517 long bitcoin futures contracts as of June 15th.

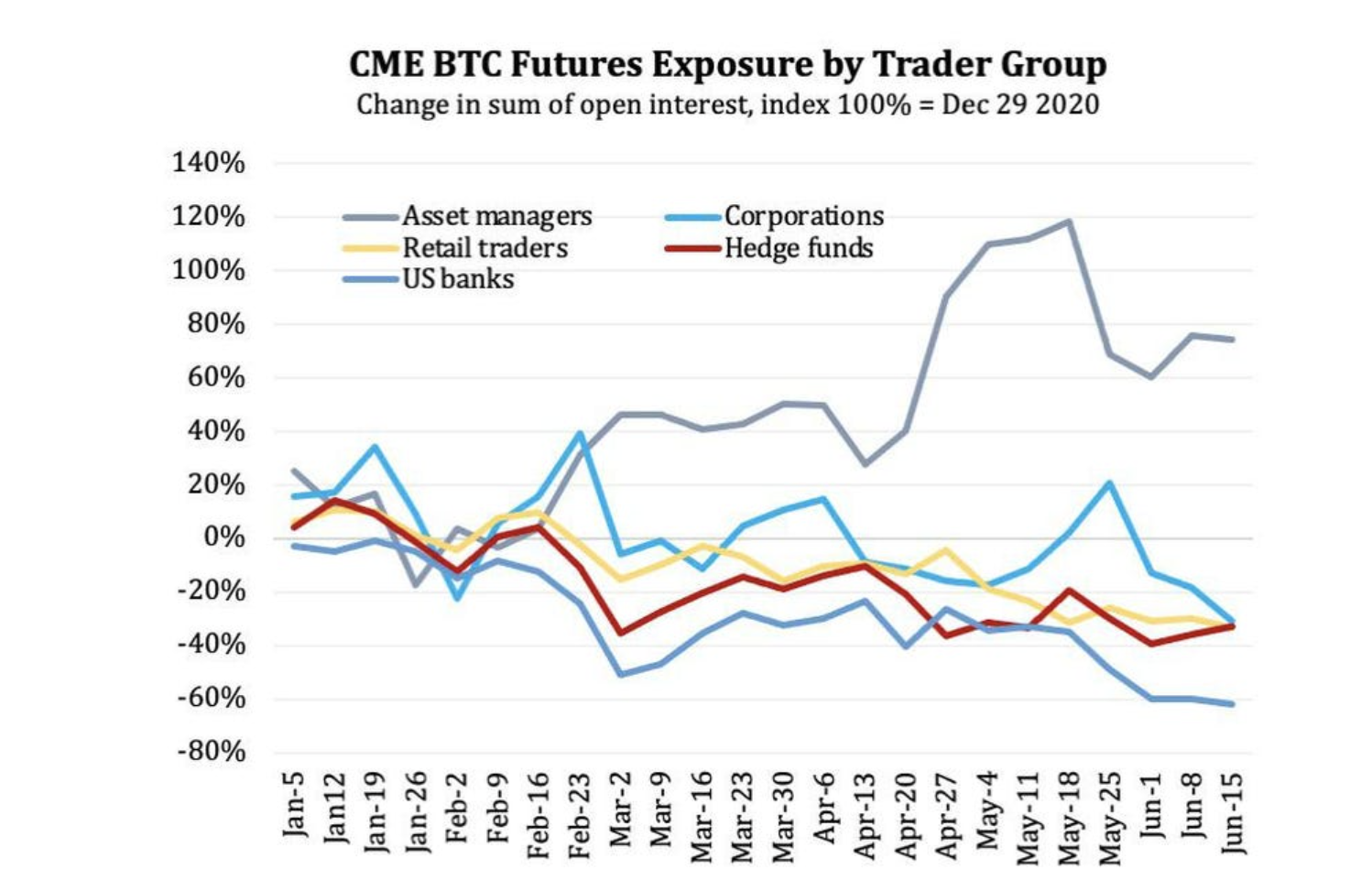

As can be seen above, this class of investors was long for much of autumn and December of 2020, but then went short for pretty much all of this year.

Now they’re once again edging towards long, although they’re still just about net short currently, but far less than last month as more and more flip bullish.

Asset managers moreover dominate as a group according to CFTC data as compiled by Forbes:

CFTC data shows in total 7,000 are short and 6,000 are long, with bears seemingly giving way as bitcoin holds $30,000.

The currency has been testing that support level now for months with it holding so far despite brief dips below it.

Following that price action, smart money is apparently betting on a change of direction with the grand theme here perhaps being that the investment proposition for bitcoin changed from a print baby print safe haven during the pandemic, to the market not being very sure what it will do once the economy opened up.

Now six months on, with the policy of easy money expected to continue until 2023 and with euro bonds hitting the market, bitcoin has retained some of its proposition while also eying gains from economic growth.

It may be therefore the turbulences from the re-adjustment from a pandemic economy to a largely non-pandemic economy, which gave us things like the GME hysteria, might now be coming to an end with bitcoin holding its proposition at this price level so far even under a state level assault.

So looking forward six months from now, these asset managers may well be foreseeing a very different economy from last year that may translate to a Christmas economic boom with inflation slightly higher than usual at about 4%-5%, and thus a lot of money looking for a place to park with bitcoin obviously being one such place alongside stocks.

trustnodes.com

trustnodes.com