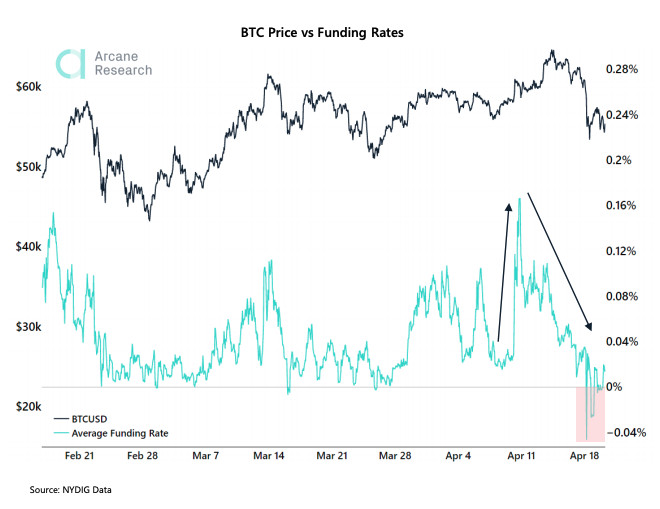

The near 15% selloff in bitcoin (BTC) on April 17 marked a quick sentiment shift from “absolute euphoria to agonizing panic,” based on an analysis by Arcane Research of the cryptocurrency’s derivative-funding rates.

In the past few days, the cost to fund long positions in the market for bitcoin perpetual swaps, a type of derivative in the cryptocurrency markets similar to futures contracts in traditional markets, declined into negative territory, which typically precede spot price recoveries. The funding rate period is 8-hours and is averaged across exchanges, weighted by the open interest, according to Glassnode.

- Prior to the BTC selloff, the bitcoin funding rate had been very high throughout April, peaking on April 10 above 0.16% per eight hours, according to Arcane.

- “Once the $60,000 support was broken, a massive sell-off occurred, leading to a cascade of liquidations of over-leveraged longs.”

- “The funding rates declined far into negative territory, with the average funding rates reaching -0.045%.”

- Arcane noted that previous episodes of negative funding rates have usually been good entry points for long positions but cautioned that “it makes sense being extra cautious – at least when it comes to leveraged plays.”

coindesk.com

coindesk.com