Blockchain data shows that the latest bitcoin market correction, which sent the oldest cryptocurrency down by more than 35% from its peak price above $64,000, may have been driven by panic selling from investors who bought during the recent bull market.

“The bitcoin market is in a historically significant correction,” blockchain data analytics firm Glassnode wrote in a post on May 17. “There are strong signals that short-term holders are leading with panic selling.”

At press time, the bitcoin (BTC) price was changing hands at $42,860.11, down 9.65% in the past 24 hours, based on the CoinDesk 20. The steep price drop came after a series of tweets by Tesla CEO Elon Musk in which he initially failed to outright deny that his electric-car company has sold or could soon sell all of its more than $1 billion holdings of BTC. He later clarified that Tesla had not sold any of the holdings.

Musk also announced on May 12 that Tesla was discontinuing acceptance of payments in the cryptocurrency due to concerns around its environmental impact. The price fell by nearly 13% that day, or more than $7,000 on the Coinbase exchange, according to TradingView.

In a post published Monday, Glassnode, citing several key blockchain data metrics, said that the ongoing market correction has been mainly led by new investors who are still selling in panic.

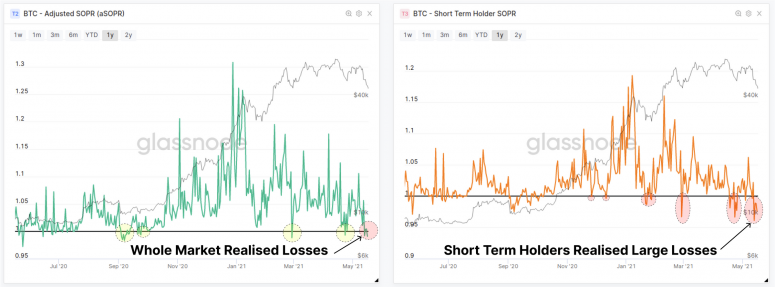

The “short-term holder SOPR” or STH-SOPR that filters for coins younger than 155 days dropped well below the key threshold of 1, meaning that newer market entrants appear to have panic-sold and realized “significant” losses on their coins, according to Glassnode.

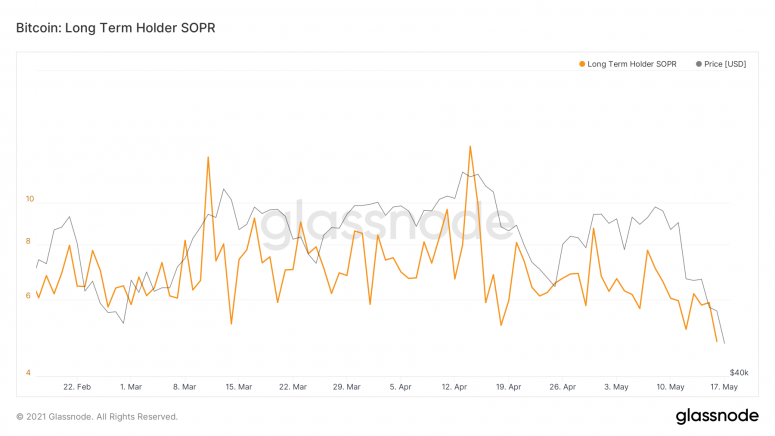

SOPR measures the net profit/loss position of outstanding bitcoin (BTC). A reading below 1 it implies that the coins moved that day are on average selling at a loss. At the time of writing, while the SOPR for the long-term holders is also trending downward, the value is still above 4.

