TL;DR Breakdown:

- About $672 million positions of long traders have been liquidated following the recent drop in Bitcoin and other major altcoins.

- Bitcoin dropped below $56,000 earlier today, a nearly 20 percent drop from the ATH.

The leading cryptocurrency, Bitcoin (BTC), has been on a downtrend since Monday. It began trading the week at around $66,000 on the Binance market. However, it has shaded more than $10,300 from that point, following the drop to $56,000 early Friday. At the current price, Bitcoin is down, trading at a one-month low.

79.3% of crypto long traders REKT

Given the decrease in Bitcoin and other cryptocurrencies, the majority of long traders in the crypto derivative markets have been forced out. About 79.3 percent of these traders have been liquidated in the past 24 hours, resulting in a combined loss of $672 million, according to the data from CryptoRanks.

Long traders on FTX lost $228 million, followed by Binance ($218 million), OKEx ($104 million), ByBit ($57 million), and others.

About $672M of Positions Gets Liquidated Due to #BTC Drop Below $56,000

— CryptoRank Platform (@CryptoRank_io) November 19, 2021

– $228M on @FTX_Official ;

– $218M on @Binance ;

– $104M on @OKEx ;

– $57M on @Bybit_Official ;

– $24M on @BitMEX ;

– $20M on @DeribitExchange ;

– $13M on @HuobiGlobal ;

– $5M on @Bitfinex . pic.twitter.com/cliG7TTByT

Why is Bitcoin crashing?

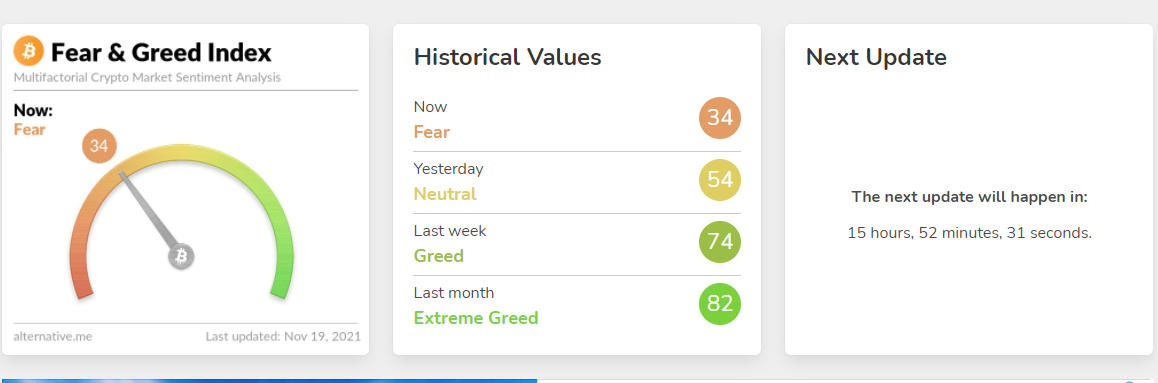

At first, it’s worth noting that the Bitcoin market has been extremely greedy for the past week and month, probably due to the renewed interest in the cryptocurrency that eventually brought in a new all-time high at almost $69,000. Usually, the market is termed to be due for correction when investors become greedy. But with the recent price correction, the index is returning to the lower side, meaning the price might start peaking again.

Besides this, many people believe the crypto crackdown in China and the United States’ $1 trillion infrastructure bill could also be other bearish factors behind the declining price of the crypto. Also, some claimed that the people are panic-selling due to the upcoming plan for refunding the early users of the now-defunct exchange, Mt. Gox, starting November 20.

Mindao Yang, a creditor of Mt.Gox, said that it may not be until 2023 for creditors to obtain #BTC , and that many of the previous claims have been acquired by hedge funds, and the long-term impact may not be significant. https://t.co/LeMk2kJ5eY

— 8BTCnews (@btcinchina) November 17, 2021

People were concerned that the users might dump their Bitcoin shortly after they were repaid. However, this FUD has been slapped down, as one of the creditors said the repayment may not be until 2023.

cryptopolitan.com

cryptopolitan.com