On-chain data shows Bitcoin exchange reserves have continued to plummet into 2022, a sign that could be bullish for the long-term outcome of the crypto.

Bitcoin Exchange Reserves Have Shown Sharp Downtrend Recently

As pointed out by an analyst in a CryptoQuant post, the BTC exchange reserve has plummeted recently. This is a continuation of the downtrend that has followed since the second half of 2021.

The “all exchanges reserve” is an indicator that measures the total amount of Bitcoin present in wallets of all exchanges.

When the value of this metric moves up, it means more coins are being deposited on exchanges. Such a trend can be bearish as investors usually transfer their BTC to exchange wallets for the purpose of either withdrawing to fiat or for purchasing altcoins. Because of this, the supply on exchanges is often considered as the “selling supply” of the crypto.

On the other hand, when the indicator’s value moves down, it implies a net amount of Bitcoin is being withdrawn from exchanges. This kind of trend can be bullish as holders usually take their crypto off exchanges for hodling, and so it may show that they are currently in a phase of accumulation.

Related Reading | Dogs Rejoice As SHIB and DOGE Jump 15% Over Past Day

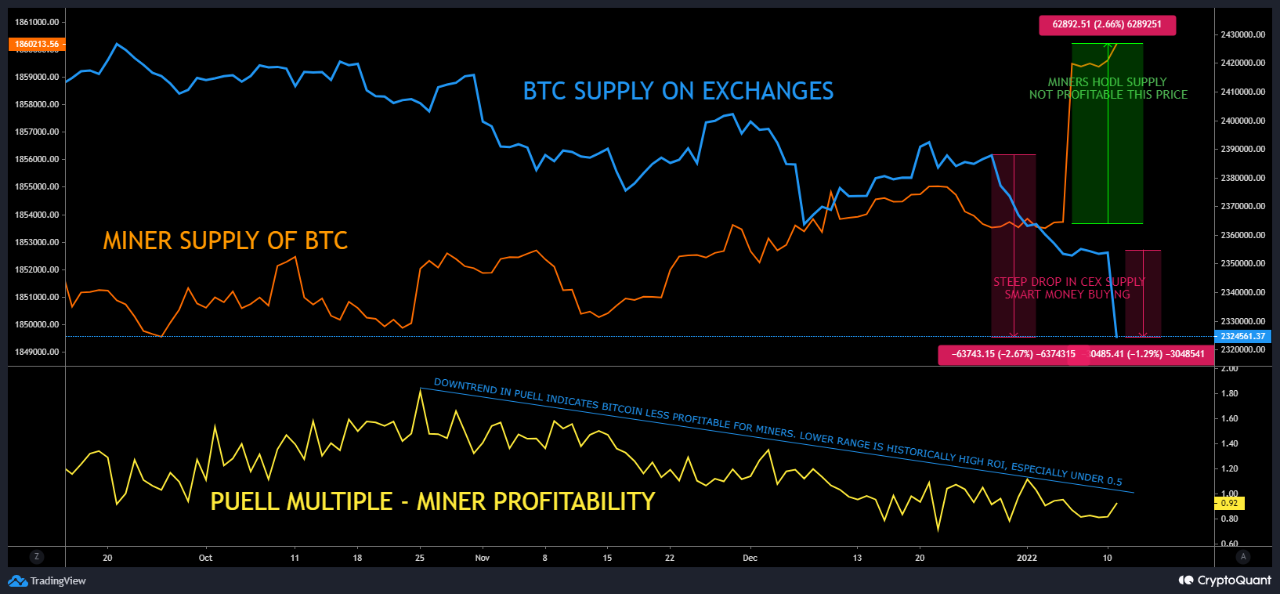

Now, here is a chart that shows the trend in the BTC exchange reserves over the past few months:

Looks like the value of the metric has plummeted recently | Source: CryptoQuant

As you can see in the upper graph, the Bitcoin exchange reserve has been going down for a while, and has showed a sharp downward spike recently.

Related Reading | Drew Estate Wants to Make You Richer And Give You 1 Bitcoin, Here Is How You Can Win It

This trend can be bullish for the price of the coin in the long term as it means investors have been in a phase of accumulation for some time now.

The chart also includes graphs for two other indicators, the miner reserves and puell multiple, which measure miner trends. It seems like miners have been accumulating as they don’t find it profitable to sell their coins at these levels. This trend can prove to be bullish for Bitcoin as well.

BTC Price

At the time of writing, Bitcoin’s price floats around $42k, down 0.5% in the last seven days. Over the past month, the crypto has lost 10% in value.

The below chart shows the trend in the price of BTC over the last five days.

BTC's price seems to have faltered once again | Source: BTCUSD on TradingView

Bitcoin finally showed some upwards momentum over the past couple of days, but today the crypto has once again fallen back down, erasing the gains.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com

bitcoinist.com

bitcoinist.com