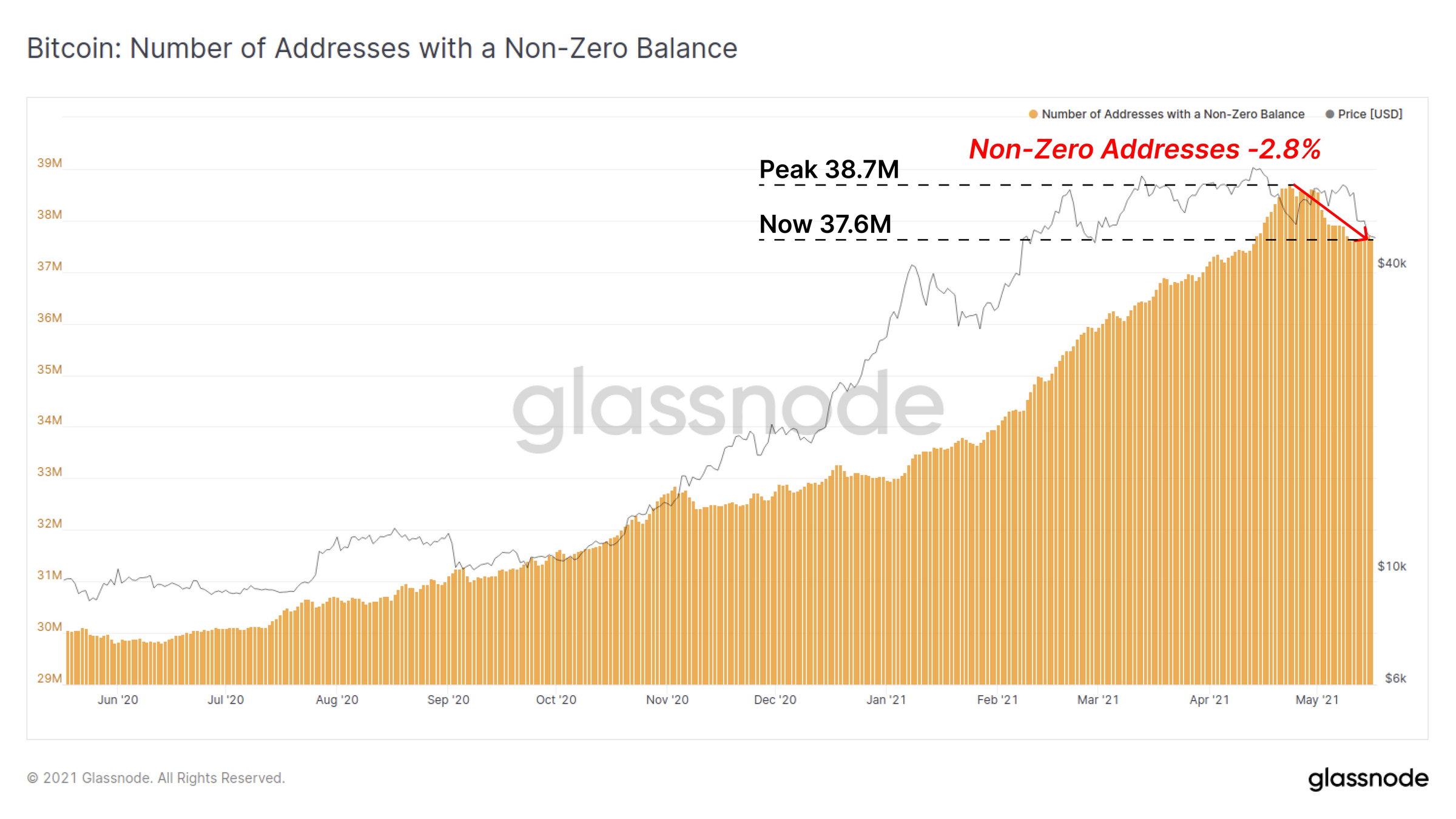

At the same time, the number of accumulation addresses of bitcoin continues to rise, as the count of non-zero balance addresses dropped by approximately 2.8% – indicating that long-term holders are buying the latest price dip, according to the Glassnode post.

With bitcoin still at a much higher price than during the last bull market, according to Glassnode’s report, bigger capital inflows are needed to drive a full price recovery.

On the other hand, the blockchain data also might imply that the current correction could be “a larger time-frame pull-back in a bull cycle.”

“Weak hands capitulate,” the post wrote. “And stronger hands recommence their accumulation of cheaper coins.”

coindesk.com

coindesk.com