Bitcoin (BTC) can surge to $92,000 in the next two weeks and still "only" be matching it past performance, new data claims.

In a tweet on April 14, PlanB, the analyst behind the stock-to-flow family of Bitcoin price models, noted that despite this week's gains, BTC/USD still has plenty of energy in it.

PlanB focused on Bitcoin's relative strength index (RSI), a classic metric used to chart the progress of price runs in particular.

RSI can give a useful insight into whether Bitcoin is overbought at a certain point in its bull run, while the opposite — oversold — is also true.

As Cointelegraph reported, PlanB has highlighted the metric's cues for hodlers throughout the past year, including during the Spring bear market bottom and in August, when sentiment was gearing up for the bull run which continues to this day.

Currently, RSI measures 92/100. This is near the top of its range but at least three points off the peak of Bitcoin's 2013 and 2017 bull runs — to match them, a lot more upside is needed.

"Bitcoin is looking strong at RSI 92. Still not above RSI 95 like 2017, 2013 and 2011 bull markets," PlanB summarized.

“I calculated BTC price needed for RSI 95 at April close: $92K. Let's see what the Coinbase IPO will do today.”

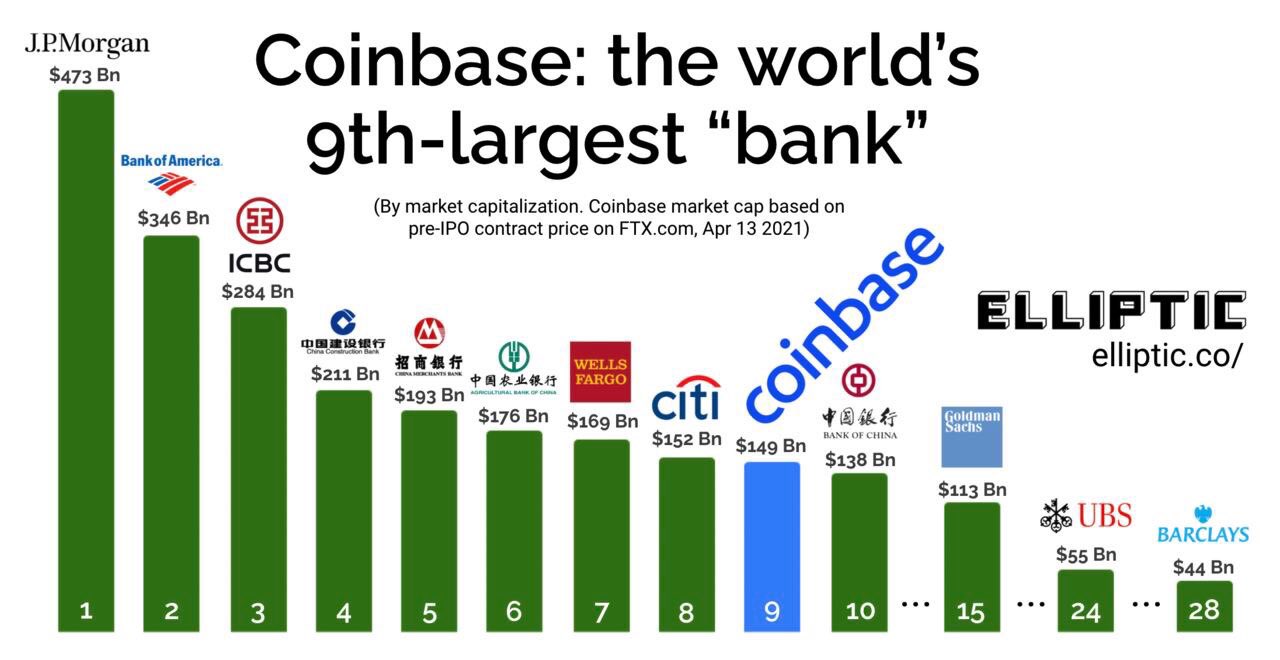

With its pre-debut of $149 billion, Coinbase will effectively become the ninth-largest "bank" in the world by market cap, figures circulating online on Wednesday showed.

cointelegraph.com

cointelegraph.com