Bitcoin whales have used the mid-April price slumps to accumulate more portions once again, suggests on-chain data. Additionally, a key technical metric outlined “huge” potential for another upside movement as BTC challenges $58,000.

BTC Whales Bought the Dip

Bitcoin went through a roller-coaster of a month in April. Being regarded historically as a bullish month for the primary cryptocurrency, it didn’t disappoint at first and delivered a new all-time high on the 13th. However, the following week or so saw massive turbulence in the opposite direction that resulted in roughly $18,000 evaporated from BTC’s price.

Although the cryptocurrency recovered most losses by the end of April, it actually failed to produce its seventh consecutive month in green as it closed with about 2% down compared to March.

Nevertheless, the enhanced volatility didn’t deter bitcoin whales from accumulating more coins. Just the opposite suggests data from CryptoQuant. The analytics company’s CEO, Ki Young Ju, outlined several metrics indicating large BTC holders have kept purchasing in recent weeks.

He mentioned the “significant” Coinbase premium – generally occurring when institutions and corporations, like Tesla and MicroStrategy, purchase bitcoin through the exchange – and noted that it “could indicate institutional investors in the US are buying BTC.”

Ju also said that wallets had moved coins to derivatives exchanges, “meaning whales might open a long position by using their BTC as collateral.”

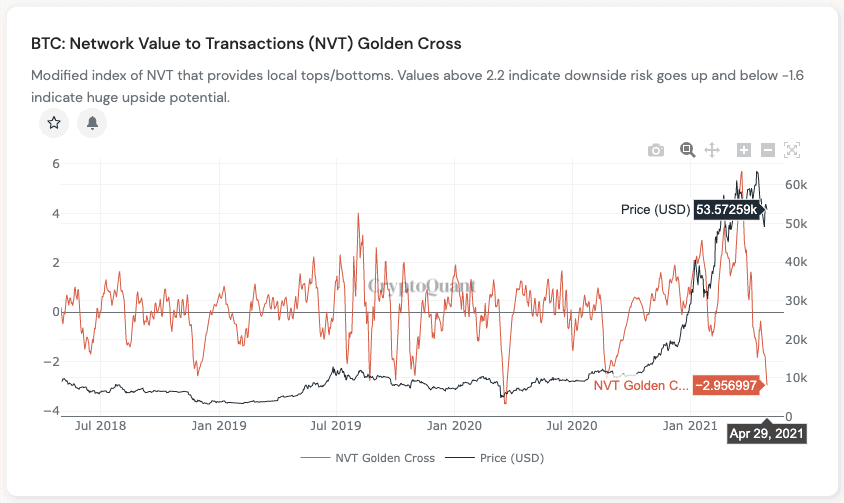

Furthermore, he touched upon the NVT Golden Cross, operating in a Bollinger-band-like signaling indicator defined by dividing the market cap with the current transaction volume. The metric reached a yearly low beneath –2, which suggests “huge upside potential” for BTC’s price.

Crypto Crowd Don’t Believe in BTC’s Recovery

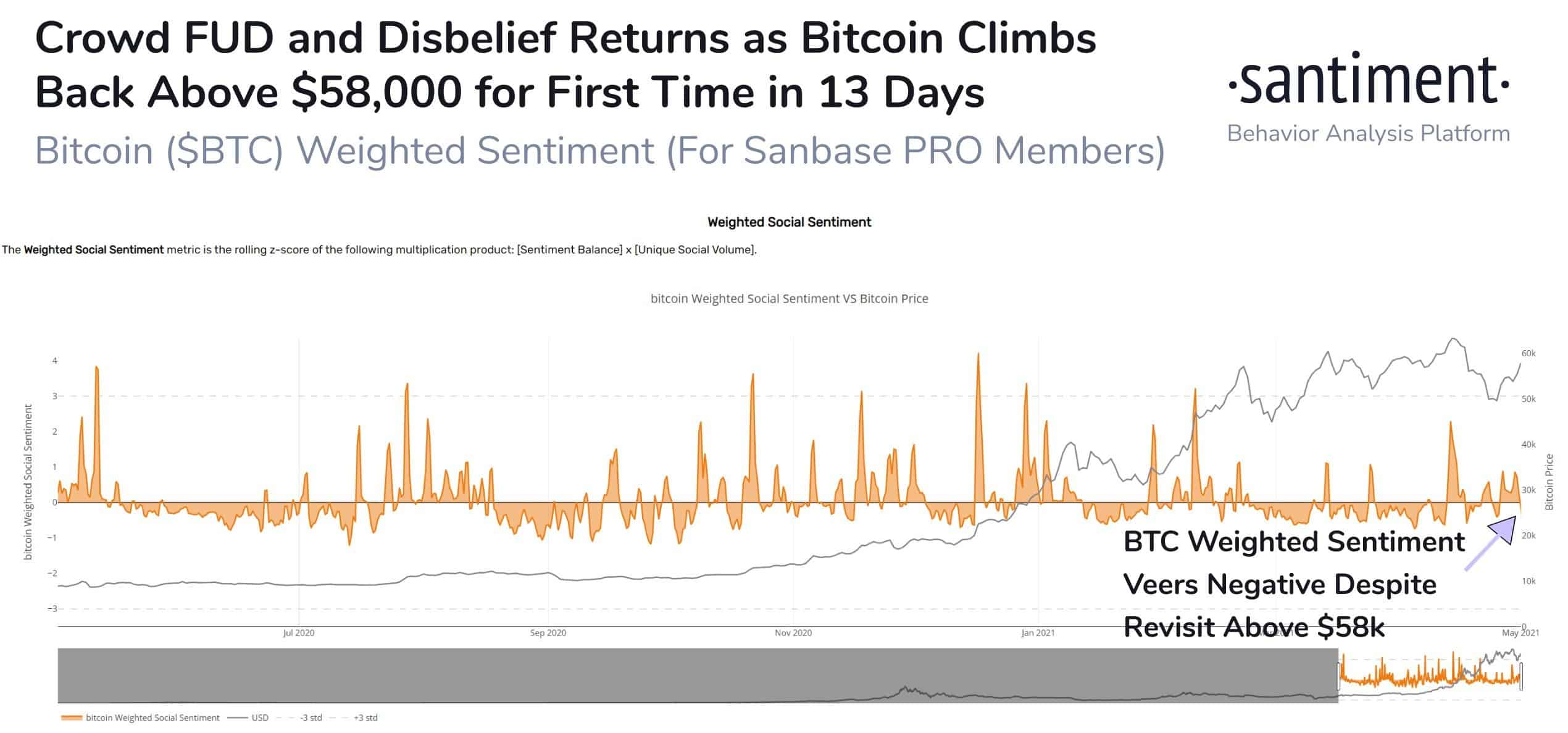

While institutions have kept buying and pushing bitcoin’s price towards $58,000, retail investors seem on the opposite shore. Data from Santiment reveals that the general commentaries and beliefs in the community are “more negative than usual despite BTC’s highest price level since April 17th.”

Nevertheless, the monitoring resource outlined that the crowd is more often wrong with their sentiment regarding a particular crypto asset, which could propel more bullish developments in bitcoin’s path.

cryptopotato.com

cryptopotato.com