Recent activity on the Bitcoin network suggests that the asset may have reached a market bottom after the significant losses it has recently suffered. Still, there is another supply barrier BTC needs to breach for prices to advance further.

Bitcoin Readies For Higher Highs

Bitcoin could be ready for an upward move.

The number one crypto has dropped by more than 20% in market value over the last few weeks, but several on-chain metrics suggest that a bullish impulse is underway.

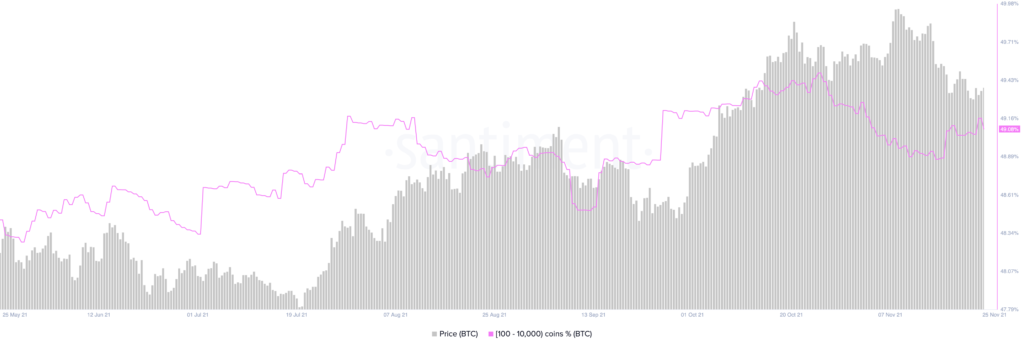

Behavior analytics platform Santiment has recorded a significant increase in whale holdings over the past week. While Bitcoin has failed to overcome its $60,000 resistance levels, large investors have been accumulating tokens.

On-chain data shows that addresses holding 100 to 10,000 BTC have added roughly 59,000 BTC to their positions, worth nearly $3.5 billion.

