The rally in bitcoin (BTC) over the past year may be nearing an end, according to New York-based MRB Partners, a boutique investment research firm.

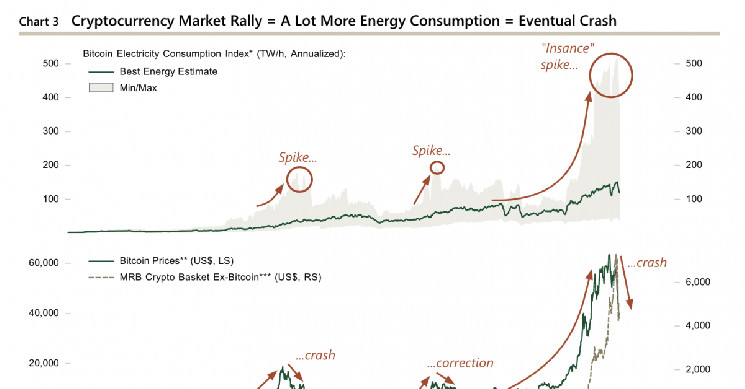

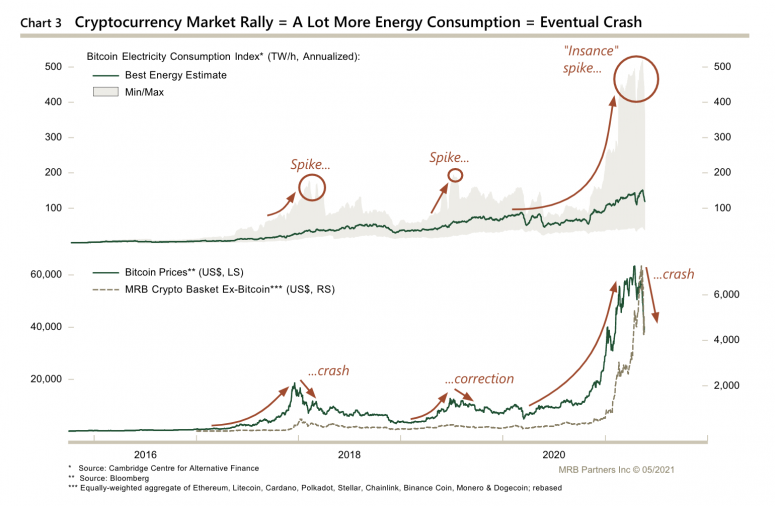

In a May 25 report titled, “Has The Crypto Fever Broken?“, the analysts cite growing concerns with cryptocurrencies’ environmental impact, possible regulatory risks, negative technical trends and a future reduction in monetary stimulus as among the many reasons bitcoin could have a tough time ahead.

“Easy money has helped fuel the crypto bubble, and a slow unwinding of this trend globally will ultimately become a headwind for the speculative digital asset,” wrote MRB.

Bitcoin has risen nearly two-fold over the past year and is up about 30% year-to-date. The world’s largest cryptocurrency suffered a volatile period in May which appears to be stabilizing over the short-term. However, some analysts expect limited upside in bitcoin despite the possibility of a brief bounce.

- MRB mentioned concerns about environmental issue, leverage and renewed fears of a global regulatory crackdown in the U.S. and China as possible headwinds for cryptocurrencies.

- To reduce the negative environmental impact, “crypto mining systems would need to allow miners to produce tokens for significantly less cost compared to their current price,” wrote MRB.

- Increased mining efficiency could lead to lower energy consumption, which typically occurs during corrections in the price of bitcoin, according to MRB.

- “Moreover, over-leverage has also become a mainstream issue for crypto markets and regulators are now being tasked with gauging the risks originating from increased non-financial intermediaries/exchanges.”

But not all may not be lost for crypto markets, according to the researchers.

“It remains entirely possible that these assets could develop into a mainstream investment vehicle,” wrote MRB. “We suspect this process will be a very long road ahead with more boom/bust phases along the way.”

coindesk.com

coindesk.com