The CEO of on-chain analytics firm CryptoQuant is revealing a key indicator he’s watching before he starts betting big on Bitcoin.

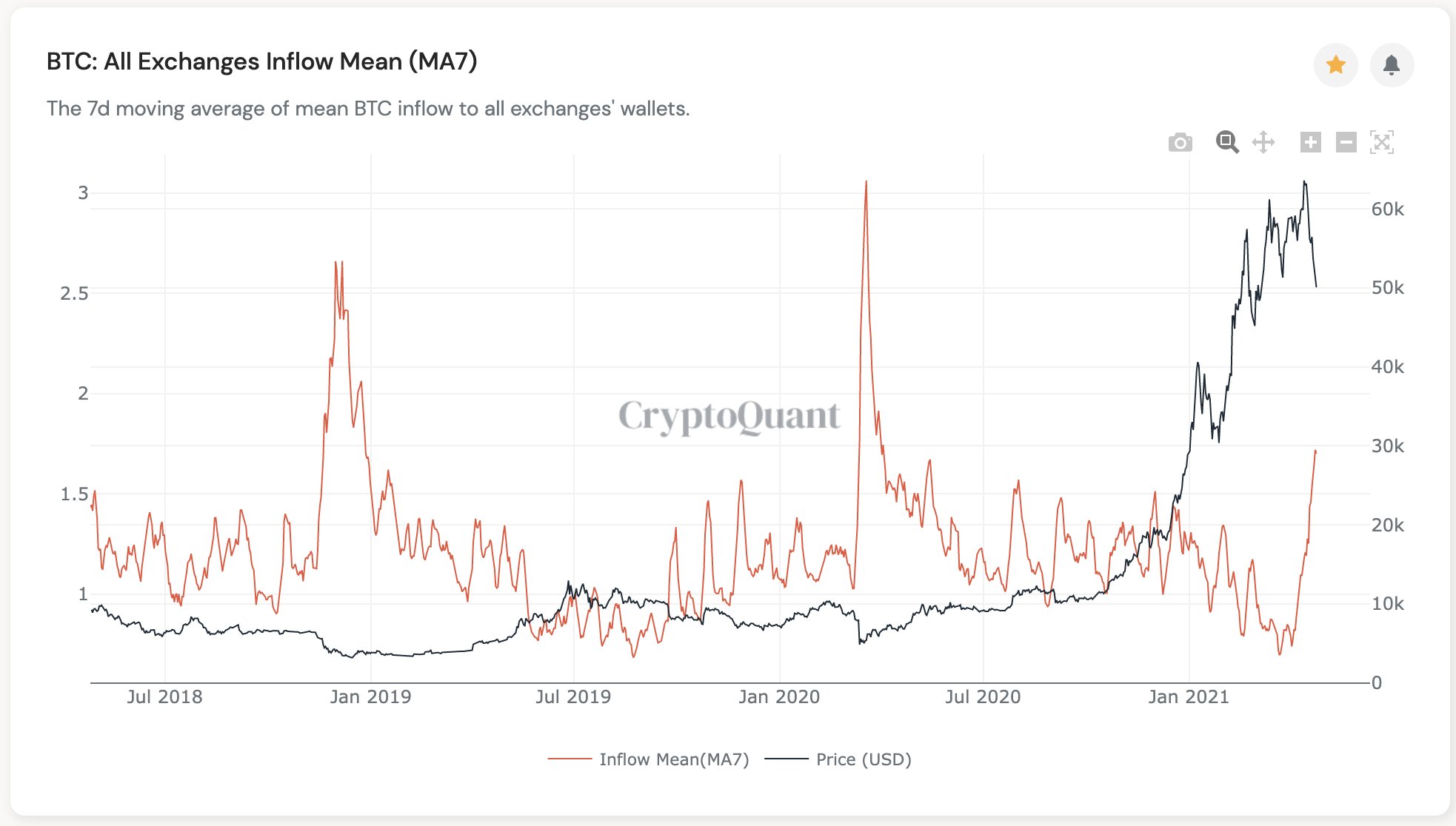

In a recent tweet, Ki Young Ju says he’s waiting for the mean inflow of Bitcoin to crypto exchanges to cool off before placing a huge leveraged long position on the leading cryptocurrency.

“This is another indicator I’m patiently waiting for cooling off to punt 10x long at BTC bottom.”

CryptoQuant’s indicator tracks the 7-day mean of Bitcoin moving into exchanges and lays it over the top of the price of BTC. According to Ki, the inflows to exchanges tend to spike in sync with BTC selloffs. Once the spike cools off and starts to point downward, opportunities for going long on the flagship crypto-asset start to present themselves.

“How to buy BTC at the global bottoms:

1. BTC drops hard over -30%

2. All Exchange Inflow Mean (MA7) spikes over 2.5 BTC

3. The indicator cools down

4. ALL-IN BTC

5. Become a billionaire and give a tip to cryptoquant.com”

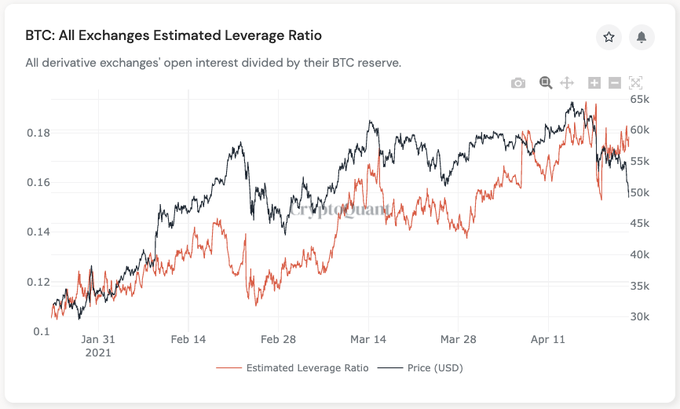

Ki also says that he’s waiting for much of the overleveraged trades to get flushed out of the market, as well as the Korean premium on BTC to go down before fully betting that BTC has carved out a local bottom.

“Short-term bearish. Long-term bullish.

I’ll keep my bearish bias until the estimated leverage ratio and Korea premium cools down.”

Like other analysts, Ki largely attributes the current Bitcoin correction to overleveraged longs making BTC vulnerable to sharp downswings during bull markets.

“Don’t get me wrong; I see this pullback as a technical correction due to overleveraged longs.

Fundamentals are still strong now. After cooling off the market in the next few weeks, BTC will go up.”

dailyhodl.com

dailyhodl.com