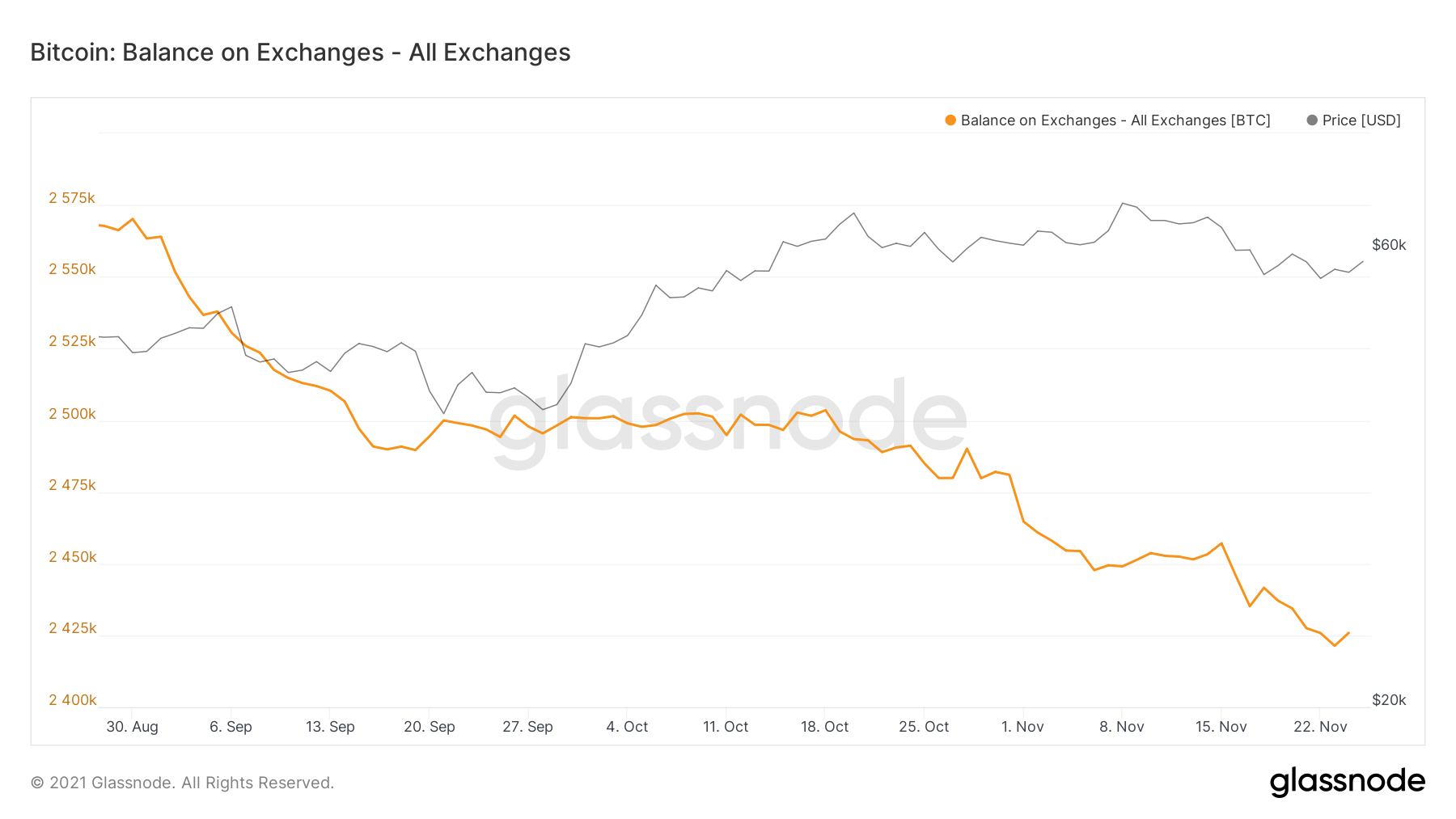

The increased buying pressure seen behind Bitcoin over the past week coincides with a considerable decline in the total number of coins held on exchanges. Roughly 16,000 BTC have been withdrawn from trading platforms since Nov. 18. This is the first time in more than three years that the balance on exchanges has dipped below 2.43 million BTC.

The declining Bitcoin supply on known cryptocurrency exchange wallets alongside the rising buying pressure paints a positive picture for the asset’s future price growth. As the number of BTC available to sell drops, the downside potential becomes limited, creating the optimal conditions for a supply shock.

On-chain analyst Will Clemente affirms that such network dynamics have led to the development of a “clear bullish divergence between BTC supply moving to strong hands and price.”

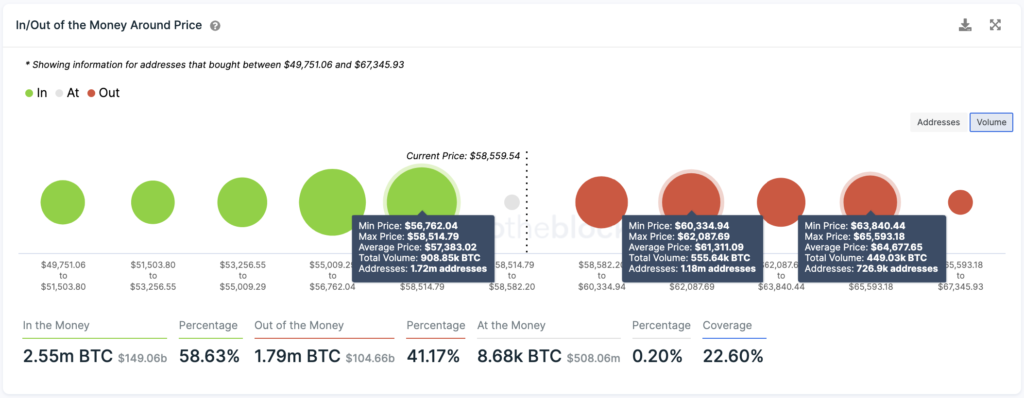

Still, Bitcoin needs to overcome a substantial supply barrier to be able to resume its uptrend. IntoTheBlock’s IOMAP model shows that more than 1.18 million addresses have previously purchased over 555,000 BTC between $60,330 and $62,090.

A decisive close above this resistance level could help Bitcoin surge toward $70,000.

It is worth noting that Bitcoin is trading above a significant demand barrier that might be able to absorb any further selling pressure. More than 3.41 million addresses have acquired nearly 2 million BTC between $55,000 and $58,500. Holders within this price pocket may attempt prevent seeing their investments go “Out of the Money” by accumulating more coins.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

cryptobriefing.com

cryptobriefing.com