Bitcoin (BTC) is keeping bulls and bears guessing as it opens a new weekly candle in the green, heading away from $50,000.

After an uneventful but uninspiring weekend, BTC/USD has begun Monday by reclaiming $53,000 for the first time since April 22. What could lie in store?

Cointelegraph takes a look at five factors that could shape BTC price action in the coming days.

Difficulty adjustments form an essential, if not the most essential, part of Bitcoin’s ability to maintain itself regardless of external factors influencing its modus operandi.

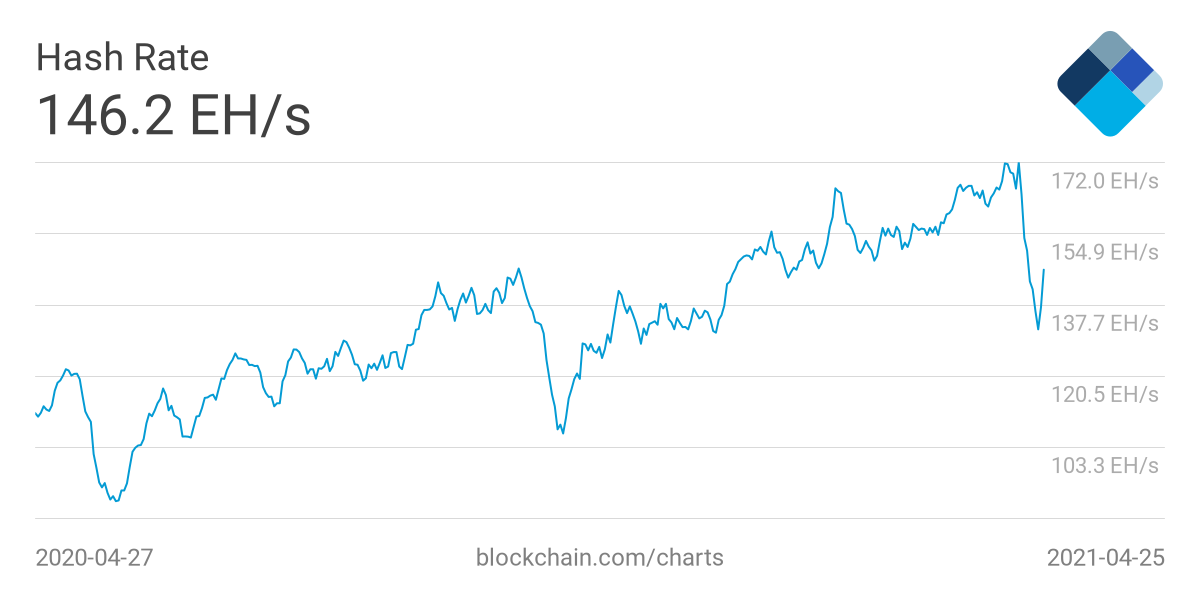

Recent months have been characterized by upticks in difficulty, which together with hash rate has seen consistent new all-time highs. Should history continue to repeat itself, price action should also revert to gains in line with their recovery.

Commenting on recent events, Adam Back, CEO of Blockstream, cautioned observers on their choice of statistics resource and argued that the drop had not in fact been as large as some suggested.

“Bitcoin hashrate back at 157 EH about 5% below 168EH peak. Mostly recovered from 25% down at 125 EH,” he tweeted on Sunday.

Sentiment tends towards “extreme fear”

Along with shorts and overleveraged longs alike, it seems that irrational sentiment in crypto has finally been shaken out.

That’s the conclusion of the popular Crypto Fear & Greed Index, which uses a basket of factors to determine trader sentiment and therefore what’s likely to occur on BTC/USD as a result of their actions.

Previously, as new all-time highs of $65,000 appeared, Fear & Greed was nearing historic record highs in line with the tops of bull markets past.

At nearly 80/100, a sell-off was clearly on the cards as per the metric, which took around a week to react to the $46,000 price dip.

Now, however, the pressure is off, and the index has gone from “extreme greed” to “fear” — effectively a “reset” of sentiment which provides scope for further price gains.

Analyst highlights price dip “silver lining”

It’s not just private individuals who have undergone a serious mood change. According to other metrics, erratic behavior from professional traders has also been effectively cleansed from the market.

In his latest update for Morgan Creek Digital co-founder Anthony Pompliano’s market newsletter on Friday, analyst William Clemente noted that longs had once again become an attractive bet.

“There was some silver lining to this event, greed and leverage was flushed out,” he wrote.

“In addition to the liquidations, this can be illustrated by funding rates. To peg the perpetual swap contract to Bitcoin spot price, funding rates are used. When the majority of traders go long, it becomes profitable to go short, and vice versa. During the event, funding rates flipped negative, meaning it became profitable for traders to take the long side of the trade. This has shown to be a buy signal in the previous two times this happened during this bull market.”

Also approaching a “full reset” is the spent output profit ratio (SOPR), a metric which Cointelegraph previously noted tends to dictate local market bottoms.

“Currently, SOPR is approaching the full reset mark, meaning price has either reached, or is very closing to reaching, the bottom of the current correction,” Clemente added.

cointelegraph.com

cointelegraph.com