Bitcoin’s recent price drawdowns – the percent decline from peak to trough – shouldn’t come as a surprise for cryptocurrency traders used to volatility and could present opportunities to buy the dip, according to a new report by Stack Funds, a Singapore based digital asset investment firm.

The near 15% decline in the bitcoin price (BTC) earlier this week is on par with previous drawdowns that took roughly five to 10 days to recover. “Drawdowns happen all the time, and crypto markets are no different from traditional markets,” wrote Stack Funds.

- “The fundamental narrative for bitcoin to the upside has not changed.” Stack Funds pointed to recent news items such as WeWork’s acceptance of cryptocurrencies as a form of payment and Venmo facilitating crypto transactions on its platform as evidence of increasing bitcoin adoption by businesses and mainstream users.

- “Hence, it might be good for one to turn this into a buying opportunity if they are looking to increase exposure of digital assets in their portfolio,” wrote Stack Funds.

- BTC drawdowns have occurred every month since the start of this year, but most ended with sharp recoveries, achieving newer highs in the following month.

- However, in a bear market, drawdowns of more than 20% can last for several weeks or months.

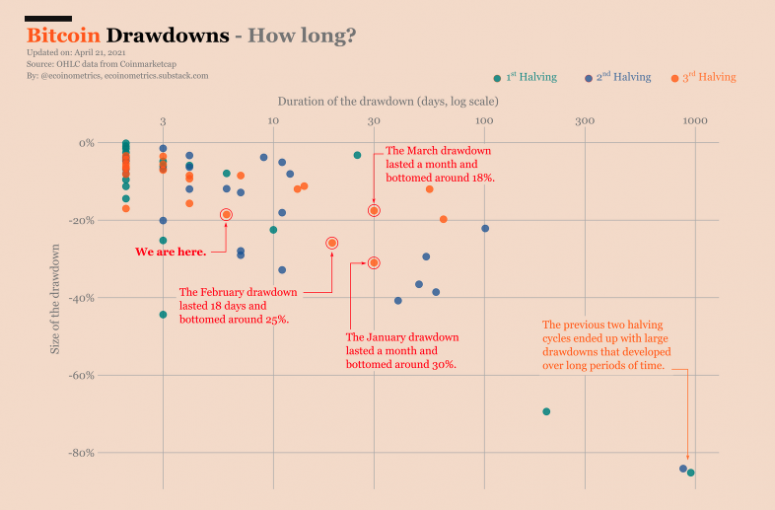

According to Ecoinometrics, a cryptocurrency newsletter, the market dynamics are consistent with what might be expected in the year after a “halving” on the Bitcoin blockchain. A halving is when the blockchain automatically cuts the rate of issuance of new bitcoins by 50%, and it happens every four years. The last one was in May 2020.

“Right now, we are in another one of those drawdowns that commonly happens during a post-halving bull market: 20% drawdowns, 5 days, nothing special,” Ecoinometrics, wrote Wednesday. “Honestly, the current price action does not look like a bull market top for bitcoin.”

coindesk.com

coindesk.com