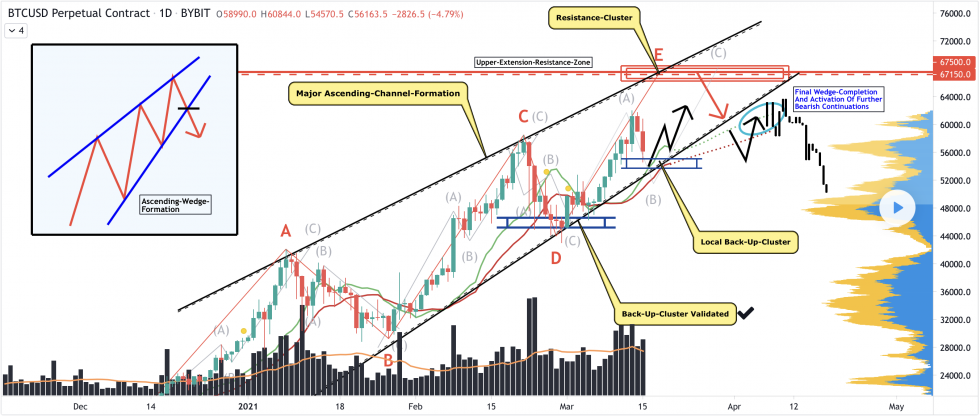

The crypto market influencer said in a note published Monday that the BTC/USD exchange rate could climb to $67,000 in the coming sessions. He noted that the pair has been trending higher inside a Rising Wedge, a bearish reversal pattern. In doing so, BTC/USD tested the Wedge’s upper trendline as resistance and its lower trendline as support on more than two occasions.

How Bitcoin Could Hit $67,000

Bitcoin’s latest rebound from the Wedge’s support, dubbed as ‘D’ in the chart below, started on February 28. Mr. Prince anticipated that the retracement would complete a wave cycle after it reaches the Wedge resistance level. And so it appears, the next pullback junction, a successive ‘E’ — a “resistance cluster” — is located near $67,000.

Bitcoin Rising Wedge setup, as presented by Vince Prince. Source: BTCUSD on TradingView.com

“Taking all these factors into consideration, Bitcoin […] will likely complete the wave-count [while] running into the strong upper resistance-cluster,” said Mr. Prince.

The statements appeared as Bitcoin threatened to break bearish on the Rising Wedge pattern.

The cryptocurrency on Tuesday was already trading near the structure’s lower trendline, anticipating a break below it to target lower levels. However, Mr. Prince remained convinced about a rebound move towards $67,000, following which the price would fall towards the same support trendline, this time to actually undergo a bearish breakdown.

Rising Wedges alert about potential bearish reversals. Typically, a break below the pattern’s lower trendline leads the price lower by as much as the Wedge’s maximum height. Therefore, depending on the level from where Bitcoin breaks lower, it would risk crashing by at least $12,000.

Fundamental Take

Market catalysts support a bullish Bitcoin bias. Last week, US President Joe Biden signed his $1.9 trillion coronavirus stimulus package into law after gaining approval from both the Congress and the Senate. In doing so, the Democratic leader enabled Americans to receive direct payments of up to $1,400.

While many of the beneficiaries would use the aid to run their households, some analysts believe that a good portion of Americans would also use the payments — or at least a part of it — to invest in stocks and bitcoin market. Billionaire investor Mike Novogratz is one among them.

“A lot of the stimulus checks are going to young people who want to buy bitcoin,” he told CNBC earlier this week.

On the other hand, the Federal Reserve officials will meet to discuss their future policies on Tuesday and Wednesday. The market believes that chairman Jay Powell would leave their existing monetary policies unchanged, based on his recent comments. Bitcoin could sustain its bullish momentum should that happen.

Meanwhile, headwinds for the cryptocurrency comes from any potential guidance on rate hikes. Markets have already priced in an earlier interest rate surge by pushing the yield on the US 10-year Treasury note up by 60 basis points since the last Fed meeting. The central bank could validate those expectations.

As a result, Bitcoin could undergo an early Wedge breakdown, risking a decline of about $12,000.

bitcoinist.com

bitcoinist.com